A reader asks:

Does Nick actually assume higher center class goes as much as $10 million?! That’s wealthy!

My colleague Nick Maggiulli has an amazing new e-book out known as The Wealth Ladder.

Nick supplies some recommendation round how your mindset and methods change as you progress up totally different rungs on the wealth ladder.

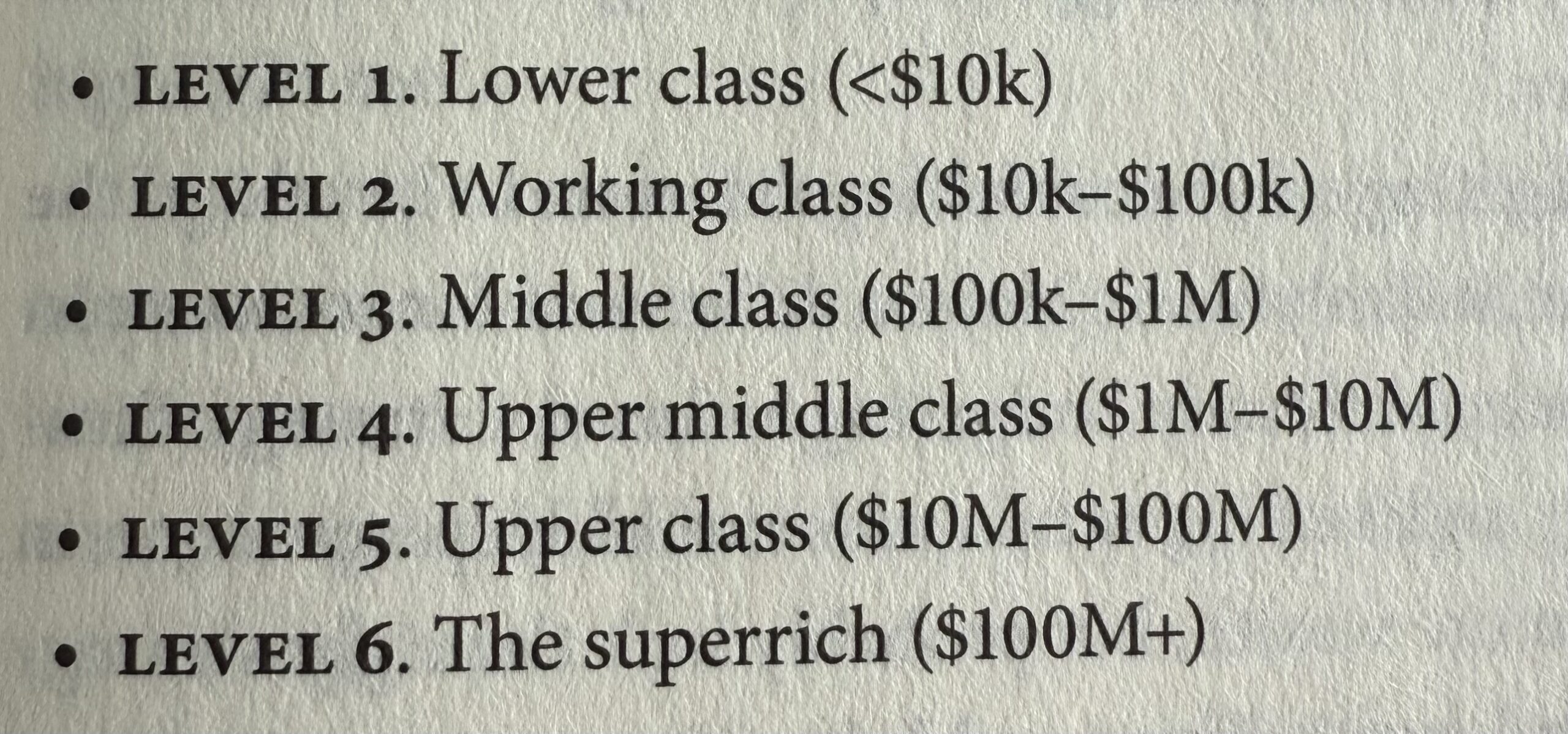

These are the degrees he defines within the e-book:

Quibble with the names should you’d like however Nick supplies much more context and particulars about every stage all through the e-book. Plus the ranges are large sufficient to supply some wiggle room relying in your value of residing.

