They are saying the inventory market is forward-looking.

Additionally they say the inventory market has predicted 9 of the final 5 recessions.

So which one is it?

Is the inventory market all-knowing?

Or is it simply as dangerous as any of us in the case of seeing across the nook with what’s coming subsequent?

It’s a bit of little bit of each.

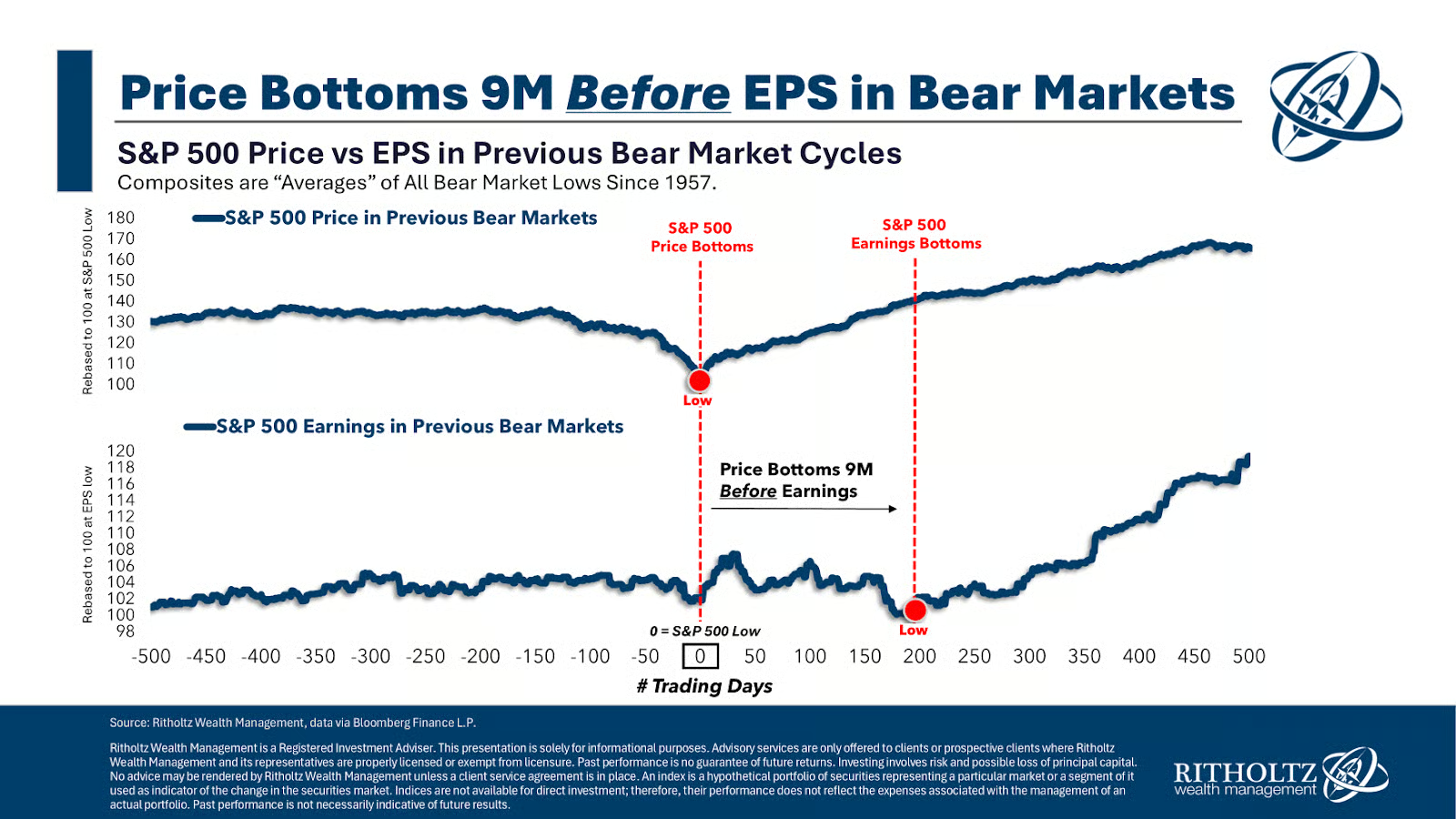

Chart Child Matt has this nice chart on his new weblog that reveals the inventory market tends to backside earlier than earnings in a bear market:

On common, shares front-run the earnings rebound by 9 months.

