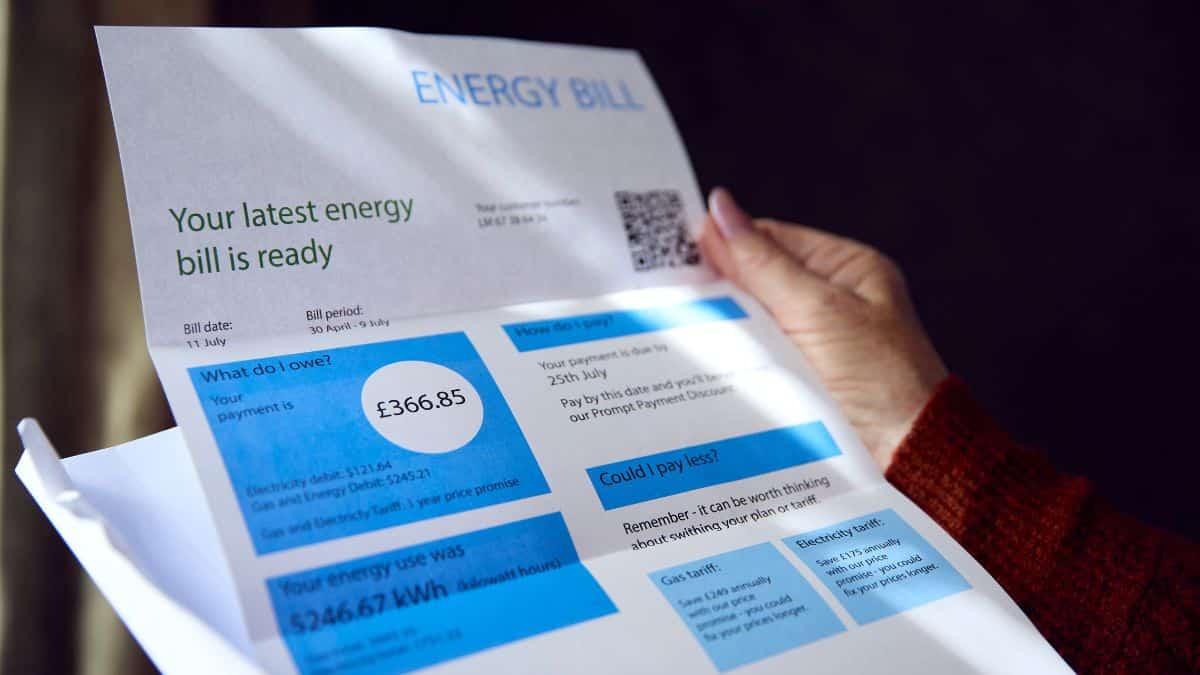

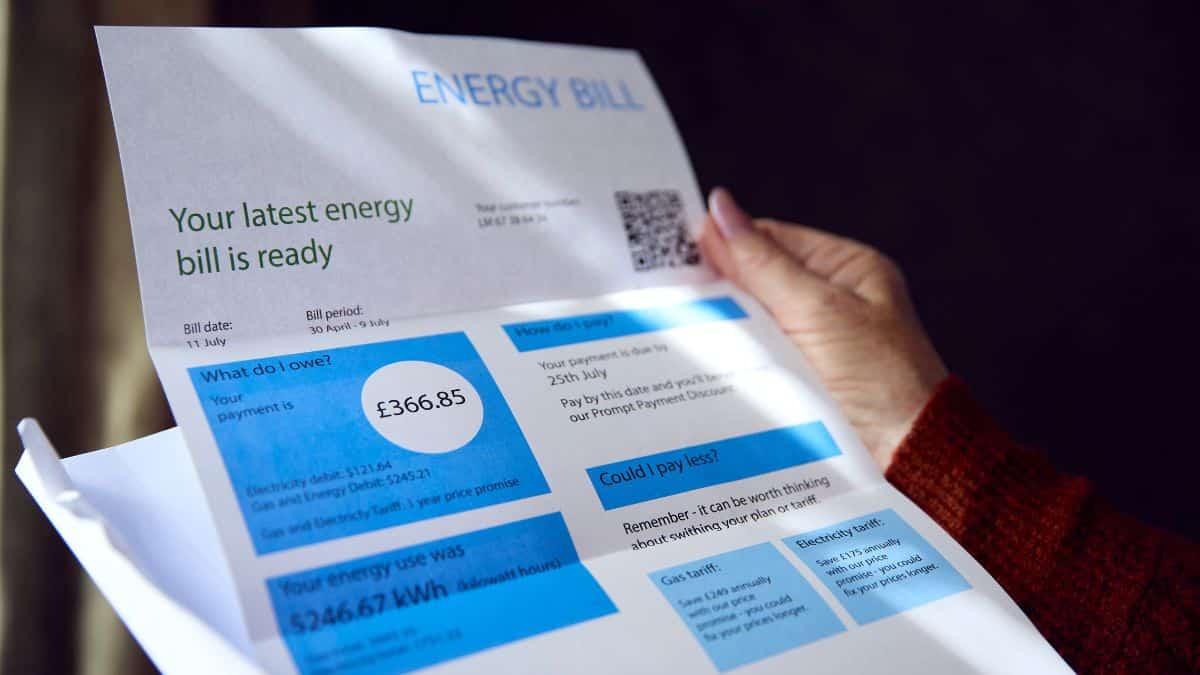

Round 195,000 households may quickly see their power money owed worn out as a part of a brand new plan from Ofgem to assist these hardest hit by the power disaster.

£10 join bonus: Earn straightforward money by watching movies, taking part in video games, and getting into surveys.

Get a £10 join bonus whenever you be a part of as we speak.

Be a part of Swagbucks right here >>

The UK’s power regulator says it’s planning to “reset and reform” the rising pile of power debt, which has reached a report £4.4 billion.

The brand new Debt Reduction Scheme would see as much as £500 million of unpaid payments written off, with the primary section on account of begin in early 2026.

Who may get assist

The primary individuals set to learn are these on means-tested advantages who’ve constructed up greater than £100 of power debt between April 2022 and March 2024.

To qualify, households will have to be:

- Making some type of contribution towards their debt or power use, or

- Prepared to work with a debt recommendation charity to assist handle their funds.

Suppliers will robotically establish eligible prospects and phone them instantly when the scheme launches.

The way it’s being paid for

The price of unpaid power debt is presently shared throughout everybody’s payments, including round £52 a yr to the everyday family beneath the present worth cap.

Ofgem’s plan may add round £5 additional per yr to cowl the price of writing off the debt, although this may change as soon as the ultimate particulars are confirmed.

Whereas this transfer will assist these struggling essentially the most, it does elevate questions on equity, particularly for households which have saved up with funds however are nonetheless stretched skinny.

Why the scheme is required

Power debt has spiralled since costs shot up in the course of the power disaster. In only one yr, whole arrears throughout England, Scotland, and Wales jumped by £750 million, and over a million households now don’t have any plan in place to repay what they owe.

Ofgem says this rising downside makes it more durable for suppliers to take a position and innovate, whereas leaving hundreds of thousands of households with increased payments.

