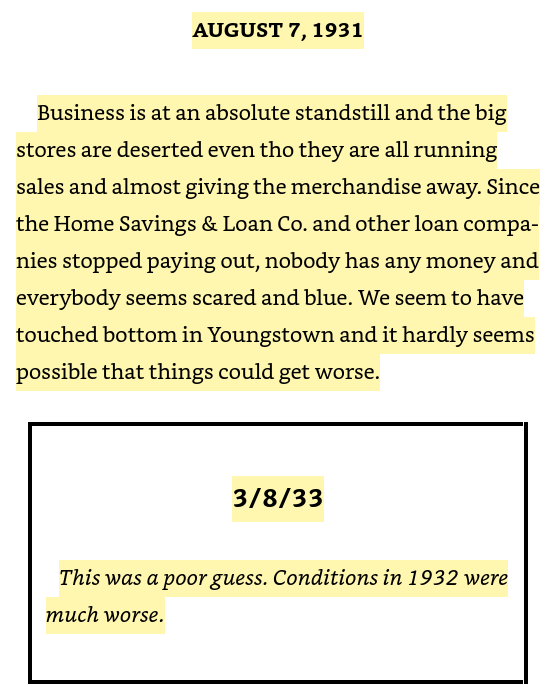

The Nice Melancholy: A Diary is the most effective ebook ever written in regards to the worst crash in historical past.

Most historical past books are written with the good thing about hindsight however this was a real-time account from a lawyer in Ohio about what it was wish to reside by the despair. Benjamin Roth additionally went again and made notes on earlier passages as he went alongside.

This one gives a great instance of what it was wish to reside by this era of endless financial strife:

That fixed beatdown of the Nice Melancholy left scars on a whole technology of individuals.

Research have discovered that Melancholy Infants skilled long-term adverse results on their schooling, earnings, and well being. Individuals who lived by that interval had been additionally much less prepared to take dangers, had been extra frugal with their cash and fewer more likely to personal shares.

On the outset of the pandemic, some individuals contemplated whether or not we might expertise an identical end result of a decrease urge for food for danger. The unemployment charge soared to greater than 14%. It appeared like all kinds of companies had been doomed. The inventory market crashed immediately. Issues had been bleak.

Then governments across the globe threw trillions of {dollars} at companies, municipalities and households. We had been off to the races.

The idea was that the speculative attitudes ignited by the pandemic spending binge could be short-lived. Individuals have been calling for the tip of those actions for years now.

Simply wait till skilled sports activities betting comes again. Then individuals will quit on the inventory market.

Simply wait till the meme inventory craze involves an finish. Retail will go dwelling with their tail between their legs.

Simply wait till all the pandemic extra financial savings go away. That can cease all the buyer spending.

Simply wait till inflation hits. That can get households to batten down the hatches.

Simply wait till we get a bear market. Then everybody goes to panic promote.

All of those self-imposed pundit deadlines have come and gone but family urge for food for danger stays sturdy.

Now it’s simply wait till there’s a once-in-a-lifetime crash just like the Nice Recession. Certain, however these crashes are uncommon by definition.

Everybody is considering this concept by the lens that this habits is cyclical.

My query is that this: What if it’s secular?

What if a whole technology of individuals experiences the alternative of the Melancholy Infants? What if the pandemic flipped a swap in people who find themselves extra prepared to take danger?

What does that imply going ahead?

I’m nonetheless pondering the potential implications however let’s take a look at a number of the proof first.

