A reader asks:

May you discuss methods to use momentum indicators and cease losses to revenue from an AI bubble? Having been an investor through the 1990’s this feels just like the early innings of a bubble, if that is one. I feel there could also be a comparatively low threat approach to revenue with out selecting particular person winners or time the highest by utilizing momentum indicators and utilizing trailing cease loss orders on broadly-based, passively managed ETFs.

Within the spring of 2006, Meb Faber printed a analysis paper titled A Quantitative Strategy to Tactical Asset Allocation.

The concept was to make use of a 10-month transferring common to dictate your allocation between threat belongings (shares) and money (T-bills).

The principles had been easy. At month finish:

- If the present value is larger than the 10-month transferring common, keep invested in shares.

- If the present value is lower than the 10-month transferring common, put money into money.

In case you’re in an uptrend, you purchase or keep invested. In case you’re in a downtrend, you promote or keep in money.

The concept behind the technique is to dampen the volatility and the chance of extreme market drawdowns in threat belongings.

The timing of the paper couldn’t have been higher. A bit of greater than a 12 months later, the inventory market peaked on the onset of the Nice Monetary Disaster. The S&P 500 fell almost 60%.

So how did Faber’s guidelines work? Extremely properly.

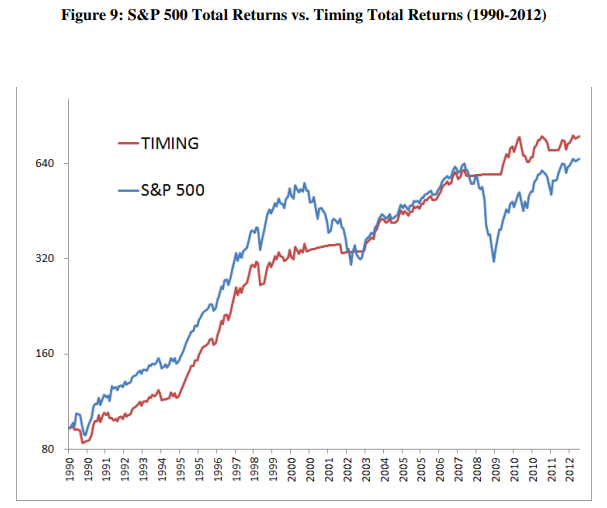

Meb up to date his paper just a few years later to point out how the backtest carried out in the actual world:

The technique didn’t get out on the actual prime as a result of that you must watch for a downtrend to take maintain earlier than getting a sign nevertheless it missed nearly all of the carnage.1

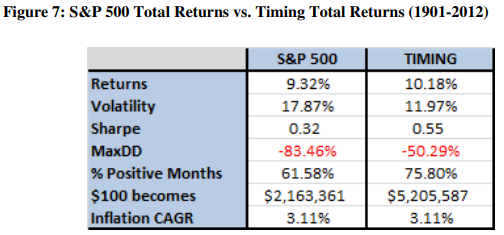

These had been the long-term return profiles for pattern following versus purchase and maintain:

Development following didn’t utterly take drawdowns off the desk, nevertheless it did dampen volatility considerably in these 110+ years of knowledge.

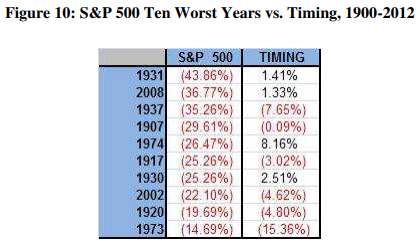

Now have a look at the efficiency of the worst years within the inventory market versus the pattern technique:

One of these technique is designed to shine within the worst inventory market environments.

There’s nothing magical about 10 months or a month-to-month indicator on this stuff however the level is you wish to have a timeframe that means that you can higher outline uptrends and downtrends.

Dangerous issues occur extra typically in downtrending markets as a result of traders are inclined to panic extra freely once they’re shedding cash. That is why each the most effective and the worst days happen throughout bear markets.

Downtrends pave the way in which for a broader set of attainable outcomes, and never all the time in a great way.

