A reader asks:

Traders have been involved about inventory market focus for years now. The S&P 500 retains getting increasingly more concentrated however the greatest shares even have the basics to again it up. How does this resolve itself? Or do you assume a extra concentrated inventory market is the brand new regular?

Focus has been high of thoughts for a lot of traders for a while now.

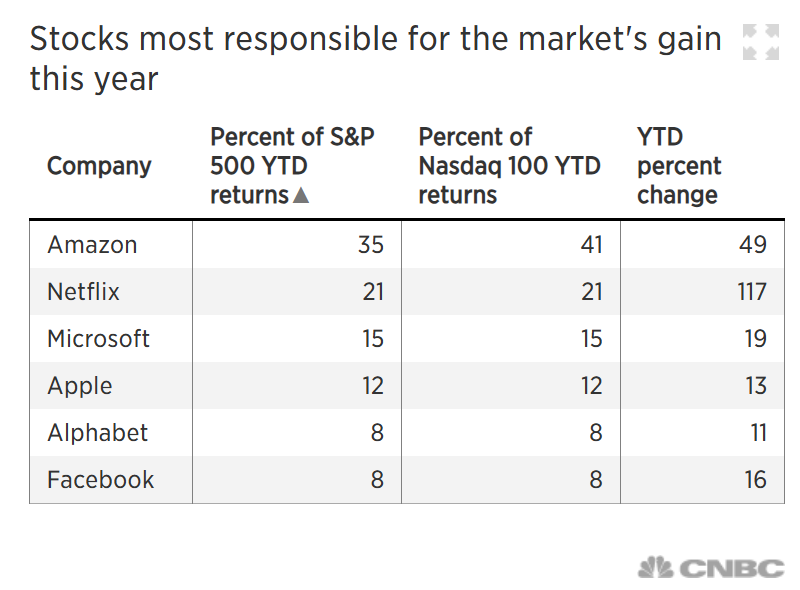

I first wrote about this matter all the way in which again in the summertime of 2018. In that piece I referenced this story from CNBC:

Have a look at the businesses they listed by way of concentrated positive aspects that yr:

These names look acquainted. The one huge distinction is that as we speak you may swap out Nvidia for Netflix.1 Traders have been frightened about focus of tech shares again then and so they’re nonetheless frightened as we speak.

What if that is simply the brand new regular for some time?