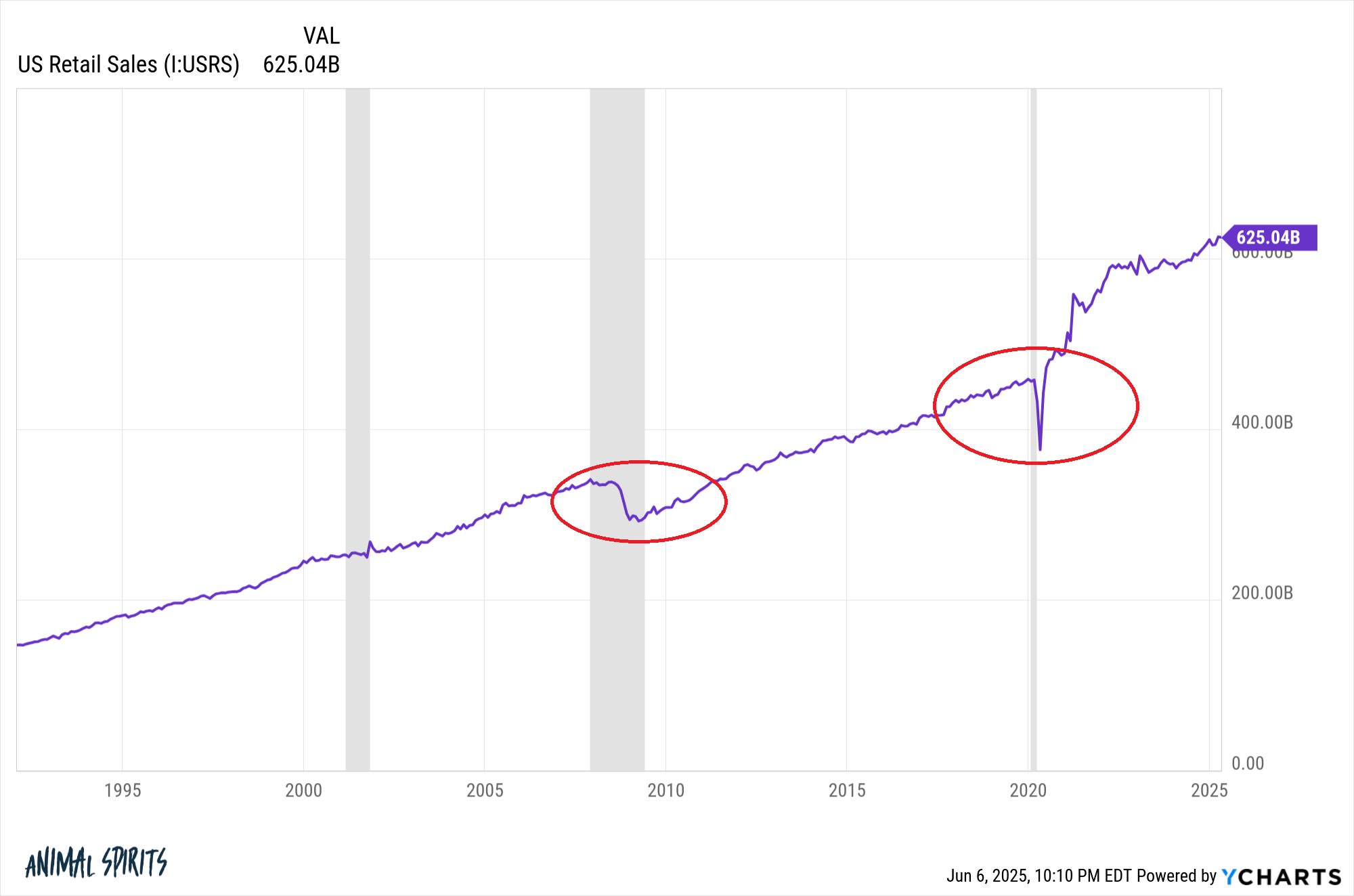

Shopper spending was knocked down a peg following the Nice Recession. Spending took off like a rocketship within the 2020s1 and set off on a brand new trajectory:

Gallup has been monitoring family inventory market possession for years now:

After peaking at 63% in 2004 following an enormous enhance in inventory market possession from the Nineties increase instances, the family share of shares fell to 52% by 2016. The 2008 disaster additionally left some scars.

