I constantly hear most of the identical questions on these markets. There are issues about valuations, tariffs, inflation, Fed independence, and, most just lately, the integrity of BLS information.

However the single query I hear essentially the most is about market focus. I wish to clarify why I don’t imagine that is deadly to the bull market, and what it’d imply for equities going ahead.

Listed below are just a few concepts – a 30,000-foot view, just a few particular details on the bottom, and a few historical past – which might be influencing my pondering.

The massive image view? It’s this submit’s title: The Magnificent 493.

A number of persons are centered on selecting the businesses that can most instantly profit from synthetic intelligence – a feat that’s each tough and will miss the larger image. (You already know these corporations because the Magnificent 7). When wanting on the historical past of main technological improvements, we see 1000’s of corporations speeding into every technology’s latest know-how. Some do properly, most crash and burn, however the greatest beneficiaries are most frequently these corporations’ clients.

Consider the tons of of corporations that produced PCs within the Nineteen Eighties and ‘90s, or contemplate the 1000’s of American corporations that entered the car business. Maybe essentially the most accessible instance is the web and the dot-com startups fashioned within the Nineteen Nineties. Most individuals don’t keep in mind Juniper Networks, Metromedia Fiber, and even Pets.com — all consigned to the dustbin of historical past, however enormous of their day.1

Their collective affect was super, even if so many of those corporations went stomach up within the 2000 dot-com implosion.

Once we take into consideration web corporations, we regularly think about these slender elements of the economic system centered on particular internet applied sciences. However at present, due to these corporations, each firm is basically an web firm. All of us have e-mail, web sites, and use numerous internet-based instruments for work. We share movies, audio, and written content material on-line. We do our consumer updates by way of Zoom or Google Meet; new consumer inquiries are on-line, as are compliance filings, and many others. Public corporations host their quarterly calls on their web sites; the SEC posts all required paperwork on-line.

What firm at present is NOT an web firm?

Now apply the identical pondering the new new factor: Synthetic Intelligence. Each firm that thoughtfully applies AI goes to be extra environment friendly, productive, and worthwhile.