Right here’s one other query we acquired this week that helps put this concept into perspective:

When Ben talked in regards to the excellent stage of wealth there may be one enormous issue that I’m having bother quantifying: the place you reside. I reside in a HCOL space and though I’m and doing very well by any possible metric ($2.5 million internet value in my mid-40s) I can’t assist however get the sense that it’s not sufficient based mostly on the place I reside. How do you concentrate on wealth by the lens of the place you reside?

A internet value of $2.5 million in your mid-40s places you within the 92nd percentile of American households. It additionally places you within the 94th percentile of individuals your personal age.

Nonetheless, the place you reside can have a big impact in your relative sense of wealth if there are many wealthy individuals who reside close to you.

Within the present Fleishman is in BotherToby Fleishman (Jesse Eisenberg) says to his spouse (Claire Danes) in a cash quarrel, “Excuse me, I make nearly $300,000 a yr. I’m a wealthy man in each single tradition besides the 40 silly sq. blocks that you just insist we reside inside (Manhattan).”

The relative nature of wealth turns into obvious when the information is prolonged to incorporate the remainder of the world.

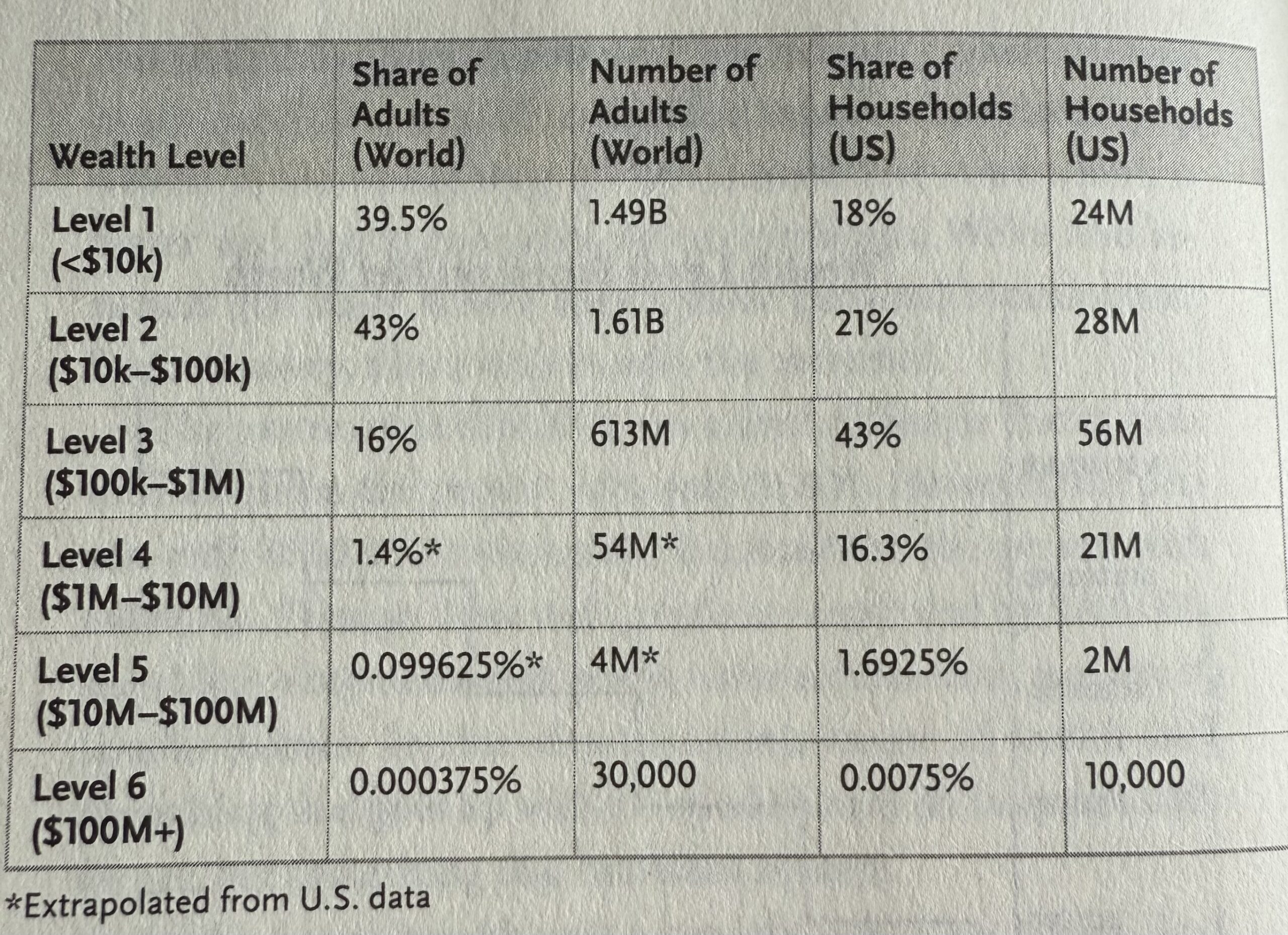

Nick breaks down every stage into the variety of folks and the share of households in every group each across the globe and in the USA:

Lower than 2% of the world’s inhabitants is millionaires, however round 20% of U.S. households discover themselves within the two-comma membership.

In case you’re a millionaire, by nearly any definition you’re wealthy however you won’t really feel wealthy.

I not too long ago commented that one of many methods wherein American exceptionalism reveals itself is by the truth that we all the time purchase the dip. What I imply right here is that it’s ingrained in our collective psyche that issues will get higher.

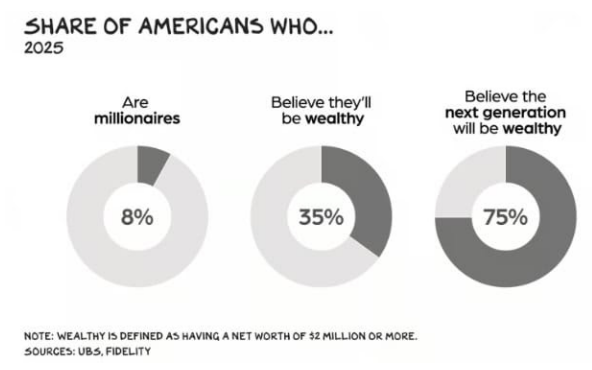

Scott Galloway has a chart that reveals the variety of Individuals who imagine they’ll be rich grows at an exponential price:

Everyone seems to be an above-average driver and everybody will probably be value $2 million or extra.

That is each miserable and provoking on the identical time. We Individuals are considerably delusional, generally to a fault and generally to the advantage of society.

