Final Friday, Moody’s Rankings downgraded the U.S. sovereign credit standing from Aaa to Aa1. Consequently, Treasury yields surged Monday morning, with the 10-year notice leaping to 4.53% and the 30-year invoice surpassing 5%. The S&P 500 fell by about 50 factors, and the Nasdaq dropped 1.3%.

Whereas Moody’s downgrade definitely isn’t stunning, it’s one other stream of gasoline lighting an ever-engulfing firestorm of financial information this 12 months, and it’s one thing price speaking about. After all, with any piece of stories like this, there may be the potential for a cascading impact via the varied markets, together with actual property.

So, What’s a Sovereign Credit score Ranking, Anyway?

You must consider America’s credit standing like your private credit score rating. TransUnion (Fitch) and Experian (S&P) have been already score us at an 825, however Equifax (Moody’s) simply dropped us from an 850 to an 825.

That issues quite a bit as a result of it’s a measure of danger. Your credit score rating is solely an evaluation of how dangerous it’s to lend to you. At 850, a creditor will give you the perfect rates of interest since you are primarily an ideal borrower who poses just about no danger of default.

In the event you had a 550 rating, nonetheless, then the creditor would take an excessive amount of warning in working with you, if in any respect, and most definitely cost you the best rates of interest in an effort to get extra of their a refund faster.

Now, for a rustic like the USA, comparable logic applies. The U.S. Treasury points debt within the type of Treasury bonds. These bonds don’t pay quite a bit in curiosity, however they’re thought-about very protected. A ten-year Treasury invoice in good instances can pay perhaps 3%-4%, however usually, the yields are decrease when the financial system is doing nicely as a result of buyers really feel like they’ll make more cash in different belongings like shares. When instances are unhealthy, buyers flock to T-bills to guard their cash, driving yields up. It’s a supply-and-demand equation.

However with the most recent downgrade from Moody’sit’s suggesting“Hey, perhaps the U.S. isn’t as reliable because it was once.”

What’s Behind Moody’s Downgrade?

Moody’s blamed “political dysfunction” and a ballooning deficit pushed by entitlement packages like Medicaid, Medicare, and Social Safety, in addition to a rising share of spending going towards curiosity funds.

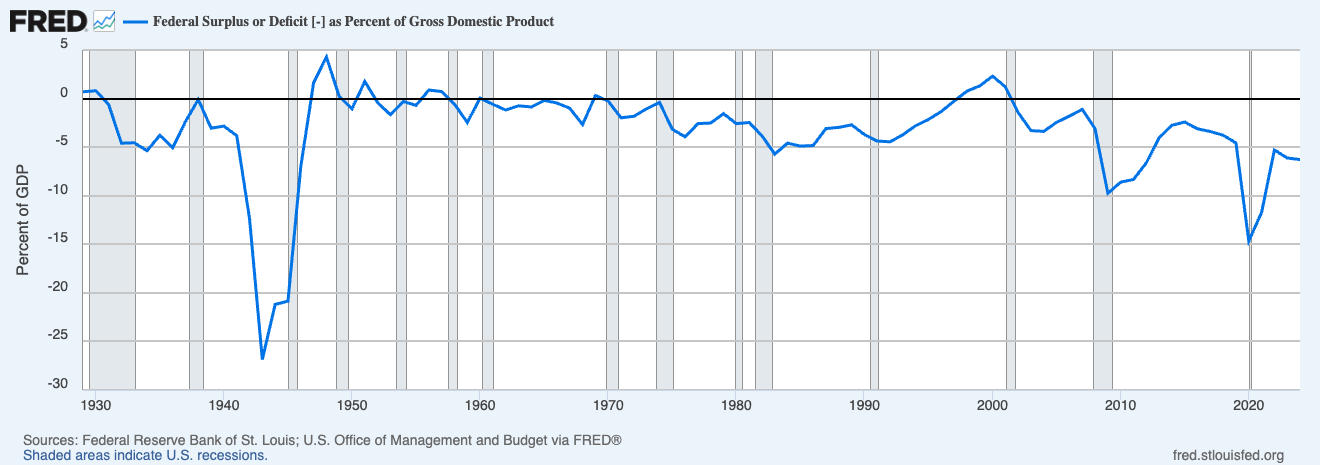

The true perpetrator, as I’ll by no means fail to level out, is Congress. They spend an excessive amount of, combat too usually, and don’t have any actual plan to repair any of it. The U.S. deficit has topped 6% of GDP for 2 years in a row. For context, the one instances within the final 100 years when the deficit has made up 6% or extra of GDP was throughout World Conflict II, the Nice Recession, and 2020, when COVID-19 struck.