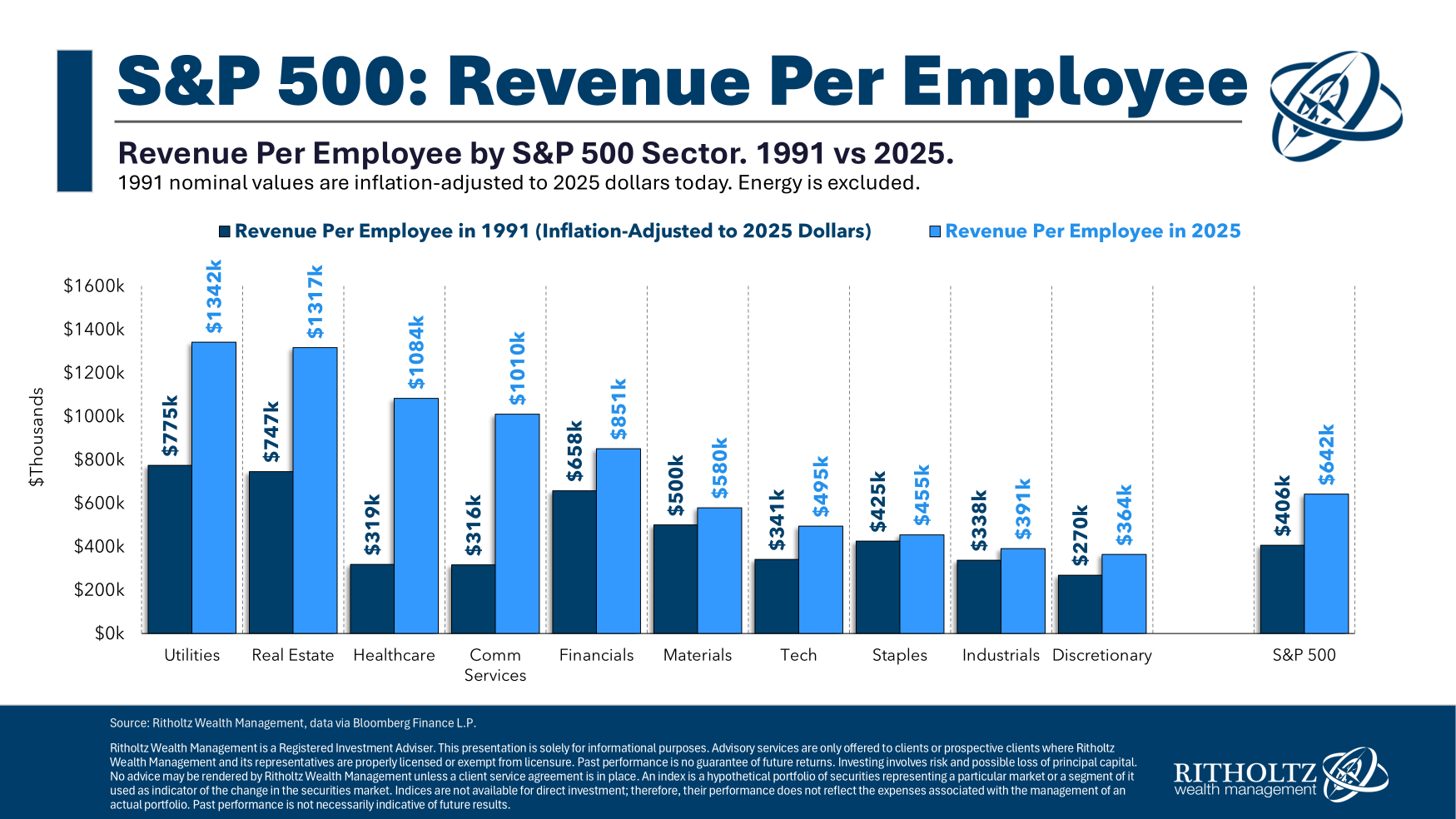

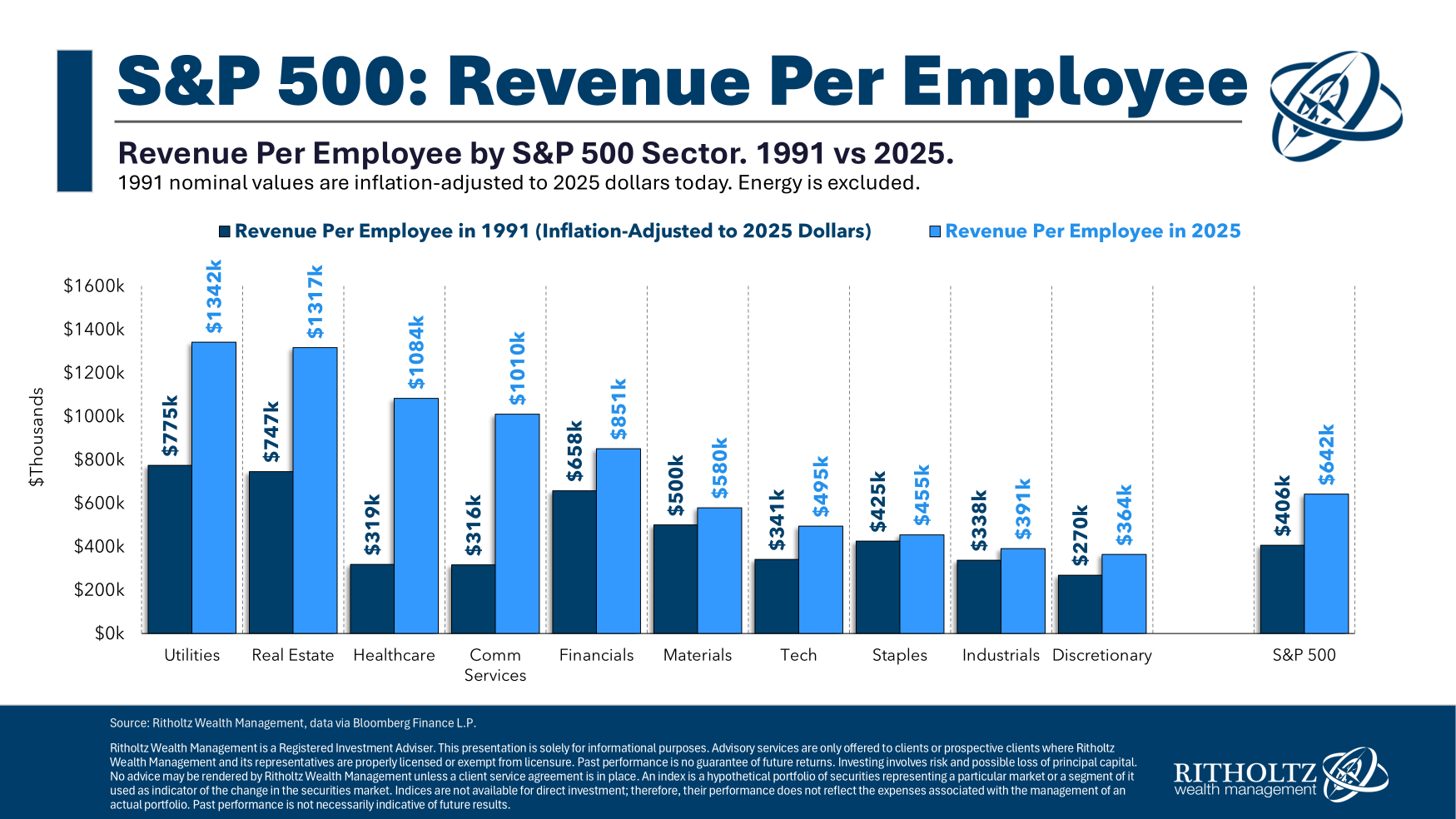

Take a look on the chart at high. It compares the Income Per Worker by S&P 500 Sector in 1991 versus 2025 (inflation-adjusted). That interval displays a big enhance in using know-how — computer systems, web, cellular gadgets, apps, software program, and many others. The end result was that company America has constantly elevated income per worker over time.

This demonstrates how a lot effectivity the mixing of innovation applied sciences drives. Now, acknowledge that we’re nonetheless within the early days of AI, and you may grasp why some buyers don’t imagine the market is wildly overvalued.

A few of you might be pondering, “Fantastic, Ritholtz, I’ll offer you sufficient rope to hold your self on valuation points, however what of market focus?”

Whereas some persons are deeply involved about focus within the S&P 500 because of the Magnificent 7, I’ve been extra centered on what these corporations are going to do to the remainder of the index: They may make each different firm within the S&P 500, or the Russell 2000, or the Wilshire 5000, that a lot better.

At the very least, that’s my 30,000-foot view, let’s see what is definitely happening at floor degree.

My Bloomberg colleagues Eric Balchunas and Breanne Dougherty level out the small print:

