We don’t know how good we had it.

Let’s think about the returns knowledge from the interval post-Nice Monetary Disaster (GFC), after which unpack what it’d imply.

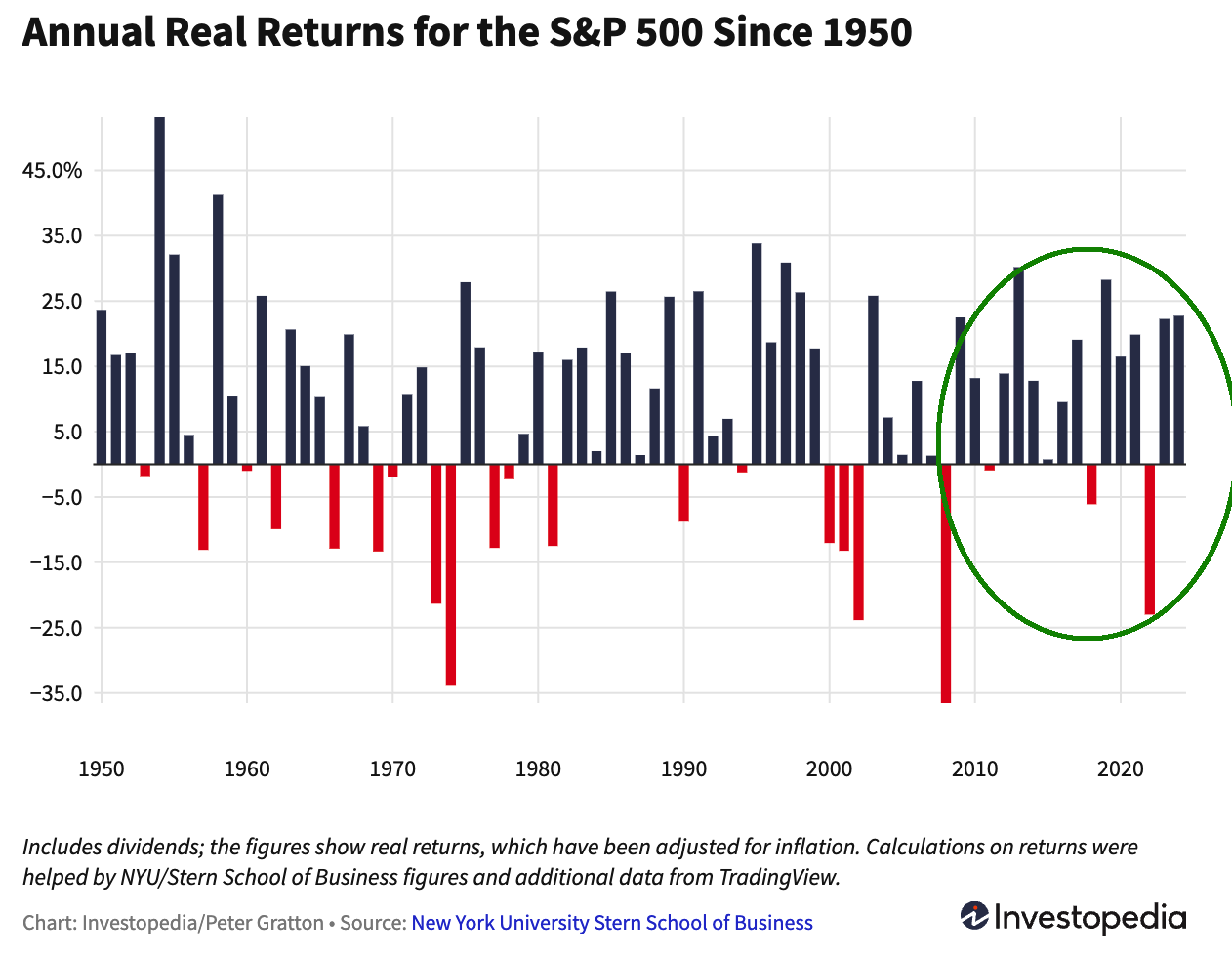

Beginning January 1, 2010, the S&P 500 generated a complete return (with dividends reinvested) of 566.8%or 13.3% per yr from the beginning of 2010 by the tip of Q1 2025. The Nasdaq 100 has practically doubled that. (Chart above is from March 2009, however that’s dishonest)

Examine this to the typical 15-year return durations over the previous century, which generated ~8.7%. Common annual returns over the previous century have been about 10.4%.

Utilizing rolling 15-year interval returns, we see how atypical this period has been. The one two higher eras have been the fast aftermath of World Conflict II by Might 1957 (about 18% annualized) and the tech growth within the Nineteen Eighties and 90s, 15 years peaking in April 1999 (round 17% annualized). This present 15-year peak was by February 2024 at ~16%.

