The Wall Avenue Journal says the center class is getting pessimistic in regards to the financial system:

The center class–usually thought-about to incorporate households making roughly $53,000 to $161,000 a 12 months–is taking part in an outsize function in that waning optimism. After months of monitoring high-income earners’ growing confidence in regards to the financial system, households making between $50,000 and $100,000 made an abrupt about-face in June. They now extra carefully resemble low-income earners’ gloomier views, in accordance with surveys completed by Morning Seek the advice of, a data-intelligence agency.

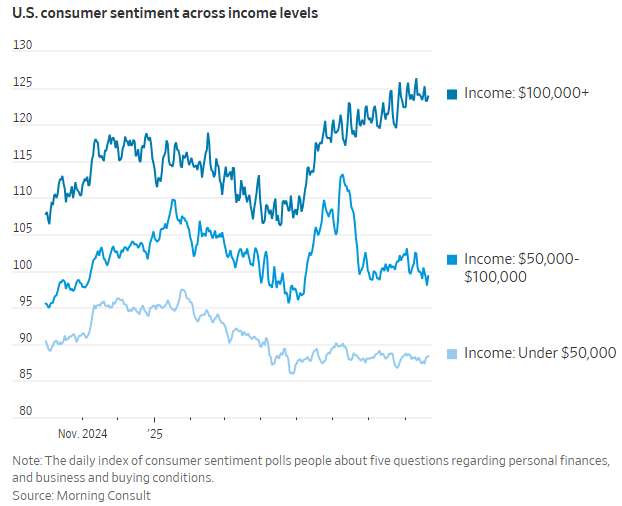

Right here’s a chart that breaks down sentiment by revenue ranges:

You possibly can quibble with their definition of center class however the factor that stands out to me is how unstable these numbers are. Sentiment crashes then shoots larger then crashes once more.

I’m unsure we will belief these surveys anymore.

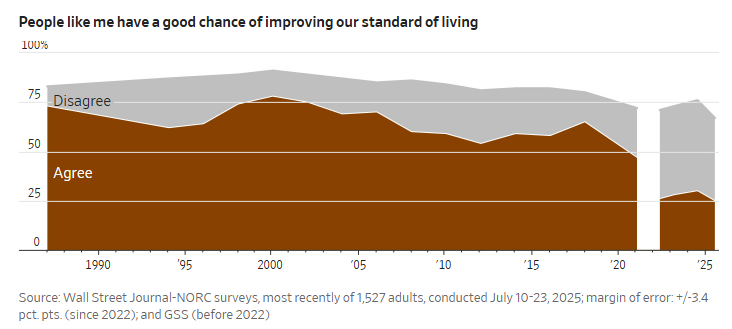

Right here’s one other one from the WSJ that asks folks if they’ve a very good likelihood of enhancing their lifestyle:

The article says individuals are dropping religion in the concept that they’ll get forward by means of laborious work.

Perhaps issues are more durable in the present day than they had been prior to now. In some methods, they in all probability are. In different methods, issues are far simpler.

However have a look at the development on this survey over time. It was already going downhill…after which Covid hit and it crashed. I contend some mixture of social media and our collective expertise throughout the pandemic has damaged the vibes for good. We will’t belief these sentiment indicators anymore. They’re far too noisy.