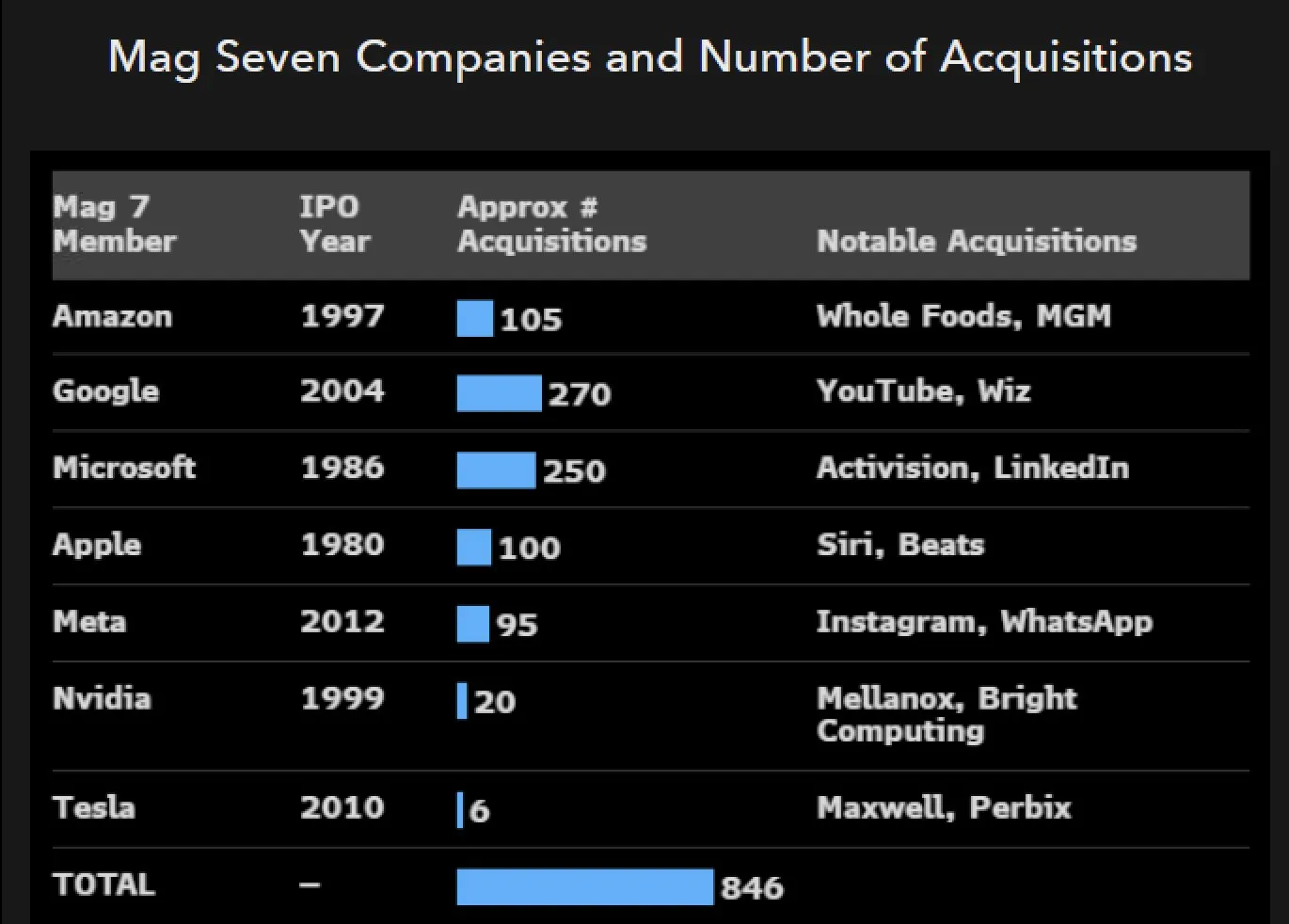

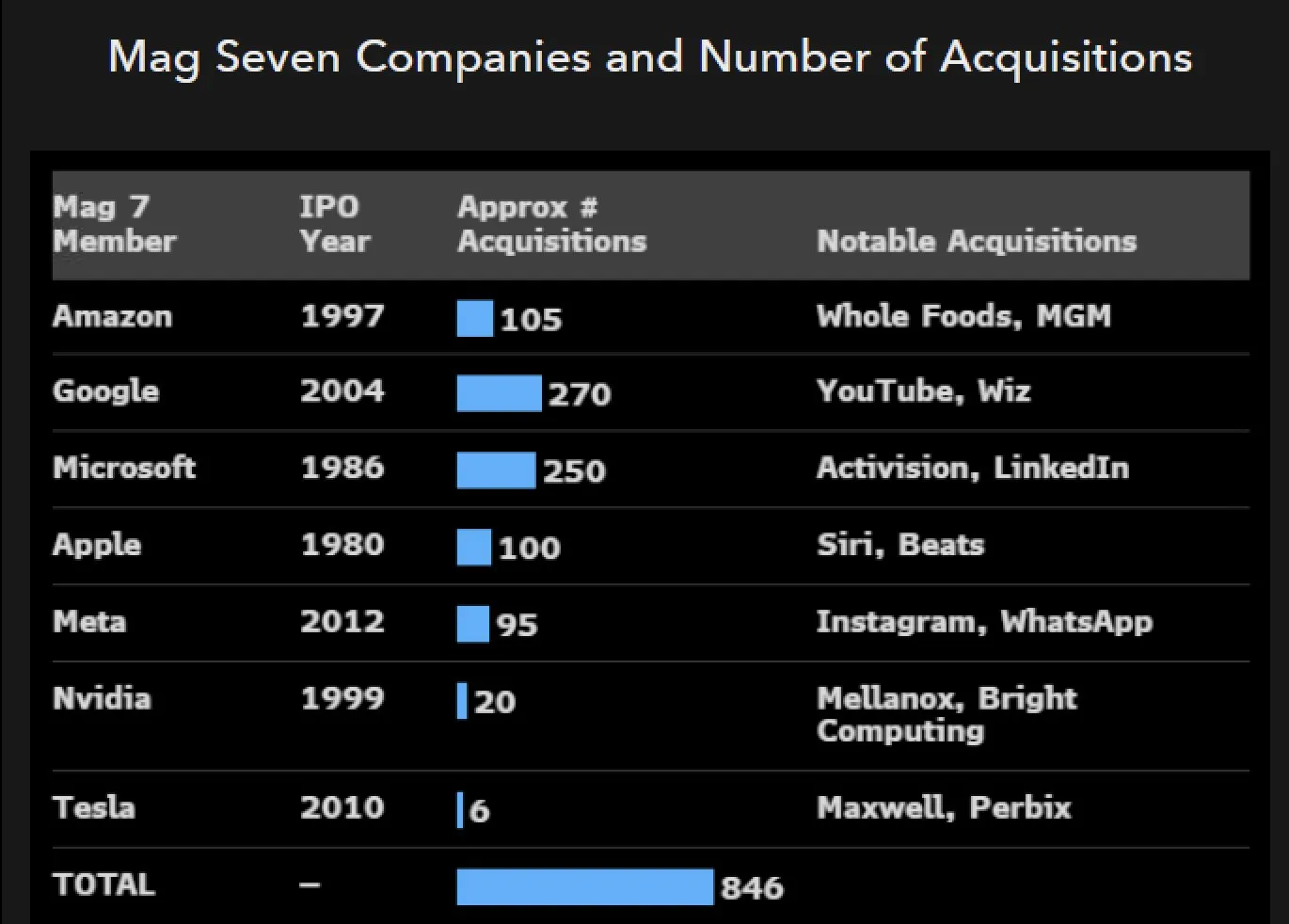

Magnificent 7? Consider them extra because the Magnificent Seventy

“They could go by the Magnificent Seven, however the reality is that they act extra just like the Magnificent Seventy. Collectively, the Seven have acquired over 800 corporations and expanded right into a dizzying array of industries – successfully functioning as conglomerates of superior know-how, whereas nonetheless rising organically. Seen this fashion – as dozens of corporations inside each – issues about their file 33% weighting within the S&P 500 miss the purpose: the index should still be as diversified as ever. (8/7/25)

Sam Ro described this phenomenon thusly:

“Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta Platforms, and Tesla — the trillion-dollar corporations collectively often known as the “Magnificent Seven — account for a couple of third of the S&P 500’s mixed market capitalization. This focus among the many most outstanding corporations makes some folks nervous. As a result of what if a number of of those corporations sees demand bitter and buyers dump the shares?

My favourite counterargument to this concern is that these seven corporations don’t function simply seven companies.”

~~~

Lastly, let’s contemplate what the historic file reveals about focus.

David Marlin (of Marlin Capital) factors out that the Magazine 7, at 35% of the SPX, isn’t an outlier. Railroads had been 63% of the U.S. Inventory Market in 1881. A more moderen instance comes from the Seventies, lengthy earlier than passive indexing existed. Again then, the Nifty Fifty was greater than 40% of the S&P 500.2