Over the whole lot of the post-GFC period, we have now been averaging a 3rd greater than the everyday annual returns since 1925, and practically double the typical 15-year stretch.

And that spectacular run of post-financial disaster returns have include just a few minor setbacks:

-Flash Crash in 2010.

-2015 acquire of “solely” 1.4%

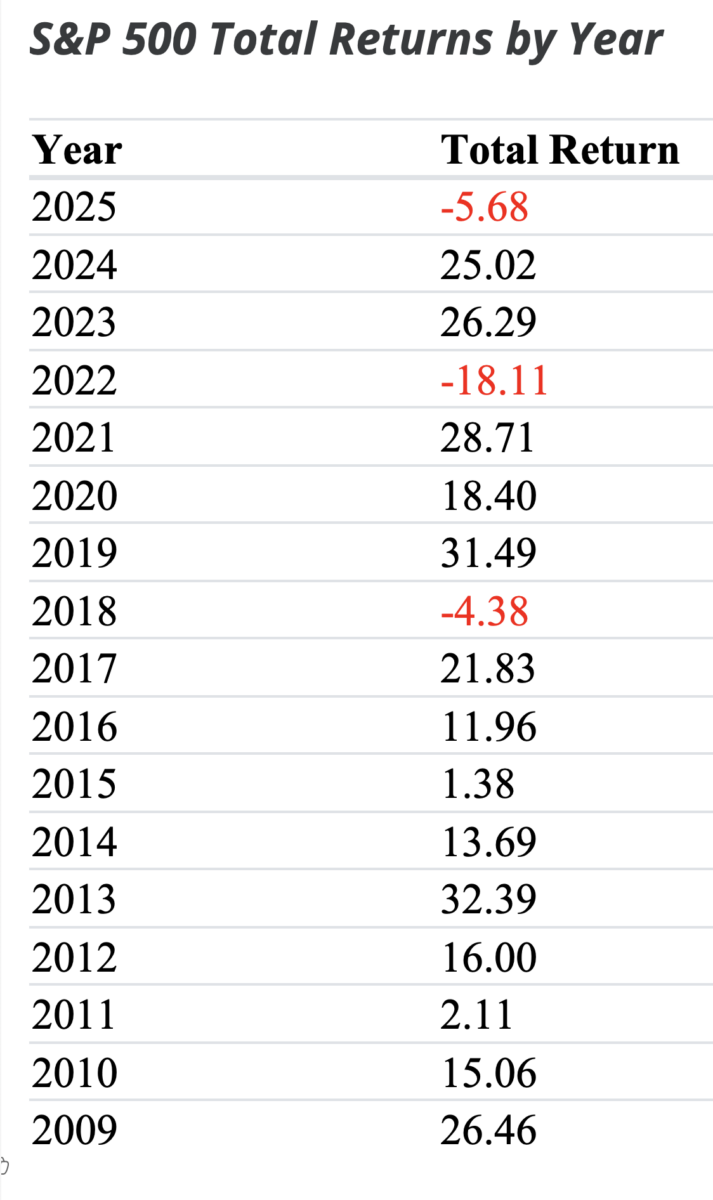

-2018 drop of 4.4%, together with a This fall drop of practically 20%.

-Q1 2020 down 34% within the pandemic.

-2022 down 18% for the yr.4

The total desk of good points for the reason that GFC appears to be like like this:

Desk by way of Slickcharts

~~~

Predominant Road has now develop into an everyday “BTFD” participant. This can be a direct results of muscle reminiscence – a Recency Impact affect pushed by 15 years of market good points. What has developed over the whole lot of the post-financial disaster period of rising fairness markets and till 2022, falling or zero rates of interest. The excellent news is that that is the way you construct wealth over the lengthy haul. Nick Maggiulli’s e book “Simply Preserve Shopping for” makes this case very persuasively.

Once we discuss muscle reminiscence, what we’re actually discussing are habits for which we have now been constantly rewarded. What breaks that prior behavior relies upon upon how we modify our behaviors in response to that punishment and reward.

Recall what occurred throughout prior adjustments in market regimes.5 Within the Nineteen Eighties and 90s, dip consumers had been rewarded, regardless of the 1987 crash (the final word 22% dip!), the 1990 near-recession, a presidential impeachment, the Thai Baht disaster, the Russian Ruble default, Lengthy-Time period Capital Administration collapse, and extra.

For twenty years, each dip buy was quickly rewarded.

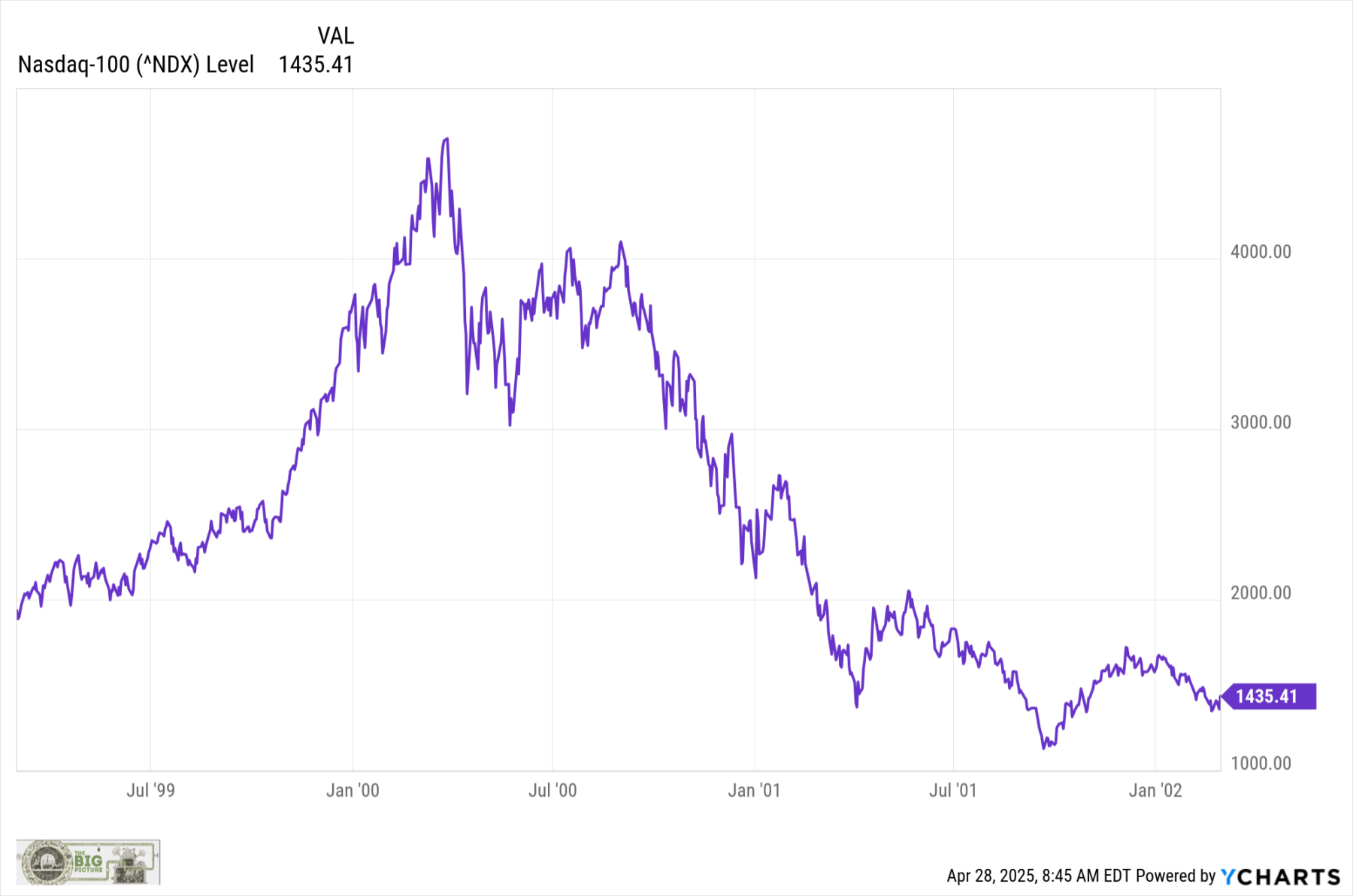

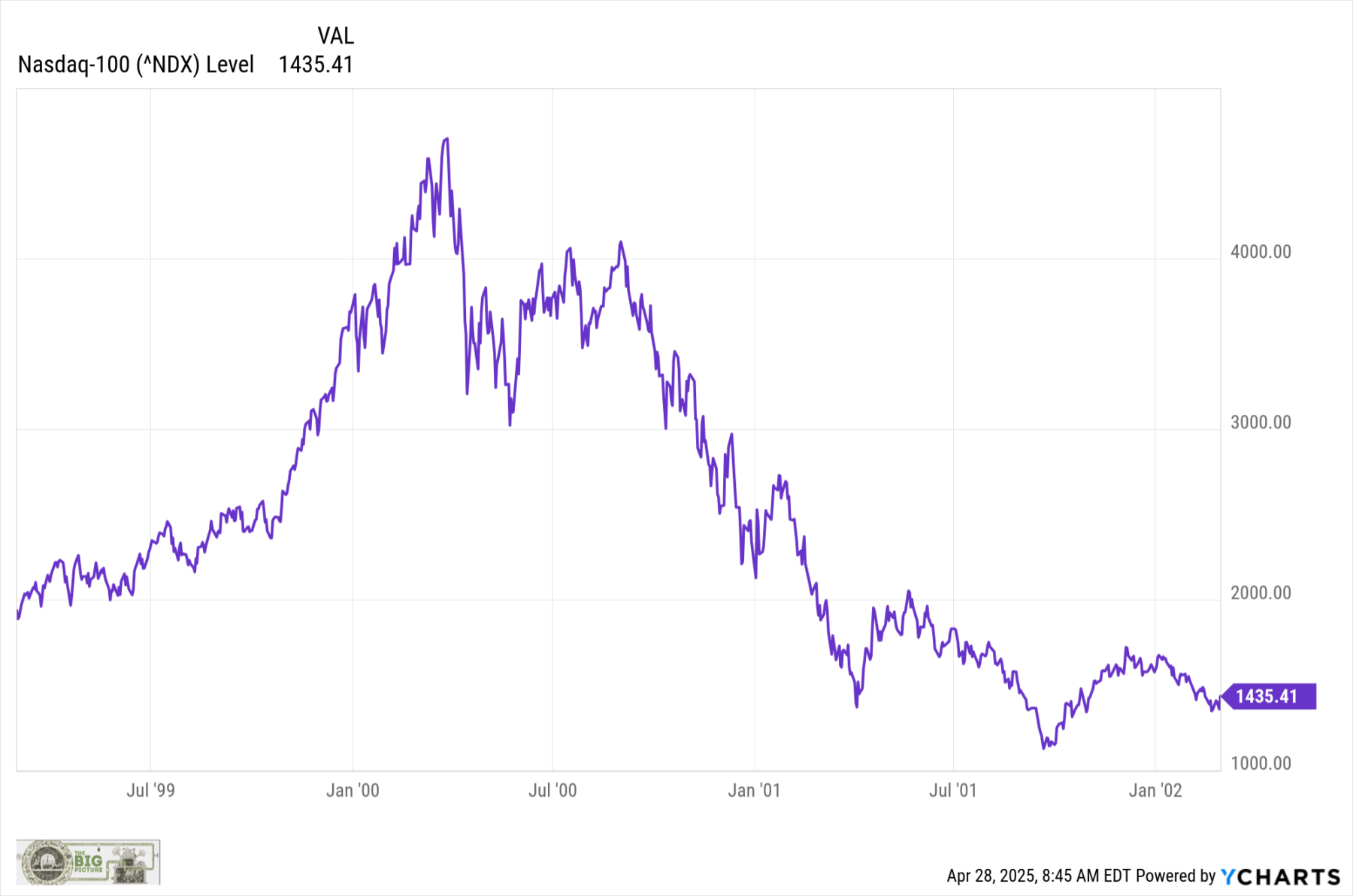

It takes some time to alter conduct. Take a look at the dotcom implosion (and the September 11 terrorist assaults). From March 2000 to the double lows October 2002 and March 2003, the Nasdaq 100 fell 82.9% (peak to trough). That was not a straight line down…