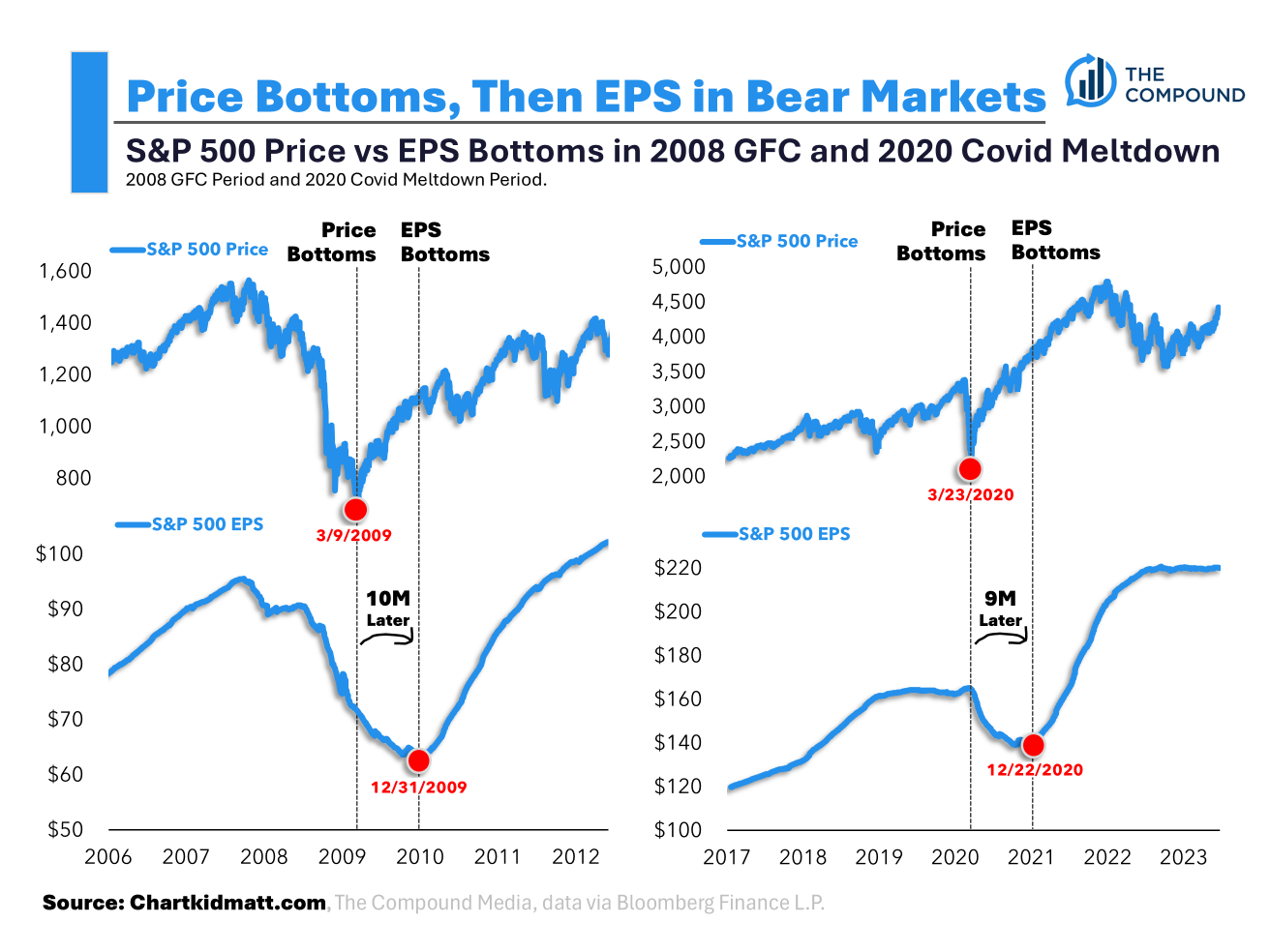

Simply have a look at the 2008 and 2020 downturns to see how this performed out in follow:

The inventory market turned larger nicely earlier than company earnings bottomed. The market noticed the turnaround coming earlier than it even occurred!

This is without doubt one of the causes it may be so troublesome to spend money on a bear market. The information retains getting worse even when shares begin going up once more. Everybody thinks it’s a useless cat bounce as a result of earnings preserve taking place.

It’s a leap of religion shopping for throughout a bear for a cause.

It’s a must to belief that the market is aware of one thing nobody else does.