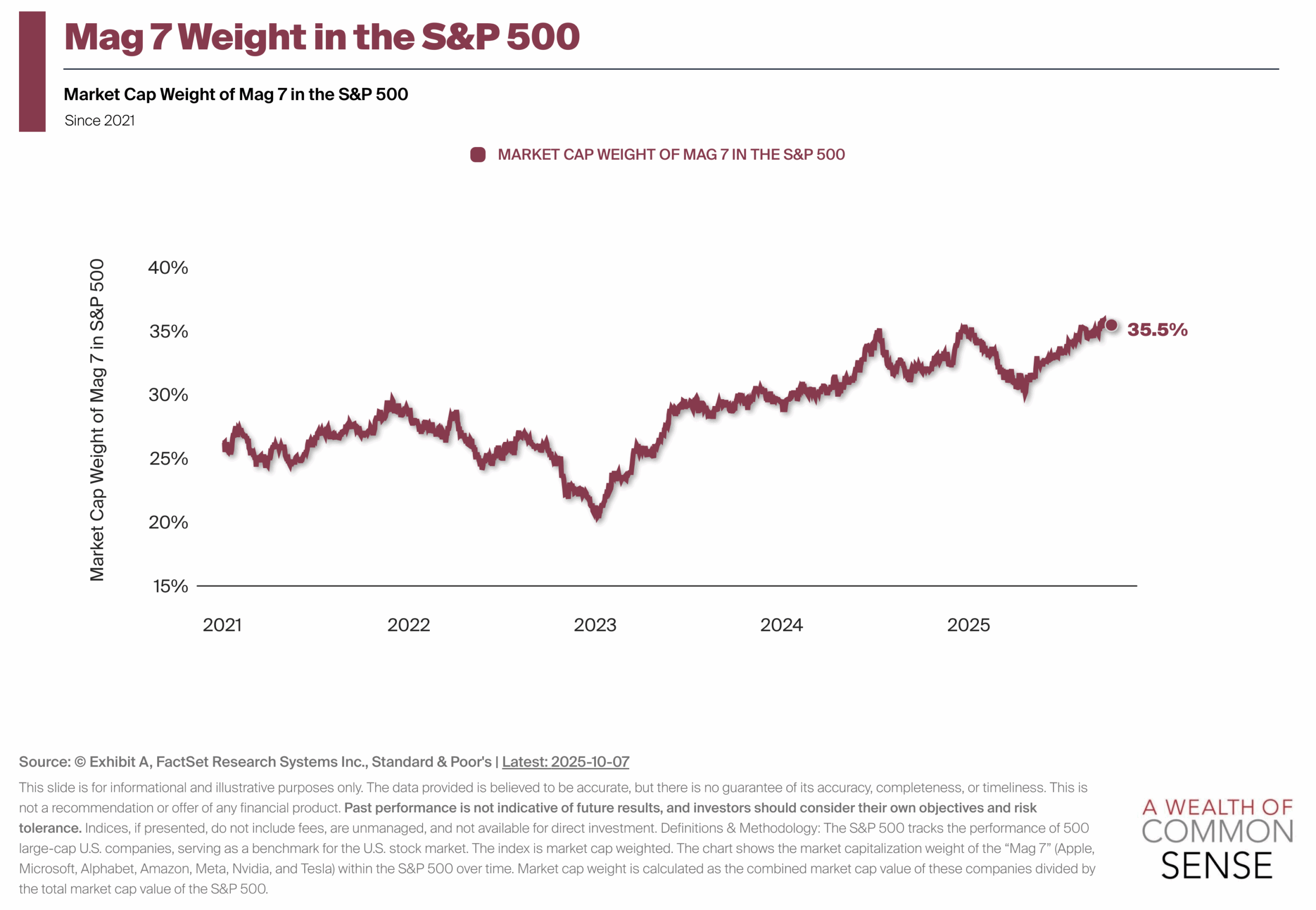

The Magazine 7 continues to swallow the inventory market:

After all, the larger these corporations get, the extra of an outsized influence they’ve on inventory market returns.