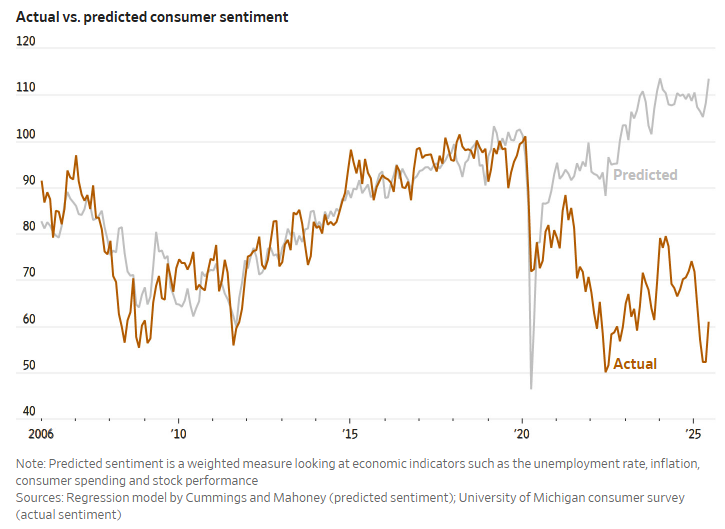

Two Stanford researchers have a mannequin that appears at how the financial system is performing versus the notion of the financial system by means of sentiment readings. The 2 used to trace carefully. Not anymore:

That is from the story:

“The hole is staggering,” Mahoney mentioned of the separation of sentiment from the stable financial metrics. One issue fueling the hole lately, he mentioned, has been the inventory market growth–“which has traditionally translated into stronger sentiment. However not on this event.”

It’s a must to watch what folks don’t what they are saying. Individuals say a number of stuff on the web that doesn’t match actuality.