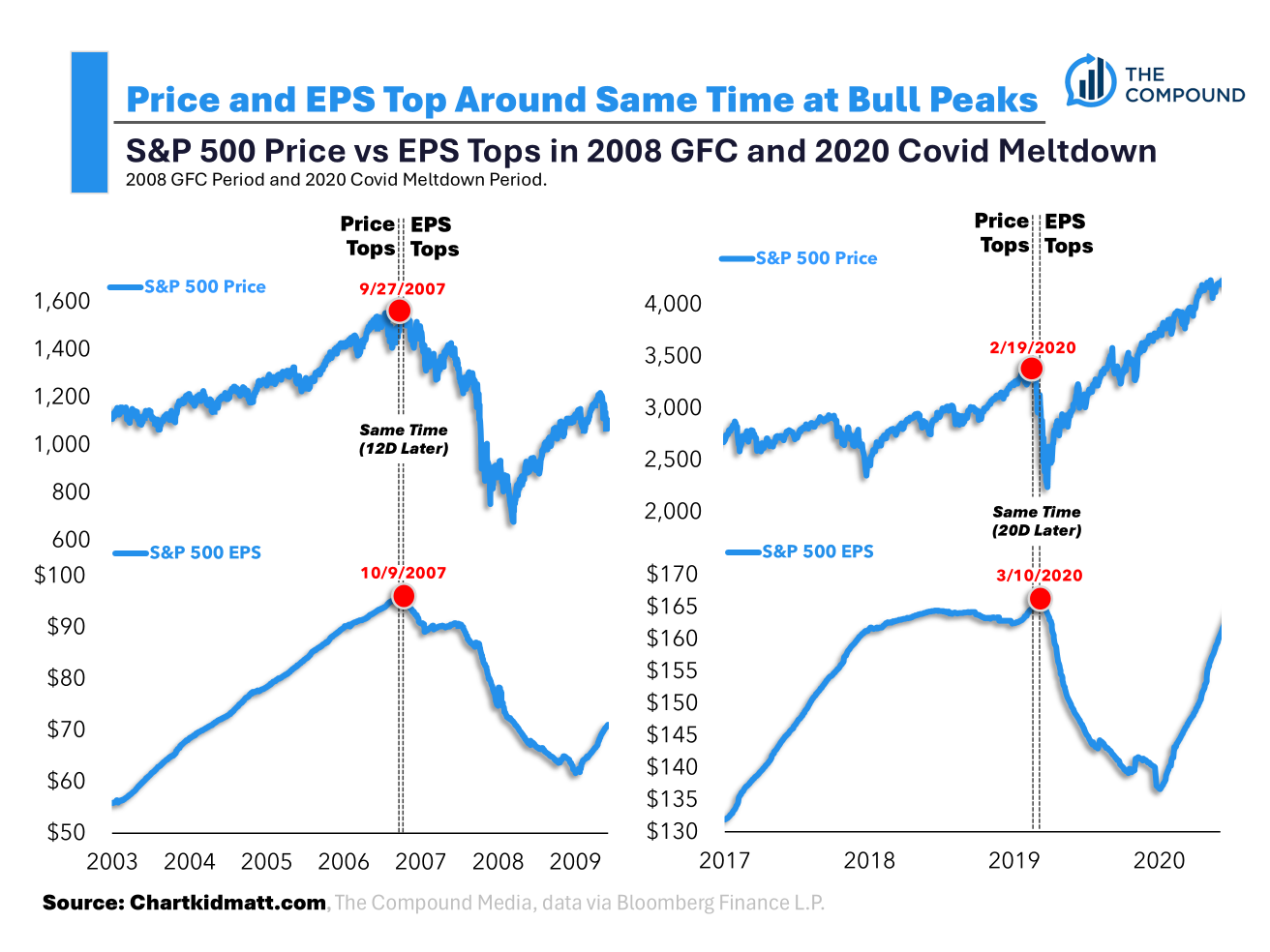

Nevertheless, the inventory market isn’t fairly Nostradamus in the case of selecting the top of a bull market.

The inventory market and earnings are likely to peak across the identical time when the bull market ends.

Have a look at what occurred on the peaks in 2007 and 2020:

Shares and earnings kind of run concurrently on the tops. There’s not a lot of a sign there since they each rollover collectively.

So the inventory market is best at predicting bottoms than tops.

Nobody’s excellent.

That is what makes investing equal components fascinating and troublesome.

Investing when shares are down requires a leap of religion as a result of it’s a must to assume the market is aware of one thing the headlines don’t.

And investing when shares are up requires a leap of religion as a result of you haven’t any thought when the rug will get pulled beneath your ft with out warning.

This is without doubt one of the causes shares supply a danger premium over different asset courses.

If investing in shares have been straightforward, you wouldn’t earn excessive returns over the long term.

No danger, no reward.

Additional Studying:

How Bear Markets Work

This content material, which comprises security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here will likely be relevant for any specific information or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or supply to offer funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.