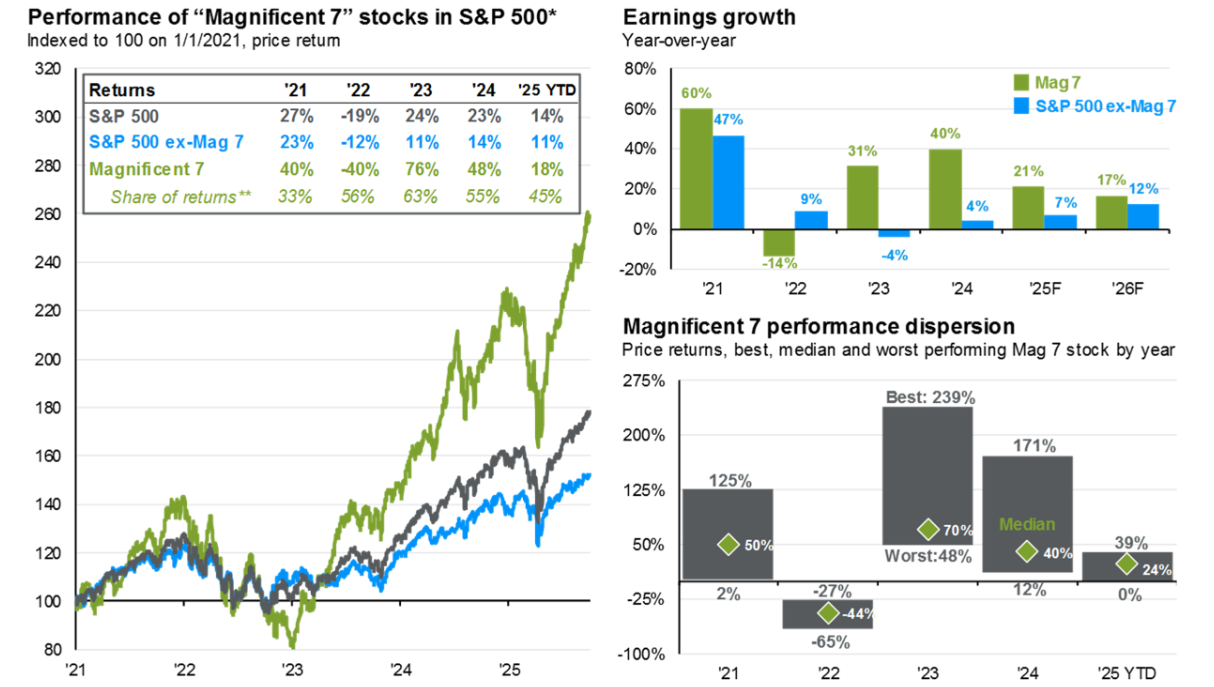

Right here’s a very good one from JP Morgan exhibiting the contribution of the Magazine 7 on efficiency and fundamentals:

The share of returns and earnings progress within the fingers of some corporations feels in contrast to something we’ve ever seen.

So how does this finish?

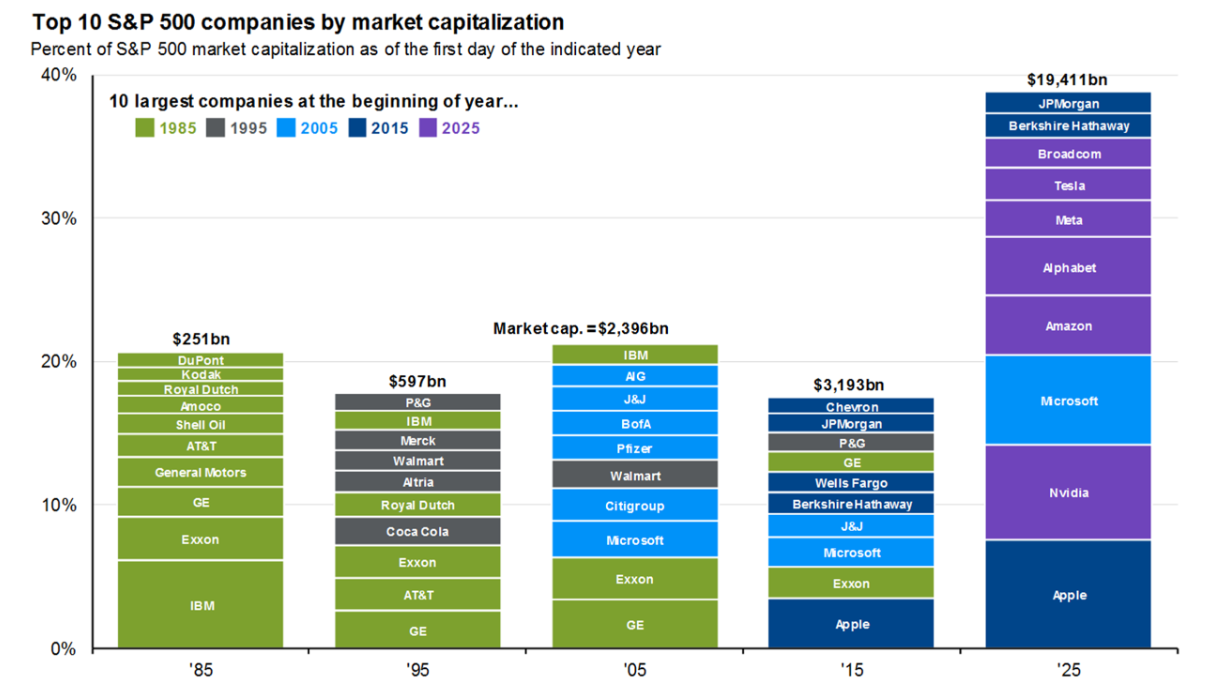

JP Morgan has one other good one which reveals the adjustments to the names within the high 10 shares each 10 years going again to the mid-Eighties:

Microsoft is the one member of the present high 10 names that was additionally there in 2005. Turnover is the norm for the large names although there are some shares that keep there for a few years. The turnover charge is roughly 30-40%, or 3-4 names, each 5-10 years over the previous 50 years.