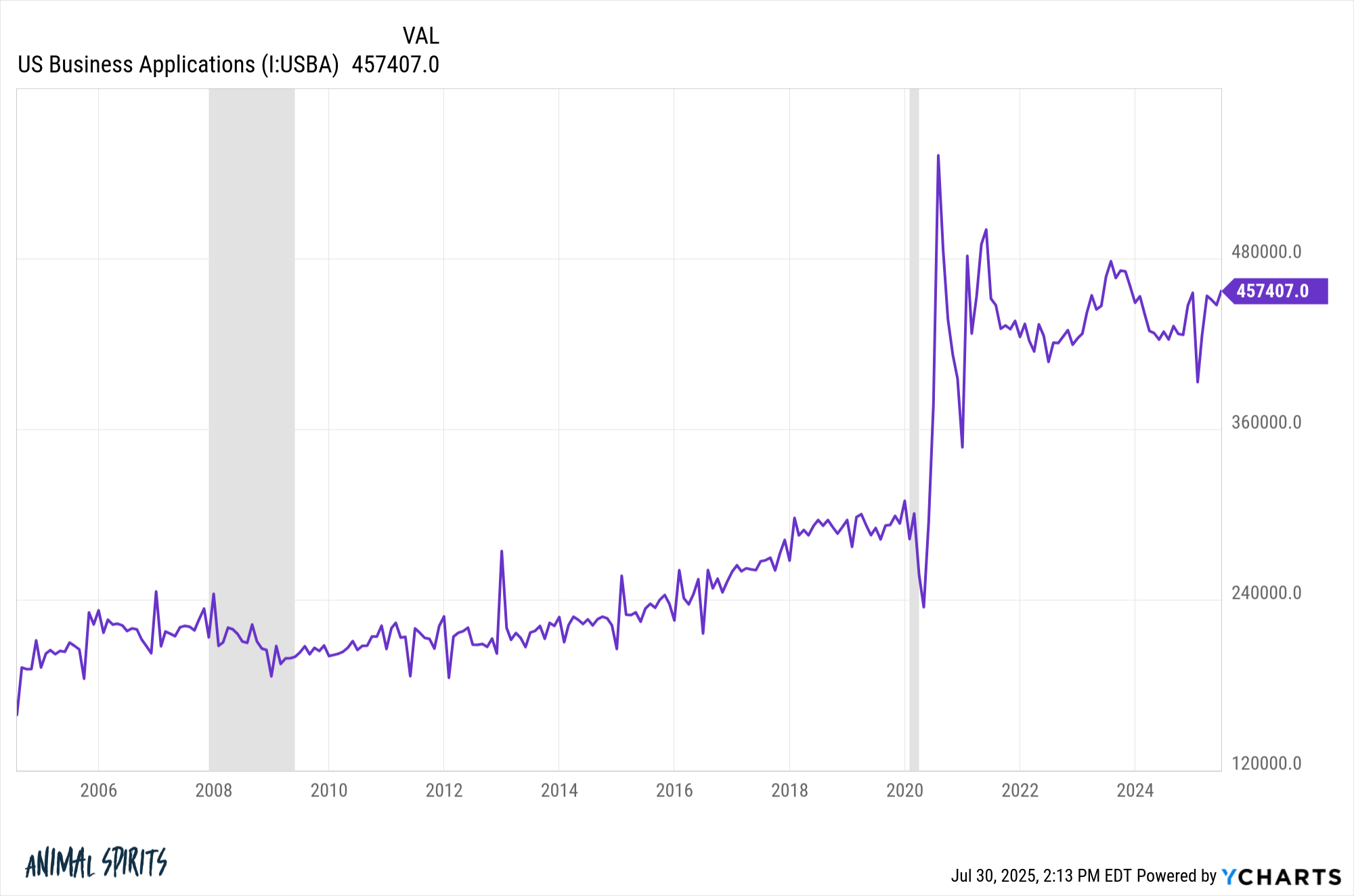

Have a look at the expansion in enterprise functions this decade alone:

Most start-up companies fail. That doesn’t cease us from making an attempt!

Cash is a wierd benchmark as a result of it can by no means be sufficient for some folks. That may trigger psychological issues on the particular person family stage however is a internet optimistic for society as a complete as folks attempt to strike it wealthy and hold getting richer.

Folks continuously striving to raised their place in life and earn more money assist hold the financial machine functioning.

Nick joined us on Ask the Compound this week to debate the totally different wealth ranges he created together with much more information and concepts from the e-book:

We additionally answered questions on inflation-adjusted returns, HCOL cities vs. your wealth, retiring in your 40s with 100% in shares and the way a lot cash it can save you by shifting out of NYC.

Additional Studying:

The Excellent Stage of Wealth

This content material, which incorporates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here will probably be relevant for any explicit details or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or supply to supply funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.