Since I started specializing in crypto in 2016, there have been a handful of shifts in overt U.S. digital asset coverage, and the importance of the newest shift can’t be overstated. The bipartisan passing of the GENIUS Actsigned into legislation on July 18, indicators a transparent 180-degree reversal. The overarching narrative has shifted. The place blockchain was as soon as seen as a instrument to assist digital currencies supplant the US greenback, it’s now being acknowledged as an inevitable expertise that may serve to solidify the greenback’s standing as the worldwide reserve forex.

There’s a important profit to the US in controlling the worldwide reserve forex. When there’s a constant world bid for U.S. {dollars}, the price of capital is reasonable, and new debt can persistently be issued to assist fund home progress and entitlements. No matter one’s political opinions on the function that the federal government ought to play, controlling the worldwide printing press with a comparatively low value of debt service is unequivocally a great factor. In consequence, it’s not a shock that the U.S. has lengthy targeted on defending this dynamic from exterior competitors, be it sovereign (Renminbi) or decentralized (Bitcoin).

Stablecoins: The Killer Crypto App

Whereas the approval of the Bitcoin ETF in January 2024 served because the catalyst to reverse the earlier crypto winter, and the favored institutional TradFi narratives have lengthy targeted on tokenization, stablecoins are the true killer software of crypto.

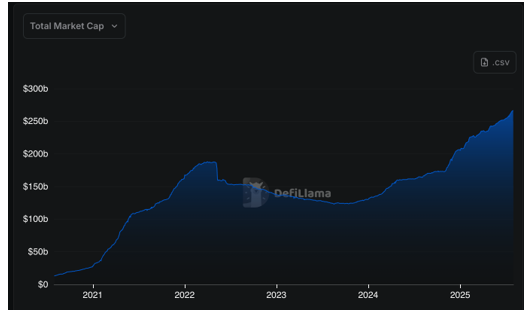

With an mixture Stablecoin market cap of practically $267 billion, up from $13.4 billion lower than 5 years in the past, the proof is overwhelming.

As may be seen from the above chart, along with the staggering five-year progress, the quantity of U.S. {dollars} settled on-chain has practically doubled year-over-year. Over 60% of the market is captured by Tether’s USDT, although this market share might proceed to compress over time as a consequence of competitors from present gamers reminiscent of Circle’s USDC, in addition to rising participation from conventional monetary heavyweights reminiscent of Blackrock, PayPal and Franklin Templeton.

Stablecoins: What, How and Why?

Stablecoins have discovered product-market match, however it is likely to be useful to take a step again. What are Stablecoins, and the way do they work? Let’s begin with why they had been created within the first place.

Whereas blockchain as a settlement layer has a stronger probability than ever to supply the rails of our world monetary infrastructure, this was not at all times the case. Given the friction inherent within the interplay between crypto and our legacy monetary framework, stablecoins initially represented a method for crypto market members to extra simply commerce, and to derisk with out having to exit the ecosystem. Contemplating all the things from Bitcoin to PEPE is quoted in greenback phrases, it appears apparent to have a crypto native token that serves as a digital clone of a US greenback. Additional, the 24/7 and permissionless transaction dynamics make stablecoins merely a greater mousetrap as each a cross-border and a peer-to-peer funds choice.

Based mostly on that, one would possibly ask how the $1 per unit worth is maintained over time? In any case, these usually are not FDIC-insured financial institution deposits, nor are they Rule 2a-7-regulated cash market funds. It’s an excellent query, and albeit there may be nothing that inherently forces a stablecoin to commerce at $1. Nevertheless, the mechanics of the create/redeem course of are not any totally different from a cash market fund or financial institution deposit. So whereas slight near-term dislocations can actually occur, equilibrium at par will win out in the long term. For instance, beneath is a one-year chart of Tether (USDT).

With a $164 billion market cap, and over $116 billion in 24-hour buying and selling quantity as of August 1, 2025, USDT is an extremely environment friendly and liquid instrument.

In an effort to simplify the use case and mechanics, right here’s how a sequence of transactions throughout the lifecycle of USDT could happen:

Whereas the above instance targeted on stablecoins as a method for buying and selling, the 24/7 permissionless nature of blockchain rails provide extra far-reaching world advantages. Not should one be on the mercy of banking hours, wire transfers or SWIFT to ship {dollars}. Stablecoins enable for U.S. {dollars} to be shortly and inexpensively transferred to anybody on this planet, at any time and with out the intervention of a 3rd celebration. That is an especially highly effective dynamic. One that’s very true in components of the world which have issue accessing the soundness of U.S. {dollars}, whether or not as a consequence of geopolitical instability or an absence of banking infrastructure.

Stablecoins: The Trojan Horse of World Greenback Dominance

Whereas this all sounds nice, and the use instances are actually clear for the sorts of folks used within the earlier examples, it might stay unclear why the U.S. Authorities is swiftly behind the expansion of stablecoins. One would possibly fairly assume {that a} digital greenback straight issued by the Treasury can be extra advantageous. And whereas a real digital greenback could assist to resolve related issues, it fails compared to stablecoins in an space of most significance to the US: funding our debt.

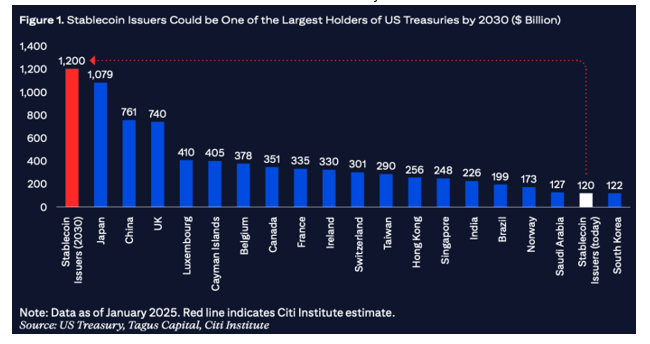

Look no additional than Tether’s independently audited reserve report as of June 30, 2025. Tether will not be the US Treasury. It may well’t merely simply print extra USDT and preserve its $1/USDT worth. It must be backed by property, and people property must at all times be value a greenback. In consequence, Tether owns over $105 billion value of Treasury payments. This places Tether on par with the possession stage of countries reminiscent of South Korea, Mexico and Germany, although nonetheless a methods off from our largest lender, Japan ($1.05 trillion of Treasury possession). That stated, based mostly on the projected progress of stablecoins, a latest U.S. Treasury Advisory Council presentation projected that stablecoin points might maintain $1.2 trillion of Treasuries by 2030.

Take into consideration that. The appearance of stablecoins has already created incremental demand for U.S. Treasuries on par with main nations, and within the subsequent 5 years that incremental demand might be the one largest purchaser of U.S. debt on this planet.

Value is positively correlated with demand. Bond math 101, worth goes up & yield comes down. Stablecoins enable the U.S. to not solely proceed funding its deficit, however to take action cheaper. That’s merely not one thing {that a} Treasury-issued digital greenback can provide, which is why stablecoins like USDT and Circle’s USDC are the dominant use-case propelling the way forward for crypto.