Beneath the transaction, Northern Superior’s shareholders will obtain 0.0991 of an Iamgold share and 19 cents in money for every frequent share of Northern Superior. The provide implies a complete worth of $2.05 per Northern Superior share, based mostly on the closing value of the Iamgold shares on the Toronto Inventory Trade on Oct. 17. The transaction will even embody a concurrent distribution to Northern Superior’s shareholders of all of the shares in ONGold Sources Ltd. at the moment held by Northern Superior.

Beneath a second deal, Iamgold will purchase Mines D’Or Orbec Inc. in a stock-and-cash deal valued at $17.2 million, web of the 6.7 per cent stake it already holds within the firm. Orbec shareholders will obtain 6.25 cents and 0.003466 of an Iamgold share for every Orbec share they maintain for a worth of 12.5 cents per share.

Teck Sources ‘very happy’ with progress of talks with regulators on Anglo deal

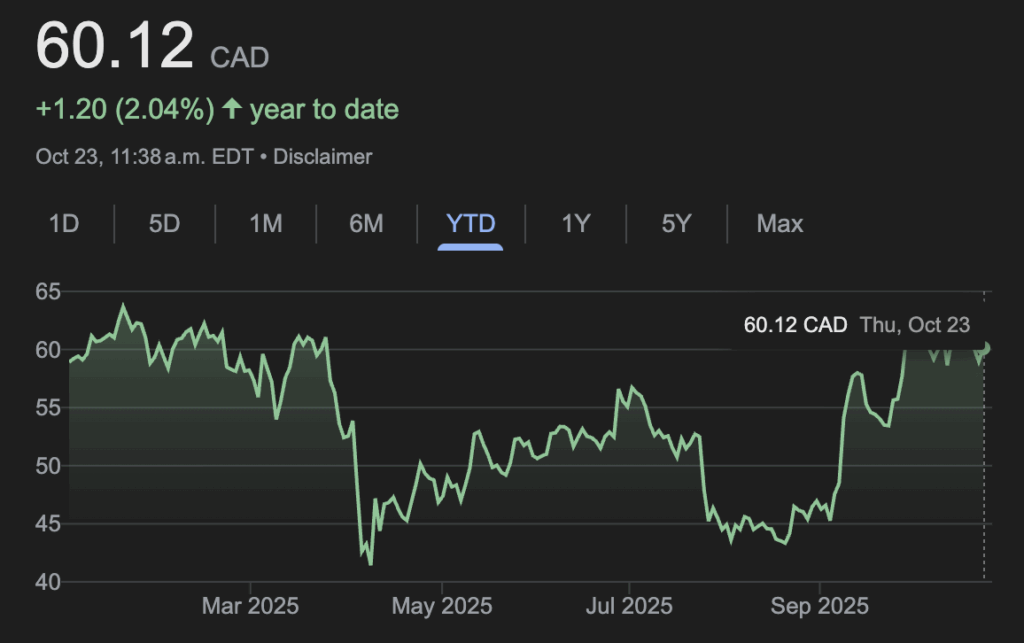

Teck Sources (TSX:TECK.B)

Numbers for its third quarter of 2025.

- Revenue: $281 million (up from lack of $748 million a yr in the past)

- Income: $3.39 billion (up from $2.86 billion in identical quarter final yr)

The top of Teck Sources (TSX:TECK.B) says he’s proud of the best way talks with authorities officers are going as the corporate seeks Ottawa’s approval for its proposed merger with U.Ok. mining large Anglo American—even because the trade minister signalled final month she wished extra from the businesses.

“Conversations are ongoing, they usually’re productive and we’re very happy in the best way that they’re unfolding in the intervening time,” chief government Jonathan Value informed a convention name to debate the corporate’s newest outcomes Wednesday.

Teck introduced a deal final month to merge with Anglo American to kind the Anglo Teck group; nonetheless, the deal requires approval beneath the Funding Canada Act, which can be utilized to dam offers deemed towards the nationwide curiosity.

“We’re participating on an ongoing and collaborative foundation with the Canadian authorities right here,” Value stated.

“These discussions have been frequent and productive.” He stated he believes the corporate has put ahead a robust and complete bundle of commitments to Canada, a key factor of which is the plan to maneuver the headquarters of Anglo to Vancouver.

The businesses have stated the mixture would create a $70-billion copper mining powerhouse with headquarters and prime executives based mostly in Vancouver. They’ve pitched it as a “merger of equals” regardless that Anglo American is value greater than double Teck. Shareholders vote on the deal in December, whereas Value stated the corporate will probably be finishing all of its filings associated to antitrust and competitors with regulators globally.

Article Continues Beneath Commercial

Trade Minister Mélanie Joly has stated Ottawa desires to see longer-term commitments to Canada if Teck is allowed to merge with Anglo American. Teck and Anglo American have dedicated about $4.5 billion in spending in Canada over 5 years as a part of the deal. Nevertheless, a good portion of that has already been introduced by Teck, together with the mine life extension of its Highland Valley copper mine.

Value’s feedback got here as the corporate reported a revenue from persevering with operations attributable to shareholders amounted to $281 million or 57 cents per diluted share for its third quarter. The end result in contrast with a lack of $748 million or $1.45 per diluted share in the identical quarter final yr. On an adjusted foundation, Teck says it earned 76 cents per diluted share from persevering with operations in its newest quarter, up from an adjusted revenue of 60 cents per diluted share a yr earlier. Income totalled $3.39 billion, up from $2.86 billion in the identical quarter final yr.

In reporting its third-quarter outcomes, Teck stated manufacturing at Quebrada Blanca in Chile continues to be constrained by the tempo of growth of a tailings administration facility, requiring downtime within the concentrator.

Mullen Group Q3 revenue down from yr in the past as acquisitions enhance income

Mullen Group Ltd. (TSX:MTL)

Numbers for its third quarter of 2025.

- Revenue: $33.2 million (down from $38.3 million a yr in the past)

- Income: $561.8 million (up from $532 million in identical quarter final yr)

Mullen Group Ltd. (TSX:MTL) reported its third-quarter revenue fell in contrast with a yr in the past as acquisitions helped enhance its income.

The trucking and logistics firm says it earned $33.2 million or 36 cents per diluted share for the quarter ended Sept. 30. The end result in contrast with a revenue of $38.3 million or 41 cents per diluted share a yr earlier.

Income for the quarter totalled $561.8 million, up from $532.0 million in the identical quarter final yr. The rise was helped by the acquisition of Cole Worldwide Inc. and Pacific Northwest Transferring (Yukon) Ltd.

On an adjusted foundation, Mullen Group says it earned 38 cents per share in its newest quarter, down from an adjusted revenue of 41 cents per share a yr earlier.

Wealthsimple says belongings prime $100 billion beneath administration

Wealthsimple Inc. says its belongings beneath administration have reached $100 billion as the corporate tweaks its choices. The privately-held monetary platform has seen its belongings roughly double from a yr in the past, whereas in 2023 it had set a goal of 2028 to succeed in the $100 billion mark.