Final week, a reader had an fascinating query in response to the Homer Simpson financial video. He puzzled, given the variety of jobs that Homer Simpson has had and the way compensation has modified over time, is there an excellent evaluation of earnings versus inflation? I didn’t know of any such evaluation, so I made a decision to give you one. Since a lot of the evaluation round this query is lower than clear (to be frank), I additionally determined to make use of it as a primer on tips on how to learn by way of financial statistics. As all the time, caveat emptor!

Common Hourly Earnings: Previous 10 Years

Let’s begin with essentially the most extensively reported stat: common hourly earnings for all staff. Under is a straightforward graph that shows hourly pay towards the inflation index. On the face of it, it seems wage earnings has didn’t sustain with inflation over the previous 10 years. After we look nearer, although, we be aware that the 2 collection have completely different scales. Costs have gone from round 210 to 258, or up about 23 %. Hourly earnings, however, have risen from about 22 to twenty-eight, or 27 %. Utilizing that evaluation, hourly earnings should not solely maintaining with inflation, they’re beating it.

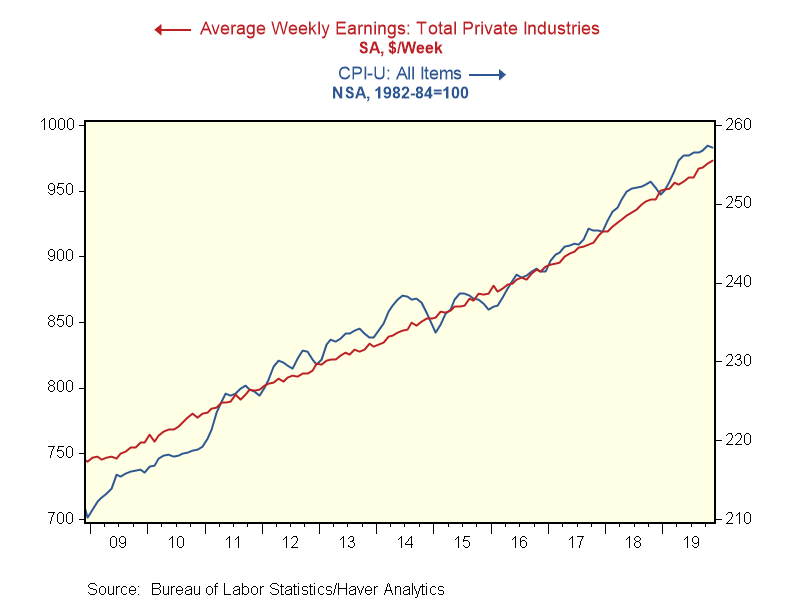

Common Weekly Earnings: Previous 10 Years

Hourly earnings should not one of the best stat for this evaluation, because the hours labored are additionally critically essential. The graph under, utilizing weekly pay, corrects for that deficiency. Right here, the graph means that pay and inflation are roughly in line. However utilizing the completely different scales, we will see that, once more, costs are up about 22 %, whereas weekly pay is up from about 740 to 975, or about 32 %. As soon as once more, weekly pay just isn’t solely maintaining with inflation, however beating it.