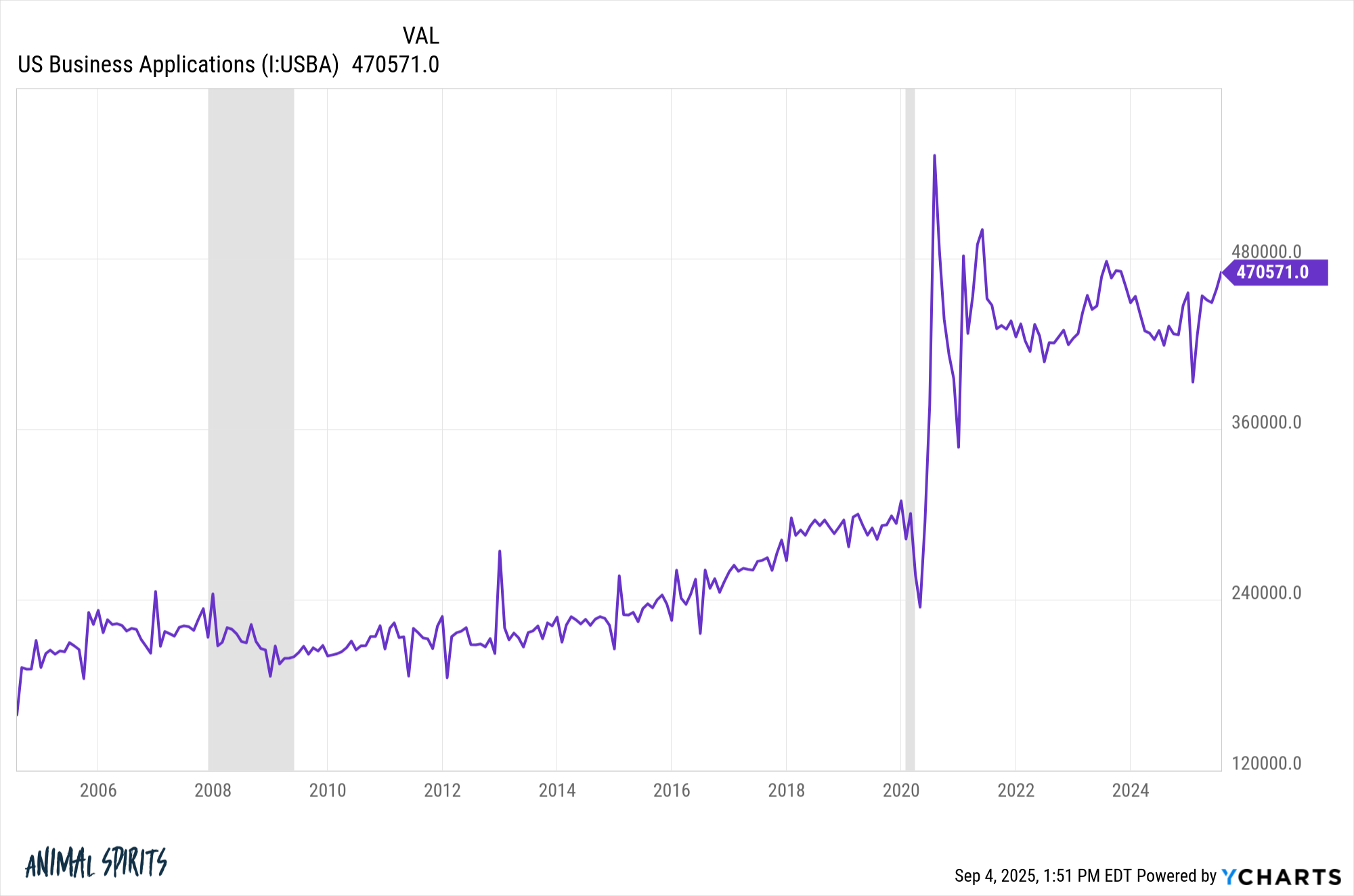

Roger Lowenstein wrote an op-ed within the Journal about American exceptionalism. He says final 12 months one out of each 24 family registered a brand new enterprise software. You don’t begin a brand new buisness if you happen to’re fearful in regards to the future or laborious work.

Take a look at this chart:

New enterprise functions have exploded for the reason that pandemic whereas sentiment has dropped to the ground.

Which one ought to we belief extra — folks’s emotions or their actions?

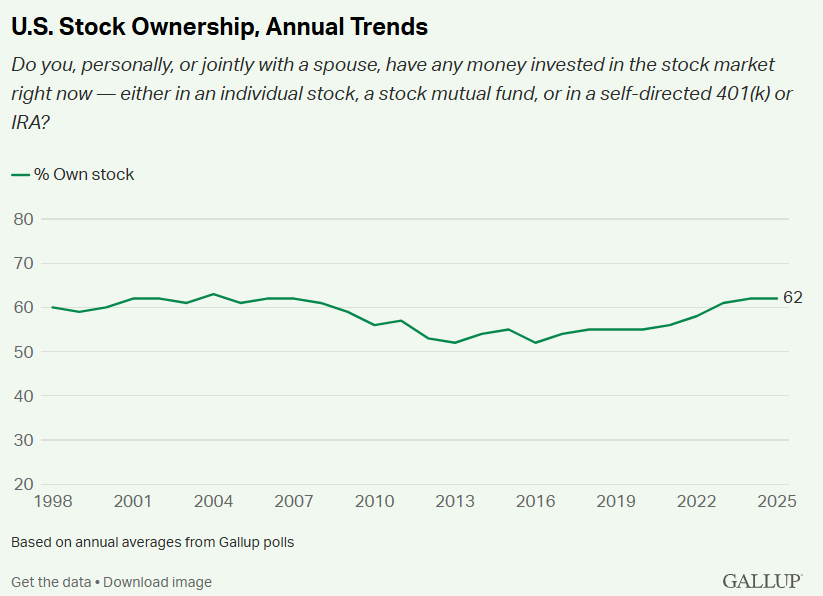

Gallup exhibits the variety of households who personal shares continues to rise:

The rise within the 2020s has been substantial, going from 55% in 2019 to 62% now. Would extra folks be investing within the inventory market in the event that they thought issues had been going downhill from right here?

Individuals say they’re pessimistic in regards to the future. Their actions don’t match their phrases.

Don’t belief the vibes. They’re damaged.

Perhaps for good.

Michael and I talked about seniment readings, American exceptionalism and rather more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional studying:

The Information is Making You Depressing

Now right here’s what I’ve been studying these days:

Books:

This content material, which accommodates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There could be no ensures or assurances that the views expressed right here shall be relevant for any explicit information or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or provide to offer funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.