~~~

We might have had it too good for too lengthy – although it didn’t really feel that manner. In October 2009, I known as the transfer off the lows “The Most Hated Rally in Wall Road Historical past.” In seven months, the S&P 500 had moved 57.5% from the underside, and the Nasdaq 100 had gained 64.6%.

Historical past informs us that when US markets get slashed by 56%, it creates a really advantageous entry level into equities for recent capital. The recency impact challenges us to beat the psychological stresses attributable to a recent, memorable crash. Folks fought the rally all the manner up, and continued so for years. “Monetary Repression” was the rallying cry for underperforming managers.

Over the following 16 years, the gang might have forgotten that ache. Any single day the place markets rally 12.5% shouldn’t be what danger managers name a rational buying and selling day.

What has developed over the previous decade and a half is just that BTFD has labored like a appeal. Maybe, it has labored too nicely. The chance is that if and when the pattern adjustments, some merchants can be sluggish to adapt; buyers might get discouraged once they study that investing for the “long run” isn’t measured in months or quarters, however in a long time.

Folks hated the rising inventory market within the early 2010s. The current concern is that, due to the Recency Impact, they not hate it sufficient…

Beforehand:

The Most Hated Rally in Wall Road Historical past (October 8, 2009)

___________

1. Information from Nick Magiulli’s return calculator.

2. If we wished to cherry decide the info, we might begin with the March 2009 finish of the GFC, and the returns can be a lot increased, or date it from the pre-GFC peak in October 2007, and make the returns decrease.

3. See additionally Lazy Portfolios rolling returns.

4. Plus bonds down 15% – the primary double-digit drop for each asset courses in 4 a long time.

5. I’m not essentially claiming a regime change is upon us; fairly, it’s a reminder of what occurs when secular traits in markets reverse.