As we speak’s Animal Spirits is dropped at you by Betterment Advisor Options and Vanguard:

This episode is sponsored by Betterment Advisor Options. Develop your RIA, your means by visiting: https://Betterment.com/advisors

This episode is sponsored by Vanguard. Study extra at: https://www.vanguard.com/audio

On immediately’s present, we focus on:

Pay attention right here:

Charts:

Suggestions:

Tweets/Bluesky:

In keeping with Challenger, the tempo of hiring has fallen off a cliff. Weakest September for job creation since 2011. https://t.co/ebwkUkVFbn pic.twitter.com/HYumFHSphD

– Joe Waived (@Thesticwart) October 2, 2025

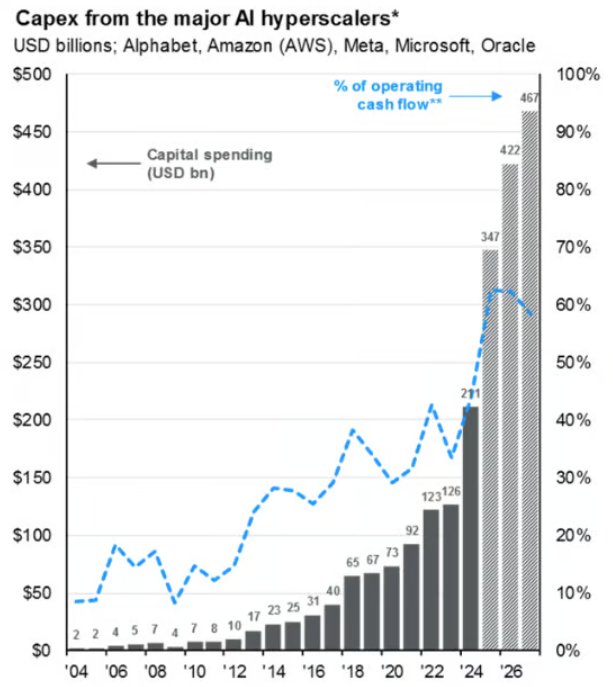

This can be a floor stage take.

Most AI capex (i.e. from hyperscalers) is spending towards present demand with income coming in instantly.

Let’s dig just a little deeper.

— John Shedletsky (@Shedletsky) October 3, 2025

Returns have been principally straight up because the Liberation Day lows. The Nasdaq has not seen even a 3% correction since then. The streak is now at 115 market days, the seventh longest going again to 1971. For comparability, the index has averaged a 3% correction each 20 days. pic.twitter.com/9Mapfdi9FO

