Earlier Episodes of the Personal Fairness (Mini) Sequence:

Personal Fairness Mini Sequence (1): My IRR isn’t your Efficiency

Personal Fairness Mini sequence (2) – What sort of “Alpha” are you able to count on from Personal Fairness as a Retail Investor in comparison with public shares ?

Personal Fairness Mini Sequence (3): Listed Personal Asset Managers (KKR, Apollo & Co)

Personal Fairness Mini sequence (4) : “Investing like a “billionaire” for retail buyers within the UK inventory market by way of PE Trusts

Personal Fairness Mini Sequence (5): Commerce Republic presents Personal Fairness for the lots (ELTIFs) -“Good strive, however hell no”

Time Machine: Y2K

A number of the older readers of my weblog may need energetic reminiscences in regards to the 12 months 2000. There was the so-called “2YK Scare” within the late 1990ies, the concern that pc methods (and planes) would crash when the 12 months 2000 would begin. After all it didn’t occur, the Dot.com bubble bought pumped up as soon as extra and the remaining is historical past.

One other occasion that bought much less consideration was the that again within the 12 months 2000, the now lengthy gone Dresdner Financial institution issued a Certificates (which is a well-liked construction in Germany to provide retail buyers publicity to something) that was truly a bond linked to the long run returns of an underlying Personal Fairness Portfolio managed by Swiss PE supervisor Companions Group. The exact same Companions Group that now has teamed up with Deutsche Financial institution to run an ELTIF.

Though I used to be not in a position to find the unique prospectus (Reviews on the internet web page solely return to 2019) , the fascinating facet of this certificates is that it has been traded since 2003 and due to this fact supplies us the possibly longest monitor file of a real, long run “retail Personal Fairness Efficiency”.