That’s a method this factor might play out. We might see a few of these huge shares falter or new entrants that take their place. We might additionally see the AI bubble pop within the years forward which might do some injury to those massive tech shares.

However that doesn’t essentially imply market focus would robotically go away.

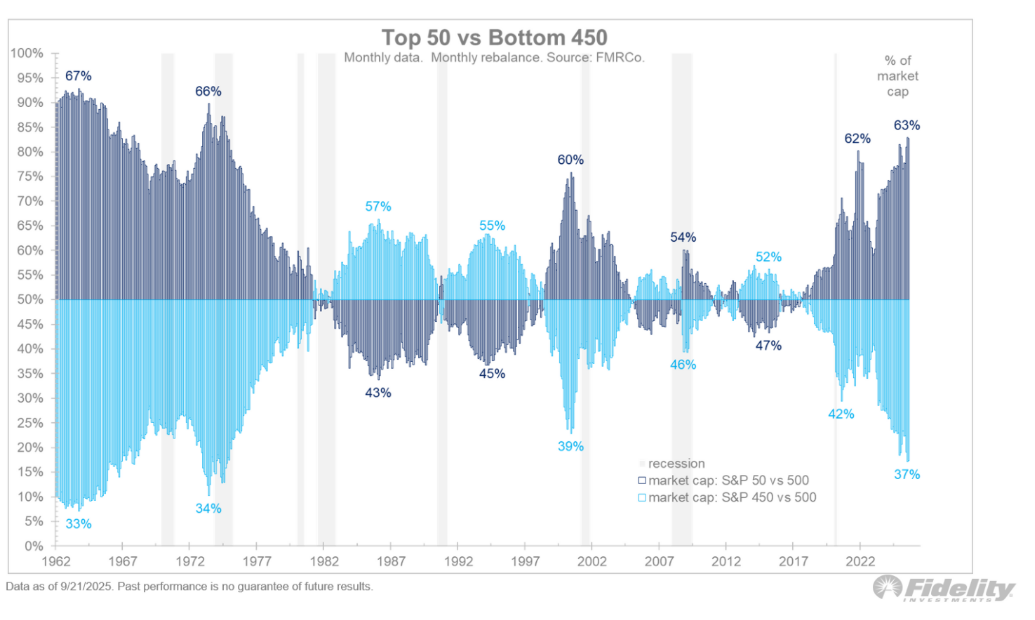

Jurrien Timmer has this nice chart that appears on the weights of the 50 greatest shares within the S&P 500 together with the opposite 450 names going again to the early-Nineteen Sixties:

He explains:

It’s price remembering that whereas the top-heavy focus in the course of the late 1990’s was rapidly reversed within the early 2000’s, in the course of the 1950’s and 1960’s the market remained top-heavy for a few years earlier than extreme valuations lastly took their toll. This might take a while.

Focus did get wrung out of the inventory market following the dot-com bust however there was an prolonged interval all through the Nineteen Sixties and Seventies the place the most important shares dominated.

There’s purpose to imagine we’re now in a brand new regular of inventory market focus on the high for a while.

The large tech shares are so entrenched in our lives that the federal government needs nothing to do with breaking them up. And anytime a brand new competitor emerges these corportations use their battle chests of money to purchase up the competitors.

These corporations now have huge moats round their companies, excessive revenue margins, and produce insanely excessive money flows.

I’m not saying these shares will outperform ceaselessly. They received’t. And a few of them will definitely fall out of the highest 10.

However don’t be shocked if we’ve entered a brand new period the place the inventory market stays concentrated on the high.

Wealth inequality within the inventory market may be right here to remain.

Jurrien joined us on Ask the Compound this week to assist reply this query:

We additionally lined questions on why the inventory market isn’t involved a couple of slowing labor market, why worldwide shares are outperforming, why gold is up 50% this yr and the way the AI growth will finish.

Additional Studying:

Focus within the Inventory Market

1Netflix is simply outdoors the highest 10. As of the newest information it’s the thirteenth greatest inventory by market cap within the S&P 500.

This content material, which incorporates security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There could be no ensures or assurances that the views expressed right here might be relevant for any explicit info or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or supply to supply funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.