— Rob Anderson (@_rob_anderson) October 3, 2025

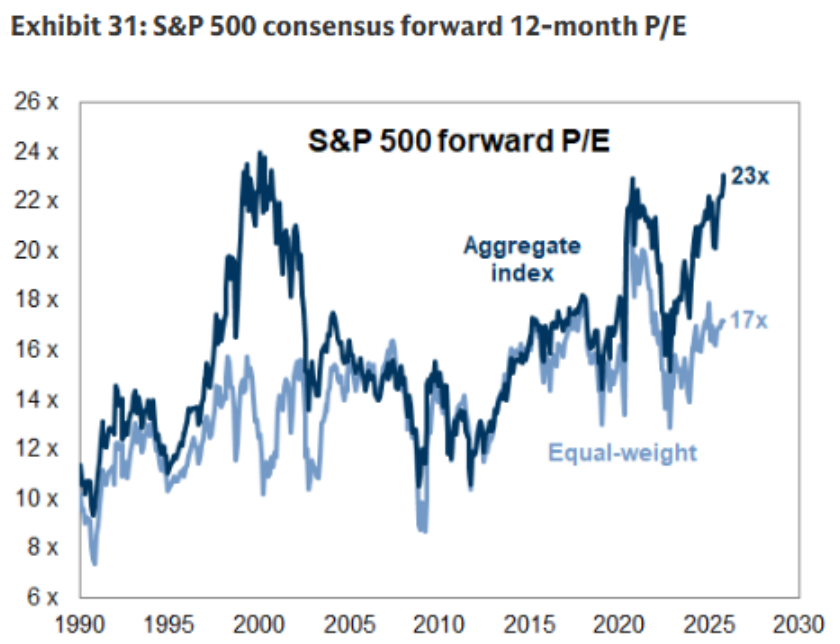

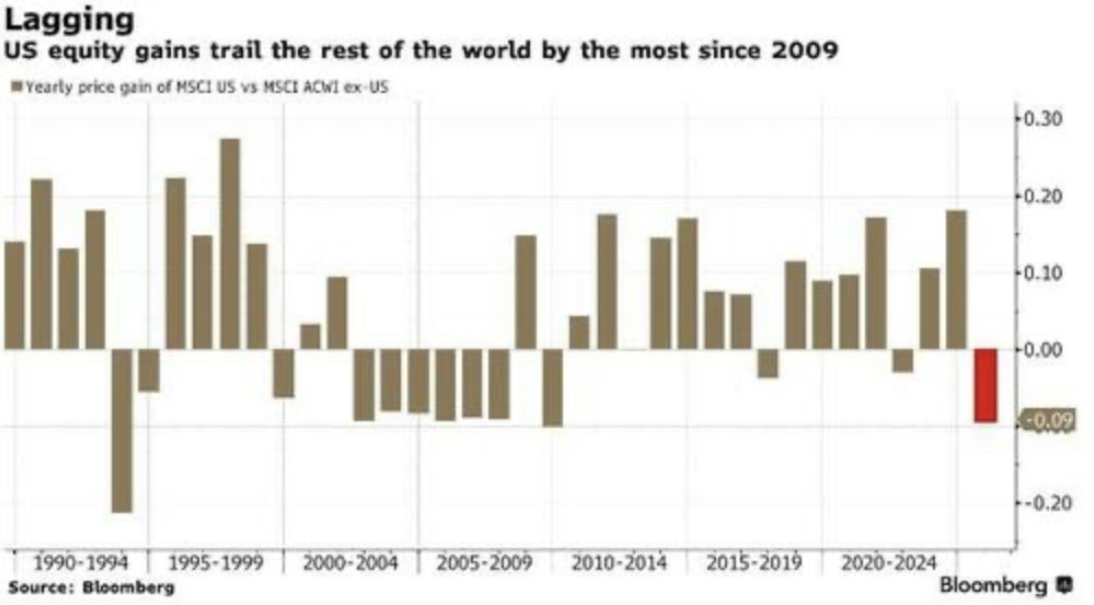

For worldwide equities the valuation query doesn’t pose a lot of a dilemma. The MSCI EAFE index not solely has an inexpensive valuation of 16.5x anticipated earnings, however its payout progress (in addition to payout ratio) has develop into fairly aggressive with the US. Worldwide… pic.twitter.com/37F0jIaUIo

— Jurrien Timmer (@TimmerFidelity) October 1, 2025

— Martin Shkreli (@MartinShkreli) October 3, 2025

Everyone seems to be a genius in a bull mkt pic.twitter.com/3kNs3Vnjmr

– tti (@kiktokinvestors) October 5, 2025

There are actually 19 shares within the Russell 3,000 up greater than 400% because the 4/8 Tariff Crash low. pic.twitter.com/NwVEFv5fwC

— Bespoke (@bespokeinvest) October 3, 2025

— modest proposal (@modestproposal1) September 30, 2025

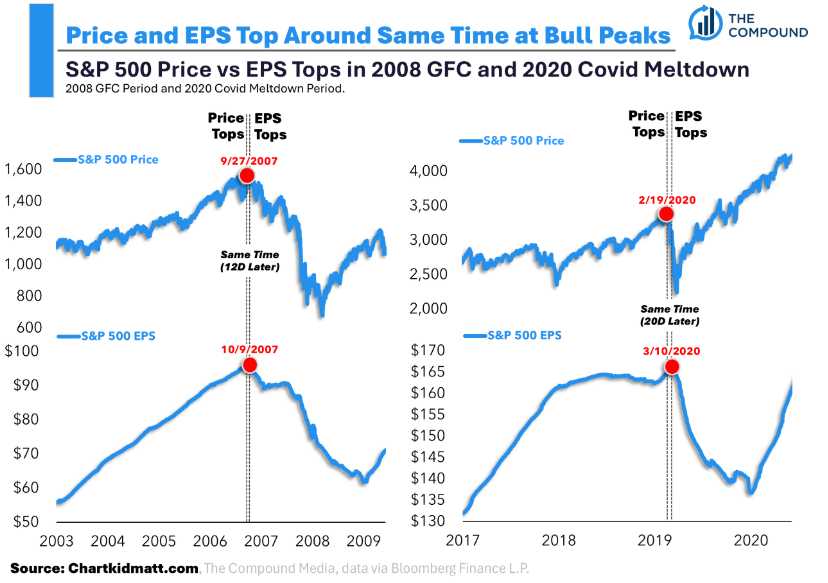

Paul Tudor Jones simply stated on CNBC that he thinks the elements are in place for large inventory worth will increase earlier than the bull market tops out