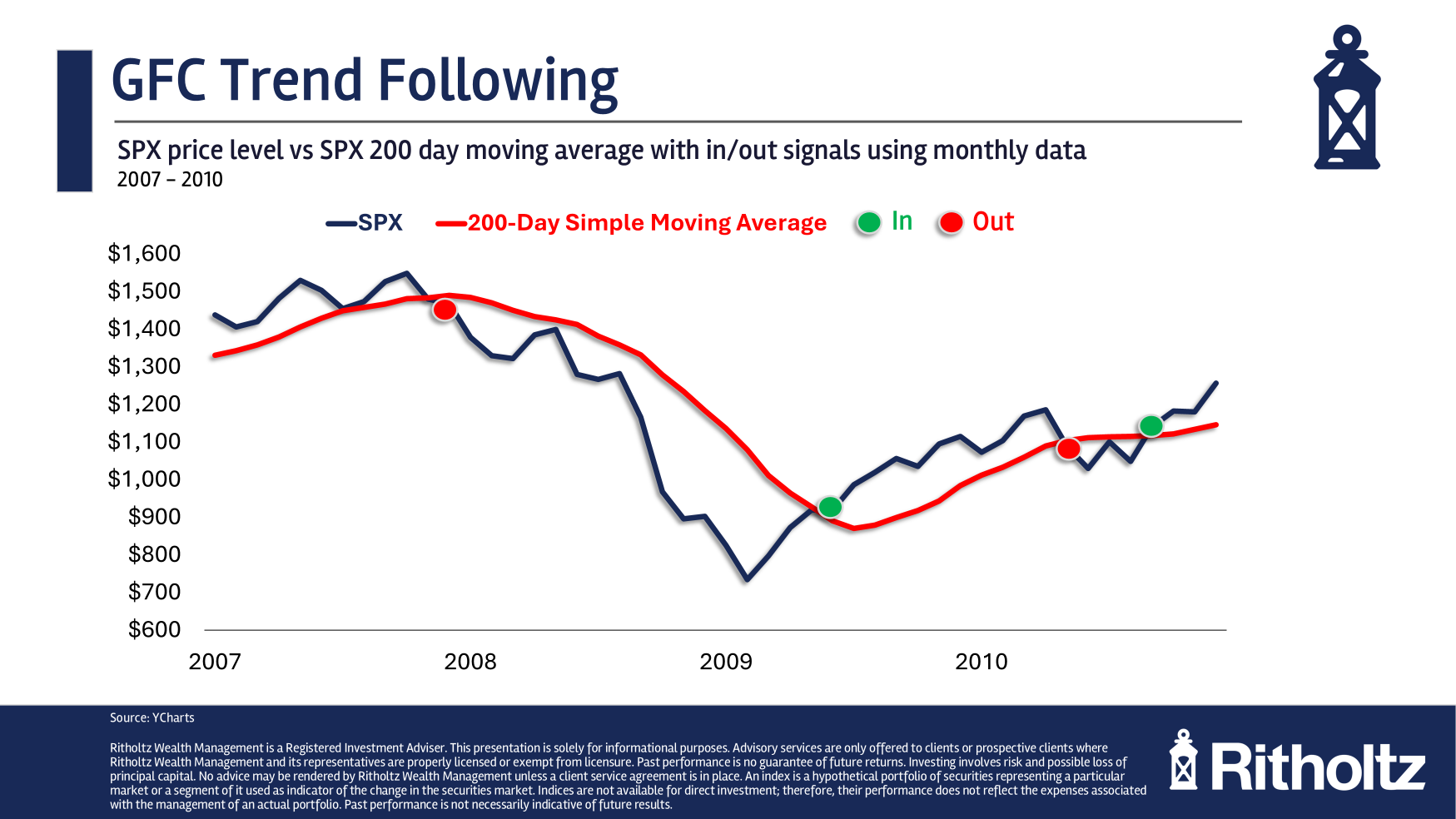

Right here’s a have a look at utilizing a easy 200-day transferring common on a month-end foundation through the 2008 monetary disaster:

The promote sign was triggered 6% or so under the height which was excellent timing. Then you definitely bought again in roughly 20% off the lows. That’s fairly good contemplating the dimensions and size of the 2007-2009 crash.

