A reader asks:

Might you speak about what share of shares which can be beating the S&P over the past 5 years additionally beat the S&P the 5 years earlier than that? I’m curious what names seem in each lists, with components like pre- and post-COVID, and pre- and post-AI enjoying an element. Possibly you possibly can additionally speak about how shares that beat the S&P over a 5-year window are likely to fare over the following 5 years on common.

It is a good query as a result of so many buyers are involved about focus within the S&P 500.

It certain feels prefer it needs to be a small variety of shares which have outperformed.

Within the 5 yr interval from 2016-2020, the S&P 500 was up somewhat greater than 100%. From 2021 by way of this week, the S&P 500 is now up round 90% in complete.

These are each superb returns at proper round 14%-15% yearly.

So what number of shares outperformed in these 5 yr home windows?

The quantity was increased than I assumed it might be.

There’s a caveat right here that shares have moved into and out of the index over this era. The turnover isn’t that prime within the S&P 500 nevertheless it’s in all probability 2-4% per yr on common.

By my calculations, 149 shares outperformed the index within the 5 years ending 2020. That’s round 30% of the overall. That’s a reasonably low quantity.

Within the final 5 years, 241 shares outperformed the S&P 500’s return. That’s extra like 50% of the overall. That’s not unhealthy.

So what number of outperformed over each durations?

I counted 40 shares.

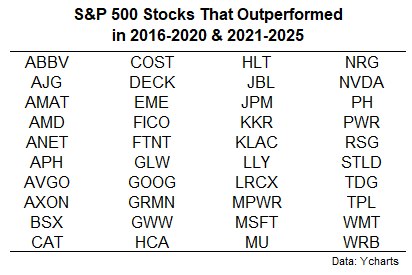

Here’s a checklist of the tickers for these shares:

It’s quite a lot of names you already know — Microsoft, Google, Nvidia, Walmart, JP Morgan, Costco and Broadcom. Nvidia’s outcomes had been off the charts good in each time durations, up 1,500% and 1,300%, respectively.

Some shocking names outperformed in every 5 yr interval as properly — Hilton, Caterpillar and Deckers Open air to call a number of.