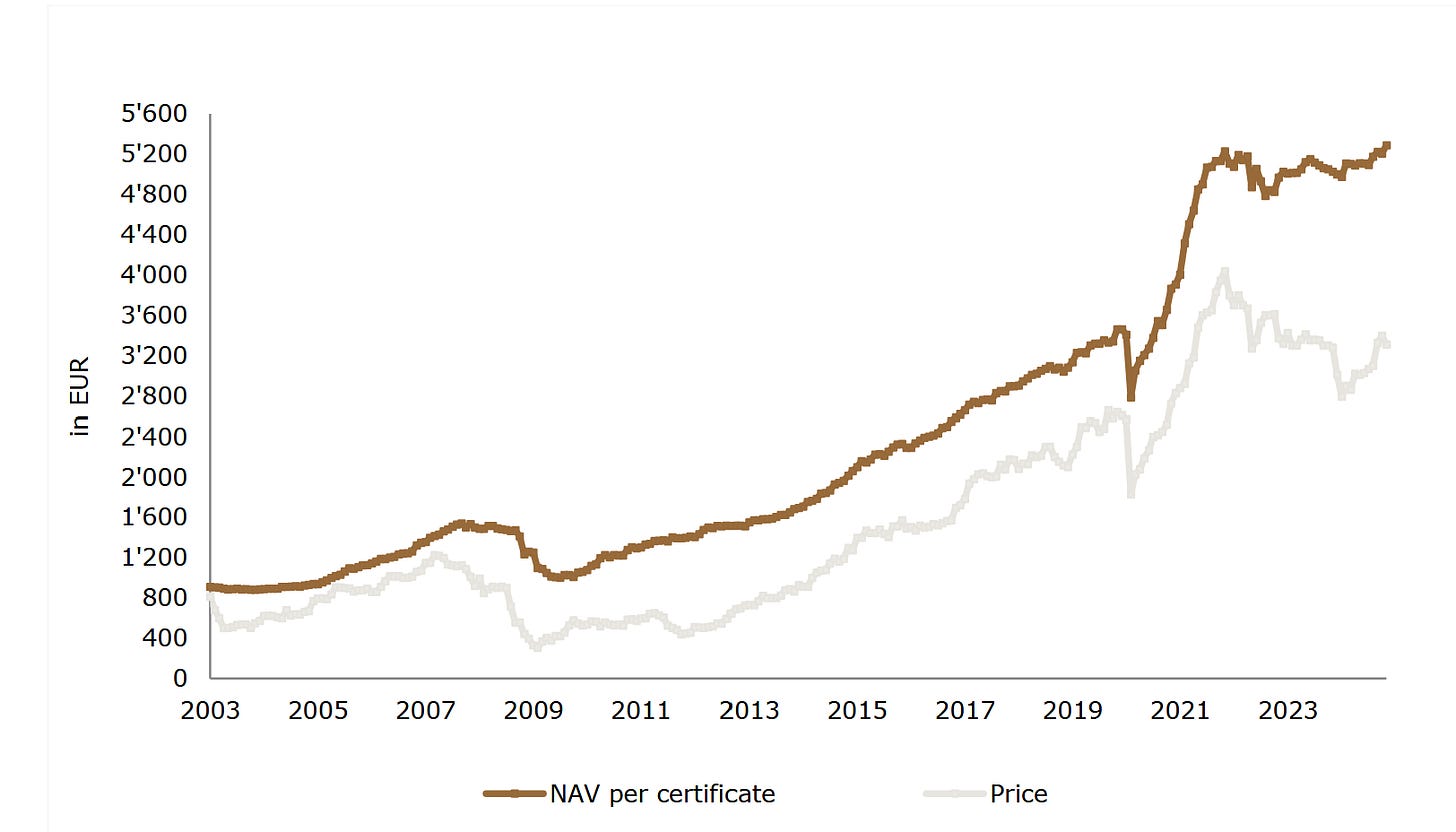

So that is how this 22 12 months chart appears to be like like:

The traded certificates doesn’t look too unhealthy, however 22 years is an extended time frame. So let’s examine it to the DAX and the MDAX and there it will get fascinating:

Even the Sleepy DAX and MDAX outperformed that product by a large margin. annualized complete return, that is what Bloomberg tells us:

So this Personal Fairness Certificates managed to return 8,31% or -2,7% p.a. lower than the DAX in the identical 22 years and 6 months. The underperformance to the MDAX which might e a greater proxy is even greater.

Even when I take the whole NAV efficiency said within the 2024 which is 428,8% and annualize it over 24 years, I get solely an annual return of ~7,2% p.a. from 2000 to 2024 for the certificates house owners.

How does that Certificates make investments & what are the charges ?

Wanting into the annual report, we will see that the underlying technique is a worldwide, Buyout targeted PE technique with a portfolio diversified over many asset managers and a excessive proportion of direct/co investments.

The payment construction is kind of just like what we have now seen in lots of different retail buildings: On the automobile stage, a payment of 1,5% flat on PE investments plus a 15% carry (5%) hurdle fee plus the charges of the underlying funds.

We can see within the annual account that the automobile charged the buyers 13,5 mn charges and prices in 2024 based mostly on round 580 mn in complete so round 2,6% in a 12 months with low efficiency.. In 2021, which was a greater 12 months, they charged 24 mn on 700 mn, so 3,5% (plus the charges of the underlying funds which aren’t explicitly disclosed.

There isn’t any annual kickback to the distributor in comparison with the Commerce Republic EQS product.

So why is the efficiency so unhealthy compared to even DAX and MDAX ?

I imply they need to have captured one of the best years of Personal Fairness and didn’t even handle to beat the old fashioned, non-tech DAX Index ?

One issue is clearly the present low cost of the value of the certificates to NAVwhich on the time of writing is a round -35%. Even when we’d alter for this, we’d nonetheless not be capable of beat the Loser indices DAX and MDAX for 22 years.

One other issue is that they appear to have hedged out the USD. The tailwind of a powerful USD is commonly included in previous EUR returns said by PE gross sales individuals however will after all not essentially be repeated. So the hedged efficiency numbers are higher predictors for the longer term in my view.

The place to begin of the time sequence in early 2003 is also a problem as this was roughly a decade low for the DAX index. However as we have now seen, the whole return since inception has solely been 7,2% and much away from the customarily talked about “double digit” returns.

Perhaps they’ve chosen the improper funds ? The names within the portfolio are literally tier 1 family fund names. KKR, Cinven, Vista, Permira and many others. These are all good names. However after all, we have no idea what they did within the early years. However Companions Group is a profitable PE supervisor, so I assume that this isn’t the difficulty.

What’s more durable to evaluate is that if they’ve possibly gotten solely the weaker a part of the co-Funding pipeline, as a big portion of the present portfolio are co-investments.

However the “exhausting reality” is:

With out all of the IRR shenanigans of Institutional PE funds and the extra payment layers of a retail product, the actual efficiency of a retail PE product is simply not superb and can almost definitely not beat a low value inventory index fund, fairly the other.

NAV low cost

One other fascinating facet of this safety is that no less than over the last 22 years, the certificates all the time traded at a major low cost to its said NAV. That is the graph from their 2024 report:

this mirrors the expertise from the UK listed autos that usually commerce at vital reductions, too.

Commerce Republic introduced that they wish to implement an “inner market place” the place buyers can promote month-to-month. My guess is that buyers will be unable to promote at NAV but when in any respect, at fairly steep reductions of 20-30%. I’m actually curious if we truly see trades on this inner market place in any respect.