“My guess is that I believe all of the elements are in place for some form of a blow off” … “Historical past rhymes rather a lot, so I might assume… pic.twitter.com/FkZNlFBOXk

— Evan (@StockMKTNewz) October 6, 2025

There’s a bubble in monetary information tales that lead w/an image of a bubble

Noticed all of those in tales simply up to now week pic.twitter.com/udr7ya0ZmK

— Ben Carlson (@awealthofcs) October 6, 2025

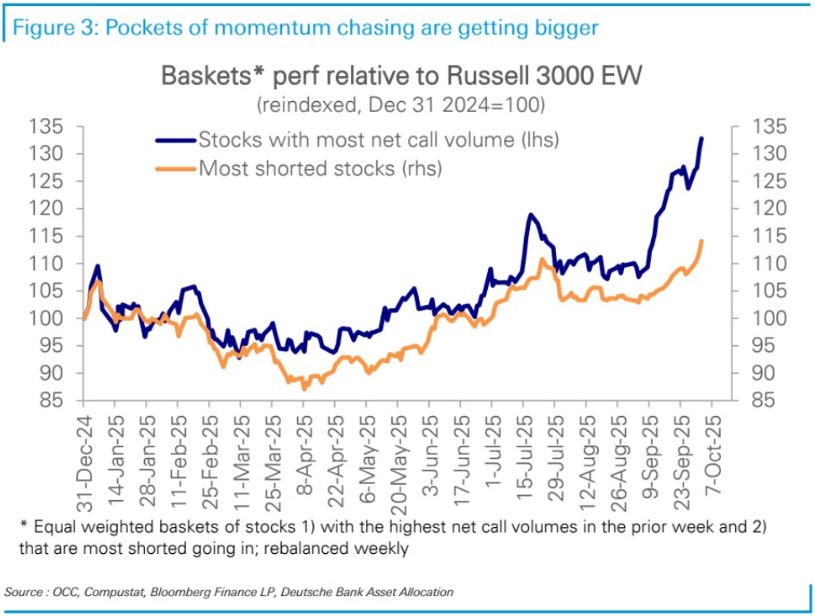

The final 6 months have been all about low high quality.

The junikier the higher! @AugurInfinity

Shares of tech firms that aren’t worthwhile have greater than doubled because the April 8 low.https://t.co/NUEbg6YUF8 pic.twitter.com/GeuVCuiDJX

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) October 3, 2025

I do not personal any BDC’s, however the BDC squad is flashing a warning signal. All names in the bathroom this 12 months, and a variety of the sponsored BDC’s like HSBD, CGBD, OBDC are completely tanking. pic.twitter.com/wEEC9HHipd

— Cluseau Investments (@blondesnmoney) September 30, 2025

Comply with us on Fb, Instagramand YouTube.

Take a look at our t-shirts, espresso mugs, and different swag right here.

Subscribe right here:

Nothing on this weblog constitutes funding recommendation, efficiency knowledge or any advice that any explicit safety, portfolio of securities, transaction or funding technique is appropriate for any particular individual. Any point out of a selected safety and associated efficiency knowledge just isn’t a advice to purchase or promote that safety. Any opinions expressed herein don’t represent or indicate endorsement, sponsorship, or advice by Ritholtz Wealth Administration or its staff.

The Compound, Inc., an affiliate of Ritholtz Wealth Administration, acquired compensation from the sponsor of this commercial. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investing in speculative securities entails the danger of loss. Nothing on this web site must be construed as, and is probably not utilized in reference to, a suggestion to promote, or a solicitation of a suggestion to purchase or maintain, an curiosity in any safety or funding product

This content material, which accommodates security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here shall be relevant for any explicit info or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or supply to offer funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency just isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.