My colleague Ben Carlson notes out that even Nvidia, a 8% of the S&P 500 isn’t the best weighting for any single inventory in martket historical past.

-AT&T was 13% of the US inventory market in 1932

-GM was 8% in 1928

-IBM was 7% of the full in 1970

The biggest shares have averaged almost 6% of the inventory market for the reason that late Nineteen Twenties…

~~~

Each cycle consists of individuals arguing throughout one another, quite than with one another. This one appears no completely different. If you wish to discover causes to be out of this market, you may. If you would like a rationalization to remain lengthy (apart from pattern and common long-term returns), these exist as properly.

I’ll gladly admit to this being an train in affirmation bias on my half. Nonetheless, you need to admit, it’s a pretty convincing one.

See additionally:

Eye-popping stats from the market’s large progress tales (Sam Ro, Aug 10, 2025)

The Week We All Discovered Out TCAF, Aug. 8, 2025

Are S&P 500 Corporations Actually Doing Extra With Much less? Sure, and I’ve three charts to show it. (Matt Merminaro, Aug 6, 2025)

Beforehand:

All Time Highs Are Bullish (June 26, 2025)

A Spectacularly Underappreciated 15 Years (April 28, 2025)

Handle the Noise (June 17, 2025)

__________

1. Juniper Networks peaked in 2000 at $77 billion market cap; 1 / 4 century later, it’s about $13.3 billion. Pets.com shut down in 2000, however at present, Chewy is a thriving enterprise in an identical house. Metromedia Fiber Community (MFN) filed for Chapter 11 chapter in 2002 and was subsequently acquired by Zayo Group in 2012.

2. Sure, I’m conscious of how the Nifty-Fifty ended — within the first a part of the 1966-82 bear market, with a 57% crash in 1973-74…