My contrarian instincts usually kick in once I see the gang reaching a questionable consensus. More often than not, what the gang does IS the market; what they saynevertheless, is commonly suspect.

Over the previous few years, the gang has anticipated fast Federal Reserve price cuts that by no means materialized; there have been repeated expectations in 2022, ’23, and ‘24 of an imminent recession that by no means occurred; the fears brought on by market focus appear to have additionally been ignored by Mr. Market.

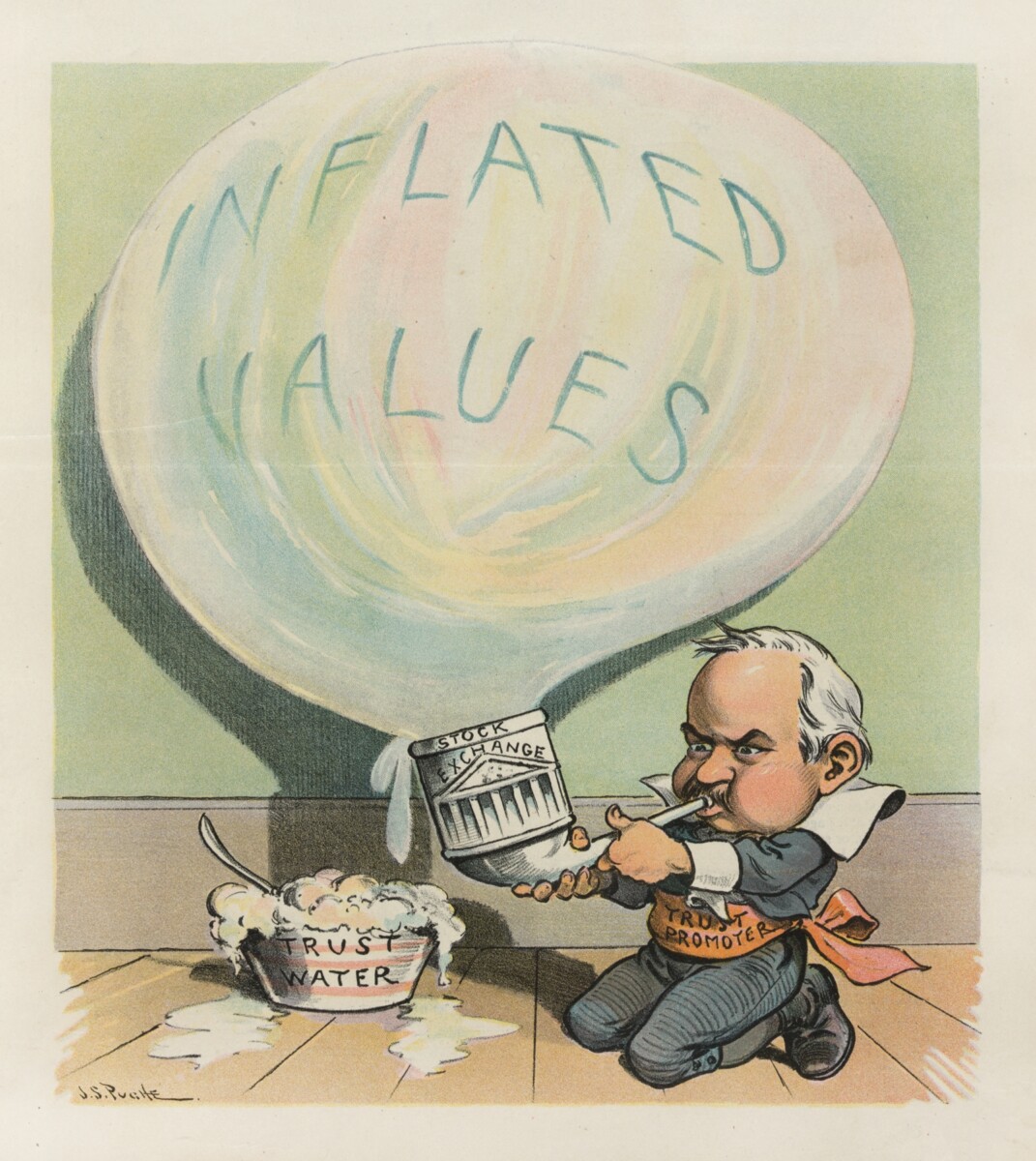

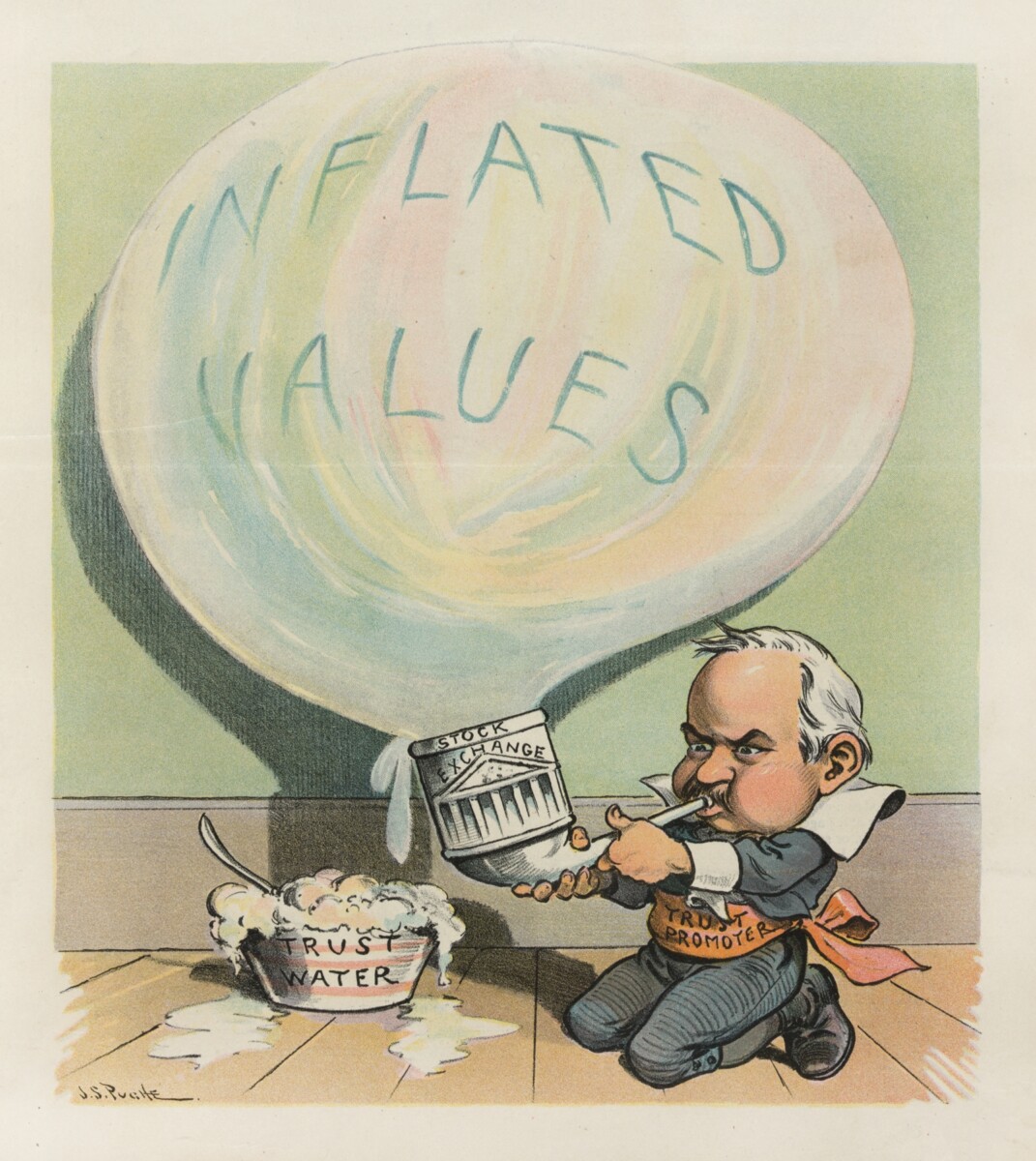

Then there’s the infinite cacophony of bubble chatter.1 I can not recall ever listening to the gang determine a bubble in actual time, after which there really a) being a bubble that b) burst quickly after.

By definition, it’s the crowd that creates bubbles via a mixture of psychology, greed/FOMO, extra liquidity, and sheer recklessness. It’s uncommon to see that very same crowd have the ability to determine that bubble in actual time.

Approach again in 2011, I attempted to create a guidelines of how you can spot a bubble in real-time.2 It’s 14 bullet quantitative factors that ought to permit you to see if any market is exhibiting bubblicious tendencies.

Let’s undergo these 14 factors to see how they maintain up at the moment: (Spoiler: Plenty of costly shares, and dear bubbly tendencies, however we’re not fairly there but):

Customary Deviations of Valuation: Markets are dear, however not Japan 1989/1999-2000 Dotcom dear

Considerably elevated returns: The previous 15 years have seen returns of 16% yearly. That is the third-best rolling 15-year interval since WW2, but it surely additionally follows a 57% GFC crash. The previous two years 25% yearly. 2023-24 actually counts as elevated.

Extra leverage: Whereas there are some leveraged merchandise put there like 2X and 3X ETFs, it’s hardly a significant quantity of capital (the identical was stated about Subprime, however that was wildly infiltrated all through the whole lot of the monetary system)

New monetary merchandise: Alts? Personal Credit score? Neither is a lot “New” as newly widespread.

