A reader asks:

Would love to listen to your ideas on AI & deflation and if that might be a priority going ahead.

JP Morgan’s Michael Cembalest just lately stated on Odd Heaps that AI is the inventory market “guess of the century.”

I feel he’s proper however let’s speak in regards to the potential financial implications first.

There are two huge long-term macro worries proper now:

On the one hand, individuals are fearful that extreme authorities spending, tariffs and deficits will trigger inflation.

Alternatively, individuals are fearful that synthetic intelligence will make jobs disappear and trigger deflation.

Perhaps AI will steadiness out the entire authorities spending. We’ll see.

However let’s concentrate on the chance of deflation as a result of it presents each a danger and a profit to society.

Let me preface all of those statements with the caveat that nobody actually is aware of how AI will affect the world. The outcomes from technological improvements are notoriously troublesome to foretell upfront. This is likely one of the causes we virtually at all times have a bubble from technological advances as a result of individuals get overly excited fascinated by the probabilities and the way the world will change.

Expectations get taken too far which causes costs to disconnect from fundamentals. And sometimes these outcomes are counterintuitive and have unintended penalties.

Having stated all that, there’s a sturdy risk AI may substitute many entry-level or mid-level white-collar service jobs — customer support, information analysts, programmers, administrative assistants, bookkeepers, IT assist, copywriters, information reporters, tutors, and extra. As AI makes duties extra environment friendly, we may see decrease demand for these kinds of employees.

If that occurs, the availability for this work will improve massively, bringing down prices. Finally, we can even have AI robots to automate much more of the work we do.

These developments can be deflationary.

Clearly, it’s not nice for thousands and thousands of people who find themselves employed in these areas or searching for new jobs.

On this sense deflation is a large danger to the labor market. I feel there’s a very actual risk that the subsequent recession will see some job loss the place these jobs merely don’t come again as corporations substitute headcount with AI instruments and fashions.

It is a very actual concern and it’s one thing governments shall be pressured to take care of. Paradoxically sufficient, this might truly result in extra authorities spending as unemployment advantages rise and entitlements develop into much more necessary.

The excellent news is that the U.S. financial system is dynamic. We’ve lived by large-scale shifts within the labor market earlier than, and new jobs will seemingly be created that we’re not even contemplating proper now.

Even when that’s the case, the transition interval will seemingly be painful for lots of people.

It’s additionally necessary to know that inflation and deflation will not be evenly distributed:

I’m to see how AI impacts the associated fee construction of providers, contemplating that’s the place essentially the most inflation has proven up this century.

If AI actually is deflationary as a result of it disrupts the labor market your greatest hedge goes to be investing in shares. Revenue margins will go up. Earnings shall be better. Companies will win once more. Personal the businesses that profit from these developments.

After all, even when this all occurs, AI may additionally current a danger to the inventory market within the meantime.

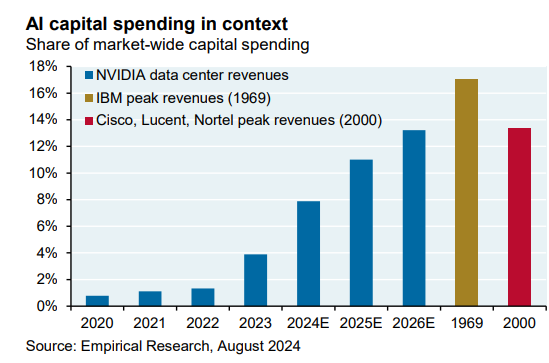

Michael Cembalest notes that the quantity of funding the massive tech companies are making in AI is approaching earlier bubble highs throughout previous cycles of extra:

That’s why it’s so necessary to know how AI adoption pans out. As proven beneath, by 2026 NVIDIA’s share of all US capital spending shall be near the 2 twentieth century peaks. Simply as notable: the hyperscalers (Google, Meta, Amazon, Microsoft and many others) would wish $400-$500 billion in new revenues to earn their conventional 50% gross margin on ~$250 billion of annual information heart spending.

Perhaps AI adoption happens a lot slower than individuals assume. Perhaps corporations shall be hesitant to show over necessary duties to a computer-generated mannequin for now. It’s not simple to foretell how this can all play out.

If these investments don’t earn a return quickly sufficient the inventory market may see some hiccups.

However it is a actual danger for employees to think about.

One of the best ways to hedge the AI danger and switch it into a chance appear like this:

(1) Personal shares. Earnings will rise in an AI-dominated world. AI doesn’t sleep. It doesn’t have private issues. It doesn’t get sick. Companies will use it to mercilessly minimize prices the place they will.

(2) to eat. This expertise goes to make individuals’s lives simpler and extra environment friendly in some ways. We’re already discovering methods to make use of AI to assist our advisors. It will probably take notes for you, provide real-time reminders and supply invaluable state of affairs evaluation and planning work. Staff who work out tips on how to combine AI into their on a regular basis lives are going to have a leg up on the competitors.

(3) Be artistic. As soon as everyone seems to be utilizing AI it should develop into a commodity. Determining tips on how to stand out from the gang by creativity and originality shall be extra necessary than ever in an AI-driven world. I’ve been utilizing AI increasingly on the analysis entrance. It’s useful however bland. Individuals who can successfully talk in imaginative methods will be capable to stand out from the gang.

AI could be the largest danger and the largest alternative of the twenty first century.

I mentioned this query in additional element on the newest version of Ask the Compound:

We additionally answered questions from our viewers about personal fairness in targetdate funds, tips on how to diversify your particular person inventory picks, when you must rent a monetary advisor and the way purchase the dip works.

Additional Studying:

Mega Cap World Domination