At this time, we simply casually spend that quantity.

Is it a Huge Deal?

As a response to the information, 10-year Treasury yields have spiked to 4.5%, whereas 30-year yields got here in above 5% for a interval. In the meantime, the S&P 500 fell 0.5%, the Nasdaq slid 0.7%, and even heavyweight blue chip shares like Apple and Walmart have been dragged down.

So, does the downgrade matter?

Type of. Let’s be clear: Moody’s didn’t reveal some surprising new data. Everybody already knew the U.S. runs an enormous deficit and that the political local weather was dysfunctional. We’ve identified this for years.

However that’s not the purpose.

Markets are forward-looking, sure. However they’re additionally delicate to narrative shifts, as we’ve been painfully reminded of final month. If all three main score businesses now agree that the U.S. doesn’t deserve an ideal rating, that’s not only a technical change—it’s a message. One that might ripple into greater borrowing prices, jittery bond markets, and extra warning from overseas buyers.

This is the place issues get difficult. In concept, a decrease credit standing ought to make it costlier for the U.S. authorities to borrow cash. Increased yields = greater curiosity funds = extra pressure on the price range.

However in observe? U.S. Treasuries are nonetheless the most secure asset round. When issues go south globally, buyers nonetheless purchase U.S. debt. Buyers continued to spend money on the USA even after S&P downgraded our score in 2011. They continued to spend money on 2023 after Fitch’s downgrade. The query is whether or not buyers will proceed to take action, and the reply to that’s sure, however in some unspecified time in the future, we’ll need to cease taking that as a right.

To color my level, I feel within the case of 2011, we have been coming off a significant recession that was world. On a comparative foundation, the U.S. was a far safer place to maintain your cash than some other nation. However as we speak, we’re 5 years faraway from a pandemic-induced recession, two to 3 years after an important inflation wave, and a surprisingly resilient job market. Most economies are doing high-quality, together with ours.

So why would our credit standing get dropped now?

For one, the opposite two score companies had dropped us a number of years again, so that is simply Moody’s catching up. Two, I feel it has to do with the most recent turmoil over the tariff state of affairs and among the information about additional tax cuts coming down the pipe that might make the deficit much more stark.

And at last, mixed with common political instability and the truth that the BRICS nations are exploring de-dollarization and a stronger-than-2011 China, which, regardless of its upside-down inhabitants pyramid and newest financial woes, presents a higher problem to the USA as a worldwide energy than ever earlier than, I feel it’s protected to say that the score drop is an instance of the U.S. being held to a better customary in a world with extra parity.

Is it the tip of the world? No. Does it change life as we speak? No. Might it change life tomorrow? Uncertain.

However is it a message? Sure. Ought to we hear? In all probability.

What About Actual Property?

At this level, what doesn’t have an effect on the housing market?

Probably the most apparent influence right here is mortgage charges. Your typical 30-year fastened price is tied to the 10-year Treasury yield, whichas I mentioned earlier, simply spiked. As long as that is still elevated, you’ll proceed to see mortgage charges circle that 7% quantity.

As for the opposite segments of the marketit simply provides one other layer to the narrative that the sky is falling. Shoppers are pulling again on spending, GDP development is destructive for the primary time in a couple of years, the tariff state of affairs final month didn’t assist with general financial confidence, the Fed doesn’t appear more likely to make a transfer on charges anytime quickly, and because of this, you’re seeing increasingly more would-be consumers maintain off from shopping for a property.

Not simply because it’s nonetheless costly however as a result of theytoolike all sensible investor, don’t wish to purchase on the high of the market after they really feel like the ground is about to fall out from underneath them.

Do I anticipate a housing crash? Under no circumstances. However to any bystander who isn’t as grossly invested in actual property information as I’m, my colleagues at BiggerPockets, otherwise you—actual property is at all times one foreclosures away from mass hysteria.

A Actual Property Convention Constructed Otherwise

October 5-7, 2025 | Caesars Palace, Las Vegas

For 3 highly effective days, interact with elite actual property buyers actively constructing wealth now. No concept. No outdated recommendation. No empty guarantees—simply confirmed ways from buyers closing offers as we speak. Each speaker delivers actionable methods you’ll be able to implement instantly.