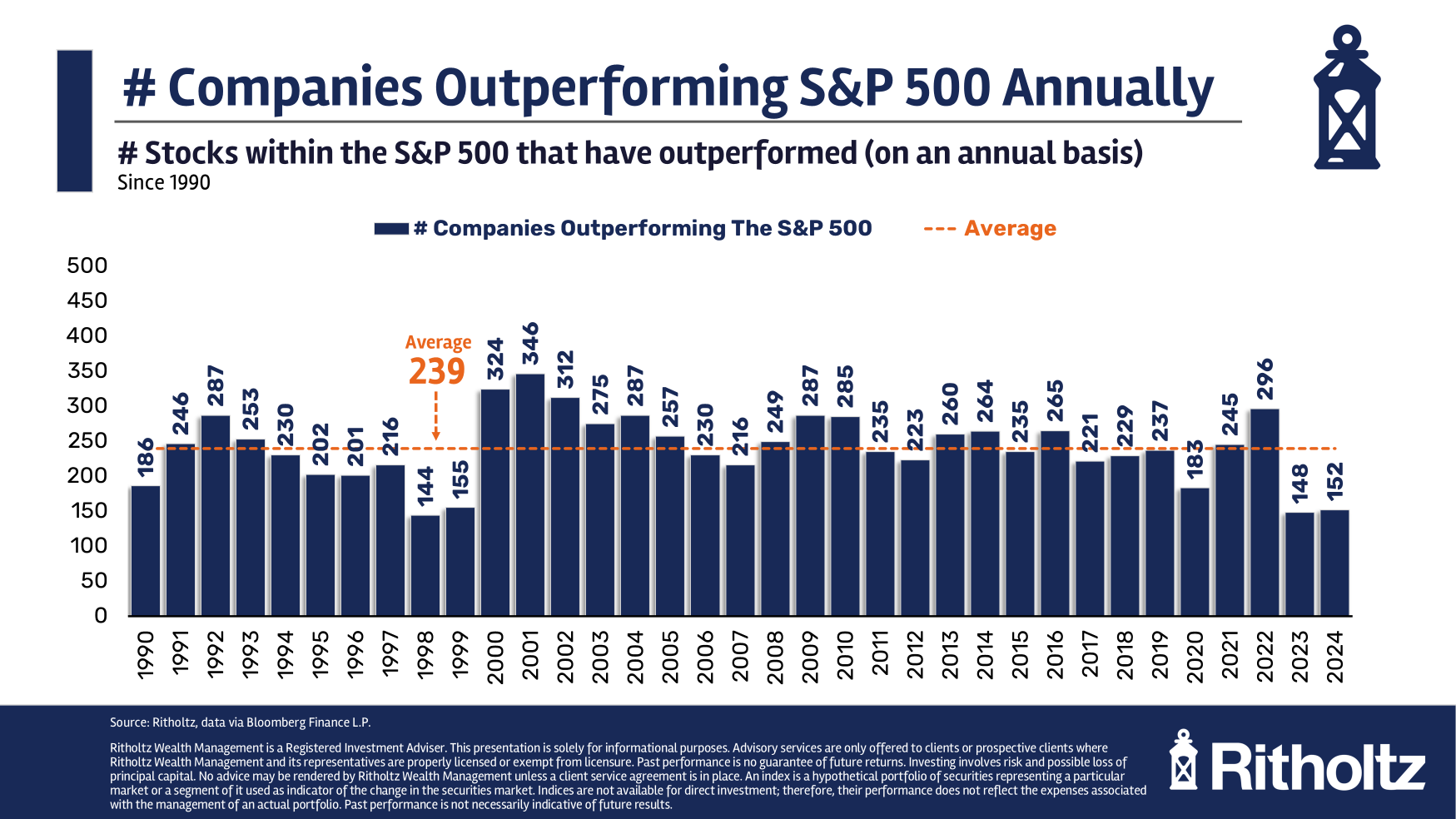

The inventory market is getting increasingly more concentrated on the prime however the variety of shares that outperform the index every year might be increased than you suppose. Right here’s a take a look at the variety of shares which have outperformed the index efficiency every year going again to 1990:

The common is simply shy of fifty% of the overall every year.

It’s attention-grabbing that it’s principally a coin flip every year on whether or not you’ll outperform or not with particular person securities.

The win fee for outperforming shares goes right down to roughly one-third over the earlier 10, 15 and 20 yr time frames.

Even with a 50% annual win fee, selecting shares is just not straightforward. However selecting the stock-pickers that outperform the market is even more durable.

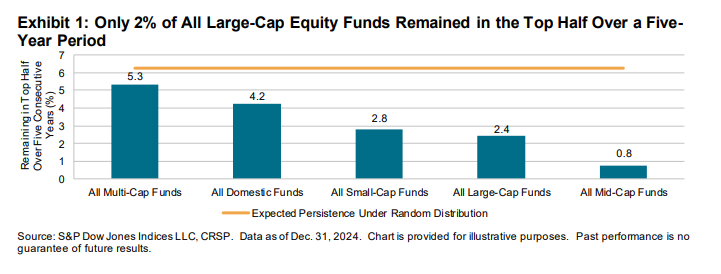

Annually SPIVA updates its Persistence Scorecard to see what number of skilled fund managers are capable of outperform in successive multi-year durations.

The numbers are dreadful.

Check out this chart:

Round 2% of all massive cap funds had been capable of stay within the prime half of returns for his or her class in 5 straight years. It will get even worse the additional out you go.

SPIVA notes that zero funds that had been within the prime quartile as of December 2020 remained within the prime quartile over the following 4 years. Not one of the prime quartile funds from 2022 had been within the prime quartile over the following two years. Not one.