Charlotte Friel from Ofgem mentioned, “We should shield shoppers by hanging the correct stability between supporting those that will pay and focusing on assist at those that want it most.”

Modifications for individuals shifting house

One a part of the plan targets a quirk in how power accounts are dealt with when individuals transfer.

Proper now, when somebody strikes into a brand new property, the power account switches to “the occupier” Till the brand new resident registers, payments can construct up beneath this nameless account.

Ofgem says this might make up as a lot as £1.7 billion of the nation’s unpaid power debt. To repair it, the regulator is taking a look at a rule that might make new tenants or owners join with a provider earlier than utilizing power.

The place there’s a sensible meter, the concept is to change it to prepayment mode with a small credit score stability so individuals keep on provide whereas organising their account.

Ought to power firms pay as an alternative?

Some MPs and campaigners have argued that the power business ought to cowl these prices as an alternative of households.

A gaggle of MPs lately mentioned power community corporations have made “extra earnings” whereas households have been pressured to decide on between heating and consuming. They need these earnings used to assist clear the debt.

However Ofgem says altering the principles now would simply result in increased costs for everybody in the long term.

The underside line

This plan is a crucial step, but it surely’s not a full repair. Writing off £500 million will solely put a dent within the £4.4 billion nonetheless owed.

Nonetheless, for households drowning in power debt, it may supply actual respiration area and an opportunity to start out contemporary with out the fixed fear of payments piling up.

In the event you’re struggling to pay your power payments, communicate to your provider or a debt recommendation charity as quickly as potential. Assistance is there, and with schemes like this on the way in which, issues may begin to ease.

Skint Dad says:

It’s good to lastly see one thing that might make an actual distinction for individuals fighting power debt. However it’s not easy. Wiping money owed for some will imply barely increased payments for everybody else. The essential factor is that this assist reaches the households who actually need it and stops extra debt from build up sooner or later.