Now it’s all the way in which again as much as 62% as a brand new technology of buyers has entered the market.

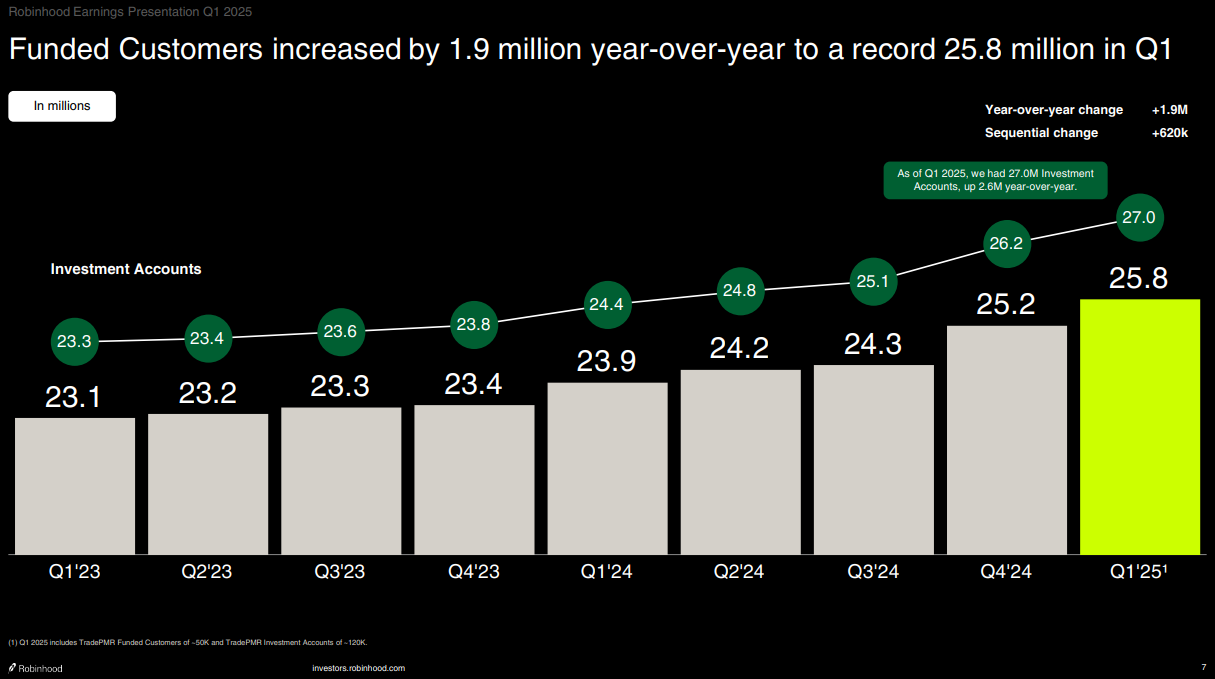

Robinhood now has almost 26 million clients:

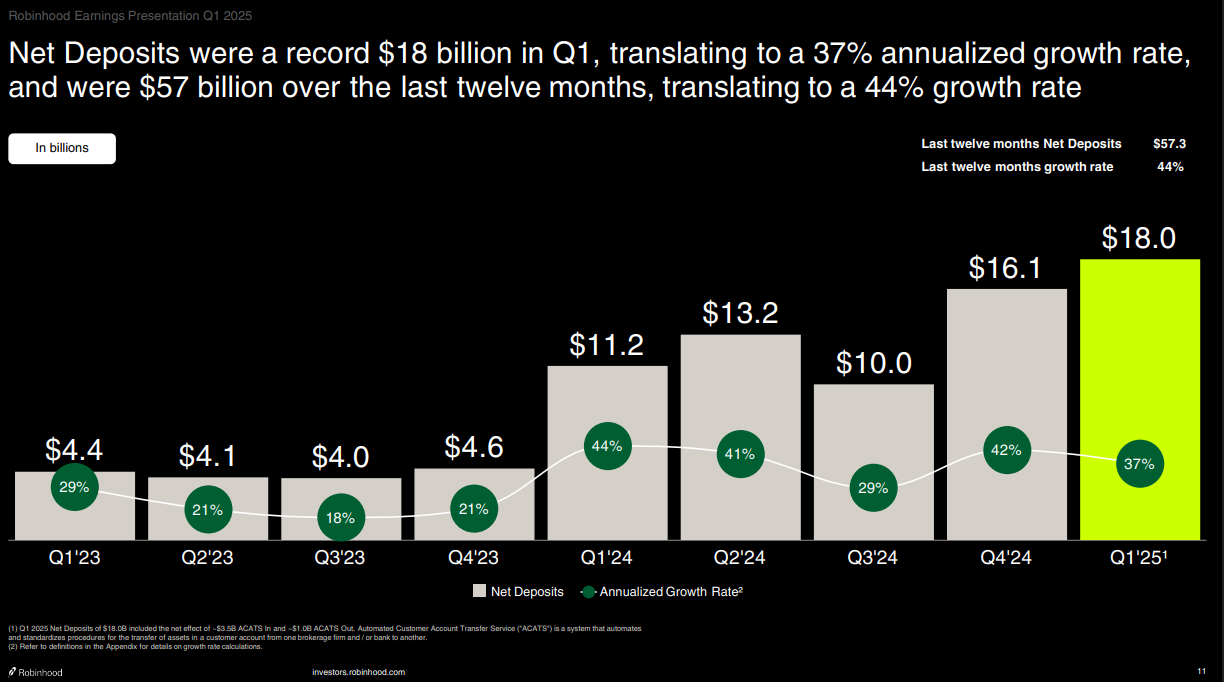

For round half of these clients, it’s their first-ever brokerage account. They usually preserve funneling cash into their accounts to take a position extra:

It’s not simply shares both.

Bitcoin is probably going the primary ever monetary asset that was owned by retail earlier than institutional buyers. Lots of the early bitcoin buyers are youthful. They’ve been rewarded with gigantic returns but additionally some bon-crushing crashes:

Bitcoin has fallen by 75% or extra twice within the final eight years. Most buyers have held on regardless of the massive losses.

In 2019, the sum of money wagered on sports activities betting was lower than $1 billion. In 2024, it was almost $150 billion.

Individuals are extra comfy with danger. They’re extra comfy with volatility. They’re extra comfy spending cash.

Now, perhaps this renewed urge for food for danger might be extinguished through the subsequent recession. We haven’t had an actual recession in over 15 years.2 It’s definitely potential all it should take for danger attitudes and client spending habits to decelerate might be a slap on the wrist within the type of an financial downturn.

However what if we solely get a run-of-the-mill recession?

What if this acceptance of danger is right here to remain?

Might it result in extra asset bubbles?

Might it result in extra frequent volatility and bear markets?

Might it result in extra V-shaped recoveries?

I don’t know the solutions to those questions as a result of it’s troublesome to foretell how experiences will form the longer term and the way the longer term will form individuals’s habits.

However this has been occurring for lengthy sufficient that it’s value contemplating the concept that we may very well be witnessing a whole technology of people who find themselves extra prepared to take dangers.

It might have long-lasting implications for the economic system and the markets for years to return.3

We talked about this concept and rather more on a reside recording of The Compound and Buddies from the Chop Store in Chicago this week:

Additional Studying:

Two of the Greatest Developments This Decade

1A few of that is from inflation after all however the level stays.

2The pandemic recession doesn’t depend. It was over too shortly and even individuals who lsot their jobs had been made entire by larger unemployment insurance coverage.

3And if we get a recession that utterly modifications individuals’s habits? Nicely, that’s human nature for you.