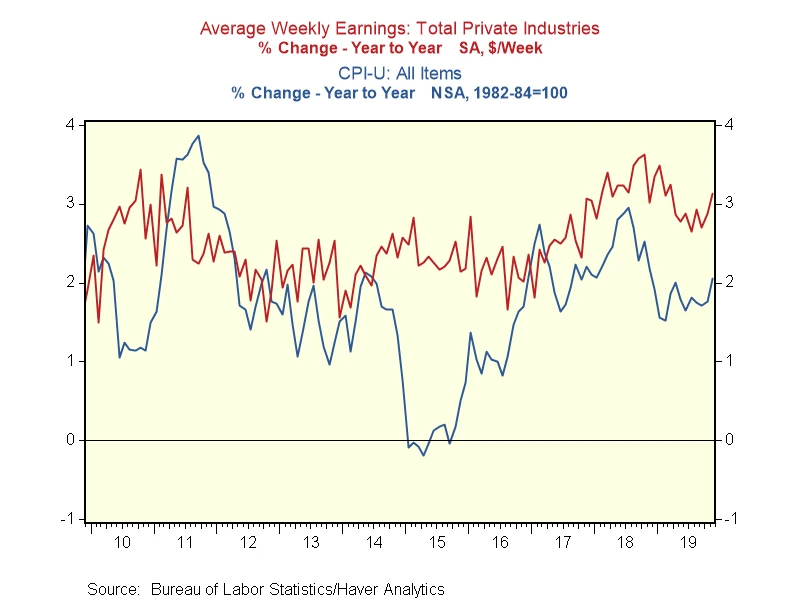

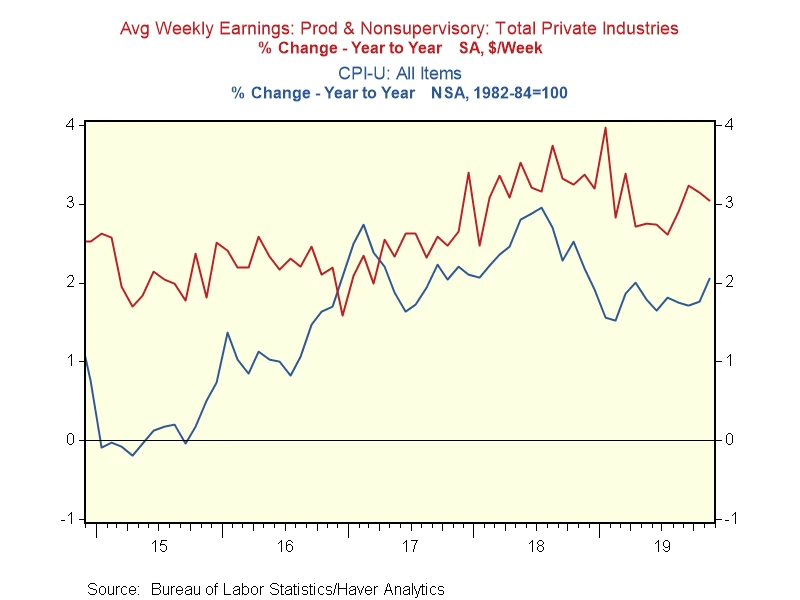

Yr-on-Yr Earnings Progress: Previous 10 Years

One other approach to take a look at this knowledge is to match the expansion over time of the 2 collection. Under, we’ve got the year-on-year development charges for each. We will see that for a part of the previous decade, particularly within the early interval, inflation was greater than earnings development. Additional, for many of the remainder of the last decade earlier than 2014, inflation ate up virtually all the earnings development. Since then, nevertheless, earnings development has constantly crushed inflation.

Let’s take it down yet one more stage. The previous 10 years is a helpful timeframe for evaluation, however most individuals’s recollections are shorter. In any occasion, you must pay your payments immediately. What if we take a look at shorter intervals?