As soon as once more: Don’t play within the On line casino, personal the On line casino

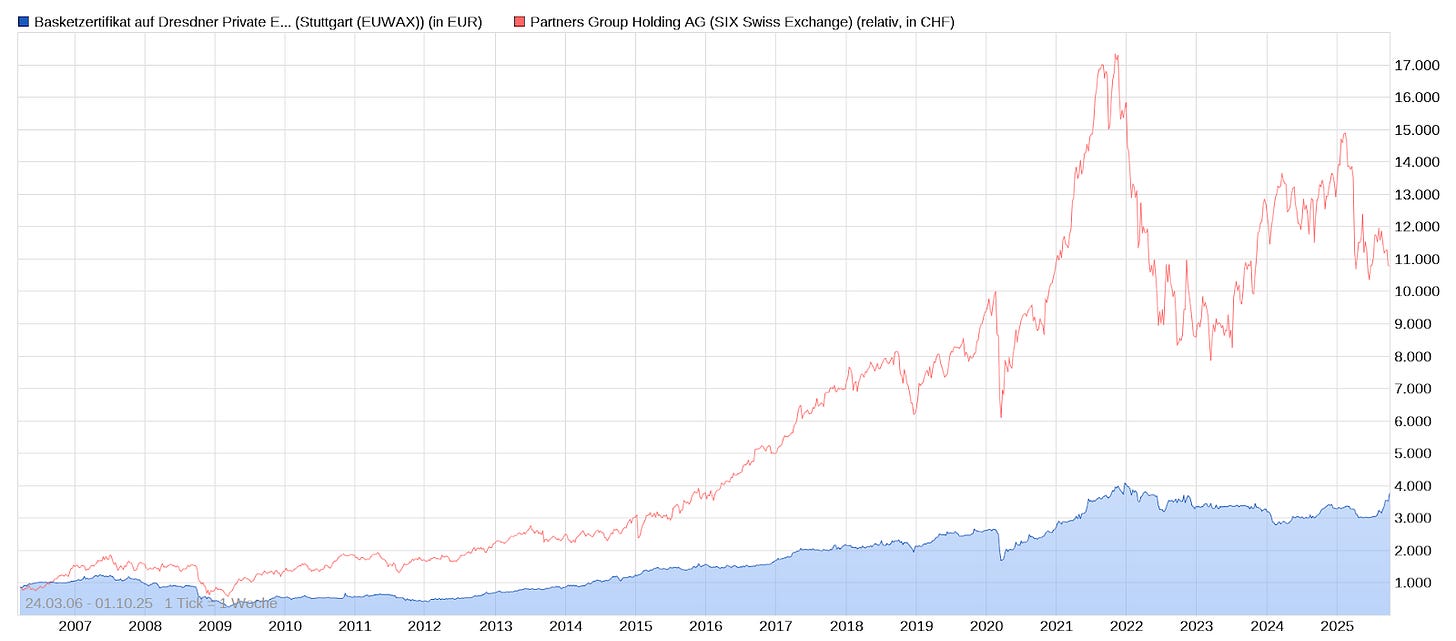

And final however not least, my favourite comparability: Companions Group was one of many earliest PE retailers to go public in 2006. That is how the inventory of companions Group did in comparison with the certificates that they handle:

As anticipated, you’d have made multiples of the cash investing into the GP as an alternative of the underlying property. And that is clear: As a partial proprietor of the GP, you acquire from excessive charges and a possible optimistic growth of the underlying property, however your draw back is restricted, as it isn’t your personal cash.

As a good friend would say: Losers play within the On line casino, winners purchase the On line casino.

So as soon as once more, my suggestion is evident: For those who imagine in the way forward for Personal Fairness, shopping for the GP by way of their listed shares will almost definitely be the higher alternative than going by excessive payment retail merchandise.

As a cliffhanger, within the subsequent episode I’ll take a look at one instance of a safety that offers you a comparatively honest publicity to PE funds should you actually desperately search for it.

Abstract:

The Dresdner Financial institution PE Certificates issued in 2000 provides a really sensible view of what retail buyers can count on in “actual world efficiency” for Retail Personal Fairness providing.

Over a interval of twenty-two years and 6 months (since this product is buying and selling), any retail buyers would have outperformed this product with a easy and straightforward DAX Index fund by a large margin of two,7% p.a. As an alternative of a 6x with the Certificates, good previous DAX would have given you a 10x in the identical interval.

The widely marketed double digit returns (after charges) for Retail PE merchandise are in my view a complete fantasy and are constructed upon previous, “massaged” IRR numbers that aren’t a great information for actual world efficiency.

I’m actually curious, what number of retail buyers will get sucked into these traps. Perhaps these articles assist a few of my reader (and their pals) to keep away from these merchandise.