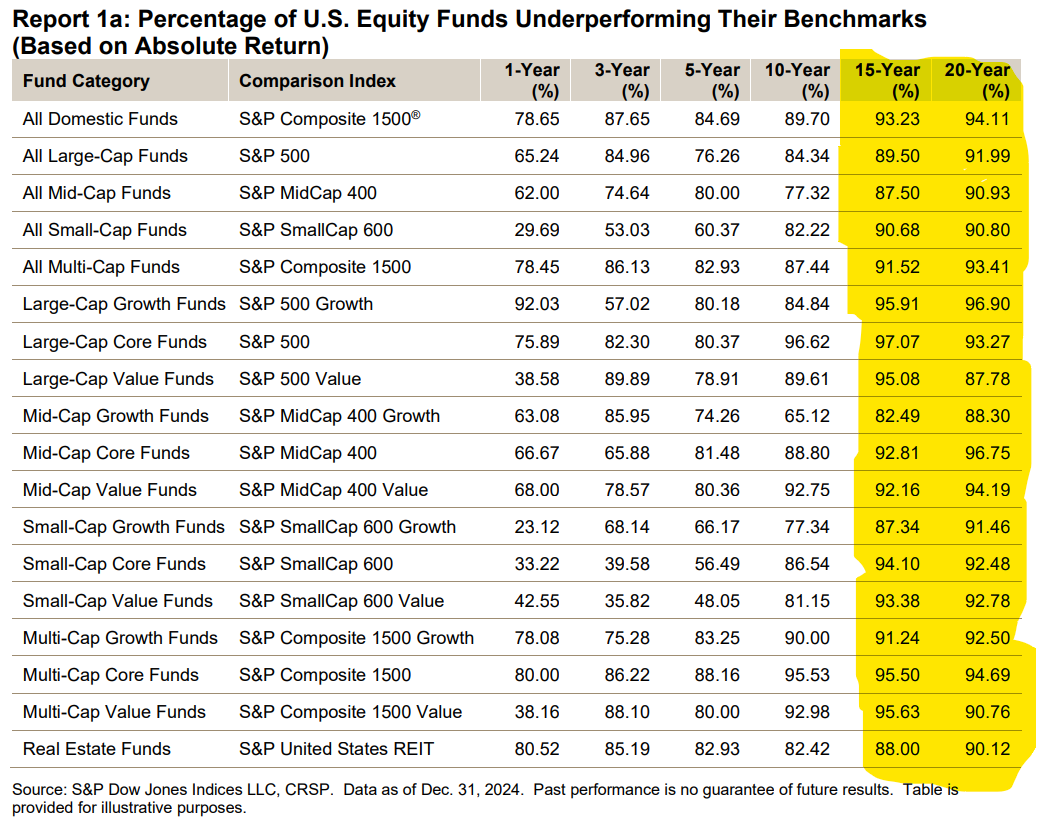

And naturally, the variety of funds that outperform over the long term is tiny as properly:

Over 15 and 20 years simply 10% or so of all actively managed funds outperform.

Outperforming is tough. Outperforming constantly is principally exceptional lately.

If you happen to’re going to take a position actively, it’s essential to be ready for lumpy returns, even for the small variety of funds and buyers who do outperform.

I believe one of many causes the win fee for the variety of outperforming shares is increased than the win fee for fund outperformance is that buy-and-hold is a troublesome technique to stay with psychologically.

Selecting the successful shares is tough however staying invested in them could be even more durable.

Purchase-and-hold might be your finest wager when proudly owning particular person shares nevertheless it’s not straightforward to take a seat in your palms and wait.

I answered this query intimately on this week’s all new Ask the Compound:

We additionally mentioned questions on the way to die with zero, how diversification works in follow, the Dave Ramsey portfolio and when to make your 529 account extra diversified and conservative.

Additional Studying:

When Purchase-and-Maintain Dies