Enlargement of Credit score: Largely tight, not very out there.

Buying and selling Volumes Spike: NYSE common every day buying and selling quantity (ADV) is roughly 1.36 billion shares – considerably above historic common of 900 million to 1.2 billion shares per day. NASDAQ common every day volumes has exceeded 9 billion shares via 2025. ADV ranges 6–8 billion shares every day, so exercise this 12 months is properly above common.

Perverse Incentives: I’m not conscious of a lot right here apart from the land seize in alts, the massive variety of new ETFs, and the return of meme inventory buying and selling.

Tortured rationalizations: These are ever-present, however there was some uptick these days.

Unintended Penalties: Have but to totally occur.

Employment tendencies: Full employment is offset by eye-watering salaries for AI engineers.

Credit score Spreads: Are very tight, and make me marvel why anybody would wish to personal HY when IG is nearly the identical pricing

Credit score Requirements: Nonetheless tight because the GFC.

Default Charges: Low, however transferring increased in autos, bank card, mortgage however particularly pupil mortgage debt.

Unusually Low Volatility: VIX atr 20 just isn’t precisely complacent; as we noticed in April, VOL has been fast to reply to any concern…

So whereas there are some indicators of bubblicious exercise, it’s hardly overwhelming or severely determinative for my part. Shares are dear, however this appears much less like a bubble and extra like a later-stage bull market cycle.

Earlier this 12 months, I famous what a spectacularly underappreciated 15 years we have now loved. The bubble discuss appears like much more of the identical…

Bear in mind, Greenspan’s “Irrational Exuberance” speech was December, 1996. All bull markets run additional, longer, and better than most count on…

Excerpt from unique guidelines after the leap…

Beforehand:

Guidelines: The right way to Spot a Bubble in Actual Time (June 9, 2011)

A Spectacularly Underappreciated 15 Years (April 28, 2025)

___________

Footnotes:

1. Outdated dealer’s joke: “There’s a bubble in calling bubbles…”

2. With the good thing about time and hindsight, it’s simple to see the affect of the Nice Monetary Disaster on that record.

Realtime Bubble Guidelines from June 9, 2011

1. Customary Deviations of Valuation: Have a look at conventional metrics – valuations, P/E, worth to gross sales, and so on. — to rise two and even three commonplace deviations away from the historic imply.

2. Considerably elevated returns: The S&P500 returns within the Nineteen Nineties had been far past what one might fairly count on on a sustainable foundation. The years round Greenspan’s “Irrational Exuberance” speech counsel {that a} bubble was forming:

1995 37.58

1996 22.96

1997 33.36

1998 28.58

1999 21.04

And the Nasdaq numbers had been even higher.

3. Extra leverage: Each nice monetary bubble has at its root simple cash and rampant hypothesis. Discover the leverage, and hypothesis received’t be too far behind.

4. New monetary merchandise: This isn’t a adequate situation for bubble, but it surely does appears that every main bubble has new merchandise someplace within the combine. It might be Index funds, derivatives, tulips, 2/28 Arms.

5. Enlargement of Credit score: That is past mere speculative leverage. With a number of cash floating round, we finally get round to funding the general public to assist inflate the bubble. From Bank cards to HELOCs, the twentieth century was when the general public was invited to leverage up.

6. Buying and selling Volumes Spike: We noticed it in equities, we noticed it in derivatives, and we’ve seen it in homes: The transaction volumes in each main growth and bust, virtually by definition, rises dramatically.

7. Perverse Incentives: The place you have got unaligned incentives between company workers and shareholders, you get perverse outcomes — like 300 mortgage firms blowing themselves up.

8. Tortured rationalizations: Search for absurd explanations for the brand new paradigm: Worth to Clicks ratio, aggregating eyeballs, Dow 36,000.

9. Unintended Penalties: All laws has surprising and undesirable negative effects. What current (or not so current) legal guidelines might have created an surprising and weird consequence?

10. Employment tendencies: An enormous enhance in a given area — actual property brokers, day merchants, and so on. — could also be a clue as to a growing bubble.

11. Credit score Spreads: Search for a really low unfold between legitimately AAA bonds and better yielding junk will be indicative of mounted earnings threat appetites operating too sizzling.

12. Credit score Requirements: Low and falling lending requirements are all the time a ahead indicator of credit score hassle forward. This may be a part of a bubble psychology.

13. Default Charges: Very low default charges on company and excessive yield bonds can signifies the benefit with which even poorly run firms can refinance. This implies extra liquidity, and creates false sense of safety.

14. Unusually Low Volatility: Low fairness volatility readings over an prolonged interval signifies fairness investor complacency.