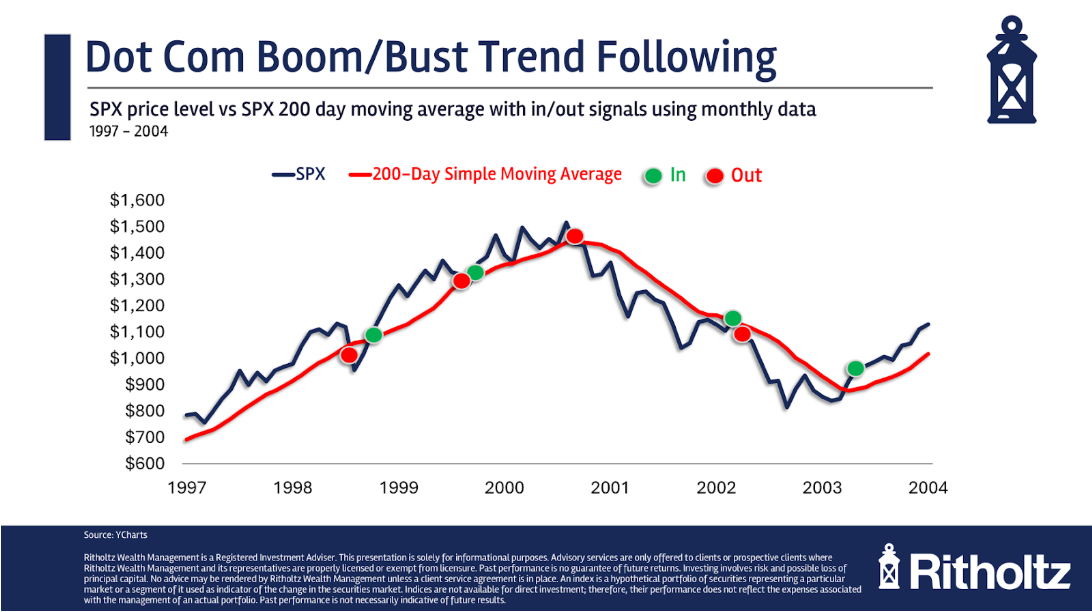

Now listed here are the indicators through the dot-com bubble:

You’ll be able to see there have been some false positives alongside the way in which to the height of the dot-com bubble. You bought and bought proper again in through the 1998 volatility. There was a whipsaw once more in 1999 when the transferring common triggered a promote sign adopted shortly by a purchase sign.

However then there was a month-end promote sign simply 6% under the 2000 peak that stored you out of nearly all of the 50% crash. Another fast whipsaw in 2002 however once more a pattern following system helped you survive a extreme downturn.

So why would you ever put money into the rest?

Effectively, pattern following is an excellent hedge towards extreme market downturns. However extreme market downturns don’t occur that usually. Crashes are uncommon.

Drawdowns don’t all the time occur in waterfall style. If there’s a flash crash scenario a pattern following technique gained’t prevent. And in uneven markets you may get whipsawed.