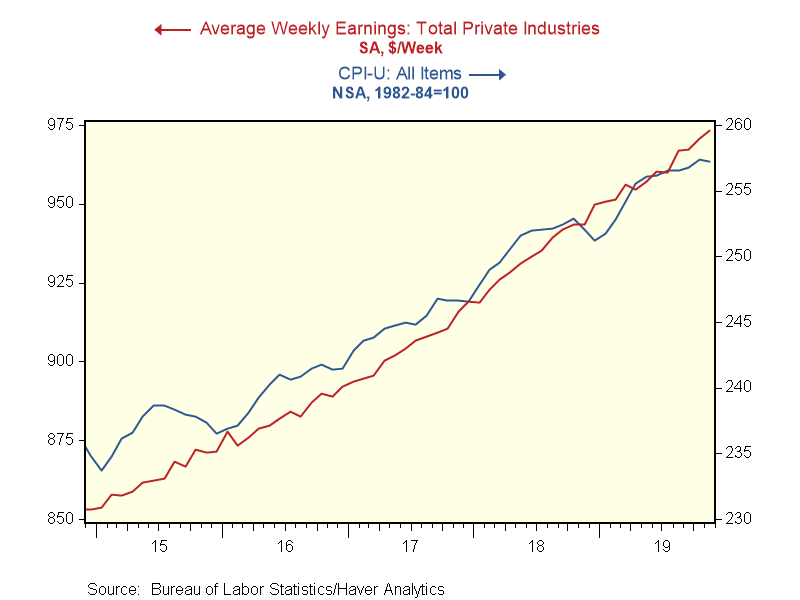

Common Weekly Earnings: Previous 5 Years

For the previous 5 years, the graph once more means that weekly pay and inflation are roughly in line. However utilizing the completely different scales, we will see that costs are up about 9 %, whereas weekly pay is up about 26 %. As soon as once more, weekly pay just isn’t solely maintaining with inflation, however beating it. In truth, virtually all the development over the previous decade got here up to now 5 years.

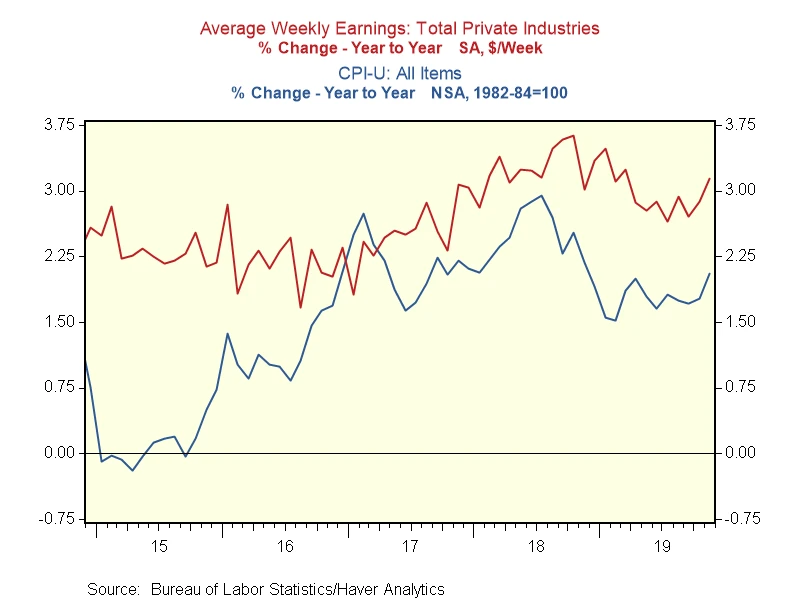

Yr-on-Yr Earnings Progress: Previous 5 Years

If we take a look at the annual modifications, we will see earnings development has been nicely above inflation for nearly all the previous 5 years. In different phrases, the common employee is materially higher off than she or he was 5 years in the past.

What Concerning the Common Employee?

One weak point of the evaluation up to now is that the “common employee” included within the charts above encompasses individuals who make much more than the common employee. However what if we restrict the information to the true working individuals—those who’re most affected by inflation on a day-to-day foundation? We will just do that with the chart under. Right here, we see precisely the identical factor, with earnings development outpacing inflation for the previous 5 years.

Good Information for 2020

Wanting on the numbers, it’s clear that earnings development has outpaced inflation for the previous 5 years, and it’s prone to preserve doing so. As such, the true buying energy of staff continues to extend, regardless of the scary headlines. This evaluation additionally gives an evidence for 2 in any other case puzzling issues: the power of client confidence and client spending within the face of those headlines. Merely, when individuals have cash to spend and are getting raises, they have an inclination to spend it.

So long as inflation and unemployment keep low, actual earnings ought to preserve outpacing inflation. And that’s what has saved the enlargement going—and is nice information for 2020.

Editor’s Notice: The authentic model of this text appeared on the Impartial Market Observer.