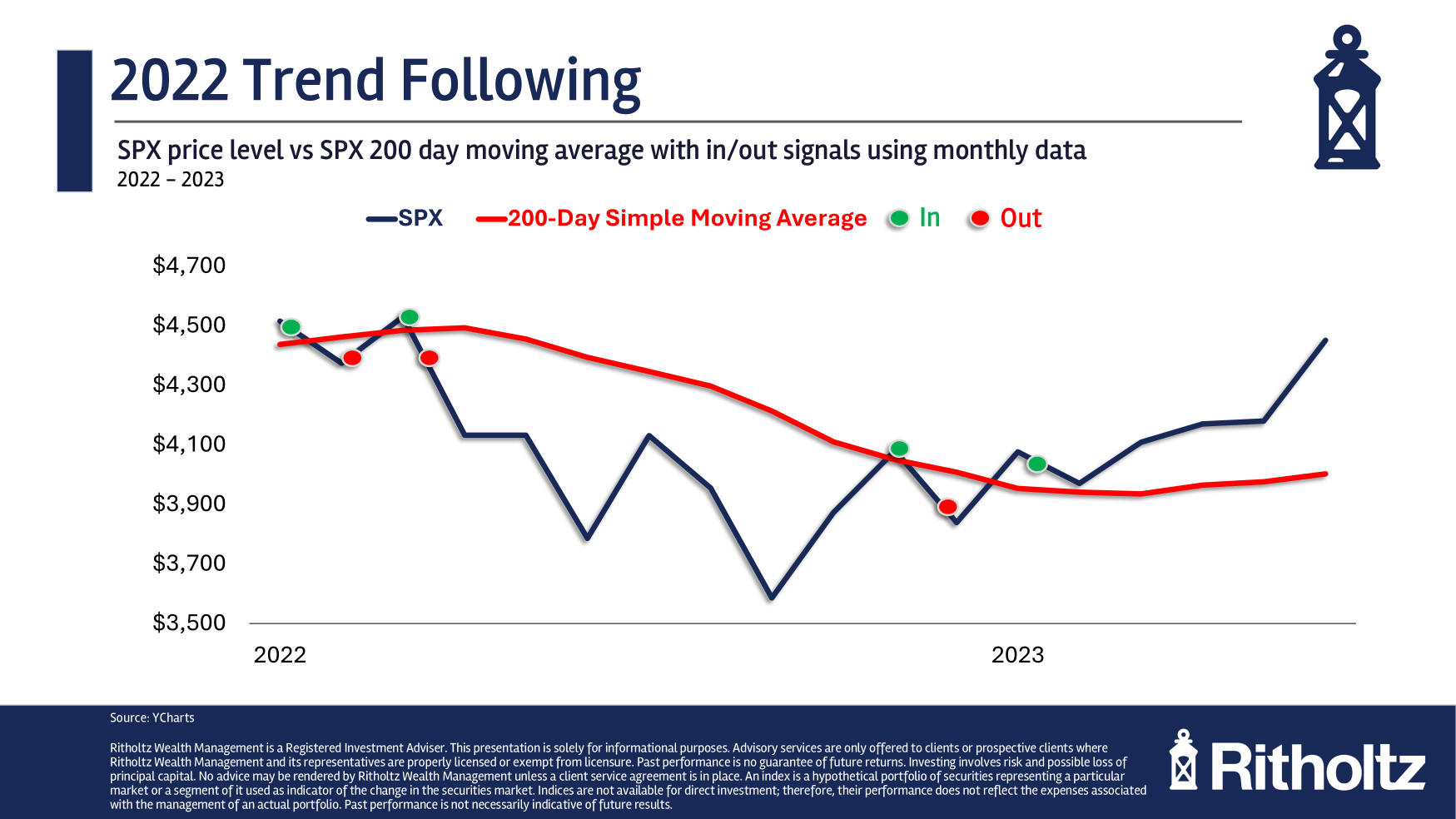

Take a look at the 2022 bear market:

You got excessive, bought low, purchased larger after which bought low once more. You continue to missed a good quantity of the drawdown however these whipsaws can check your persistence.

You might see a down 10% month, promote and see that adopted by an up 10% month the place you purchase after the achieve. Now, you’ve simply eaten the entire losses and missed out on all of the positive factors in a brief window of time.

Right here’s the factor a few pattern technique — it’s important to comply with the foundations for it to work. No wavering. No feelings concerned. You’ll be able to’t purchase and promote whenever you really feel prefer it as a result of nobody is aware of whether or not a 15% correction will flip right into a 50% decline or not. More often than not 20% down doesn’t flip into 40% down however nobody is aware of that within the second.

Development following is an insurance coverage technique the place typically you’re compelled to pay the premium with out the safety. More often than not whenever you set off a promote the inventory market gained’t utterly fall away from bed however you don’t purchase insurance coverage on your home hoping it burns down.

Generally the inventory market does burn down, however these are uncommon occurrences.

You even have to think about taxes. If you set off a promote sign you would be compelled to pay short-term capital positive factors. Or after a protracted bull market you would be compelled to pay long-term capital positive factors. That eats into your returns. Development following works a lot better in a tax-deferred account than a taxable brokerage.

Bull markets are one other constructive for this technique.

Most hedging methods present draw back volatility safety with no upside. The fantastic thing about pattern following is that it stays invested so long as the inventory market stays in an uptrend. And when the uptrend breaks, there may be an off-ramp.

One of these technique isn’t for everybody. I’ve had loads of conversations with individuals over time who merely don’t need or want a volatility/behavioral launch valve.

Others need one thing that may enable them to stay with the remainder of their long-term plan. That’s why I feel pattern following is a pleasant complement to a longer-term buy-hold-and-rebalance asset allocation.

These methods can act in a different way in several environments and at completely different factors within the cycle.

The potential for diminished volatility is good, nevertheless it’s the diversification advantages that helped me perceive the purpose of pattern following in a portfolio.

I don’t know if pattern following will defend you when the following large downturn hits.

However that is the sort of technique the place that you must perceive the trade-offs earlier than investing.

If you wish to be taught extra about how we do that for shoppers, attain out right here.

I did a deep dive into this query on this week’s Ask the Compound:

Invoice Candy joined me as properly to debate questions on Roth IRAs earlier than retirement, shopping for your dream residence, capital loss carryforwards, 529 plans and shopping for a trip residence for property planning causes.

Additional Studying:

My Evolution on Asset Allocation

1It’s additionally value noting that the pattern technique underperformed within the Nineties bull market by a decently vast margin. You need to anticipate that with a method like this.