Extra enthusiasm in asset costs spans a variety: there’s overly bullish sentiment, mispricing, overvaluation, speculative extra, booms, manias, and frenzies.

After which there are Bubbles.

Folks throw that phrase round far too simply; a bubble is a comparatively uncommon occasion, and never one thing that happens yearly. We see bubbles solely as soon as each few a long time.

Take into account the infrequency of historic bubble peaks occurring:

The Tulip Mania (1637, Netherlands)

The Mississippi and South Sea Bubbles (1720, Britain and France)

The Railway Mania (1840s, Britain)

The Florida Land Growth (Twenties, USA)1

The US Inventory Market Crash (1929, USA)

The Japanese Asset Bubble (1989, Japan)

The Dot-Com Bubble (2000, USA)

The International Housing & Credit score Bubble (2008-09)

I wish to keep away from the Justice Potter Stewart 1964 take a look at for obscenity: “I do know it once I see it.” As an alternative, I created a real-time guidelines. However you may discern the broad similarities in the entire above. These bubbles all adopted related patterns:

Expertise: A brand new innovation (railways, web, crypto, AI) will get commercialized;

Capital: is extensively out there for speculative makes use of;

Leverage: Credit score is reasonable and plentiful and extensively used;

Narrative: A compelling and seductive story rationalizes excessive costs;

Psychology: The media studies on, then amplifies, reckless conduct;

Herd: The contagion spreads, resulting in widespread participation.

Not each bubble is equivalent, and a few can have extra of this than that. However all of them appear to roughly adhere to this sample.

The mixture of mass/social media and the financialization of recent economies seemingly results in extra frequent bubbles. There have been unquestionably three main bubbles throughout three a long time: The Nikkei (Nineteen Eighties), the Dotcoms (Nineteen Nineties), and the GFC (2000s).

However not each act of speculative extra is a full-blown bubble:

Speculative extra

The Canal Mania (1790s, Britain)

Nifty Fifty (Sixties, USA)

Bond Bull (1980-2022, USA)

The Bitcoin & Crypto Booms (2015-ongoing)

The SPAC and Meme Inventory Mania (2020–2022, USA)

The ESG / Inexperienced-Tech Bubble (2018–21, International)

Market Focus (2020s, USA)

Synthetic Intelligence (AI) (2024-ongoing, USA)

For the file, I don’t know if Bitcoin/Crypto or AI is a bubble – but. They each appear to comply with the sample referenced above, however neither checks off all of the packing containers on my real-time bubble record.

I like Cliff Asness’s concise definition of bubbles: “No affordable future consequence can justify present costs.”

When was the final time the gang, the media, or Wall Avenue precisely recognized a bubble in actual time? By definition, it takes a crowd to drive costs to bubblicious ranges. It’s a problem for the gang to concurrently speculate on a bubble and precisely determine one because it inflates.

I recall doing a CNBC hit with Peter Boockvar in 2006; we every mentioned totally different points of what we noticed as a bubble in credit score and subprime mortgages, and why we have been apprehensive about mortgage-backed securities (MBS)—and the way worthwhile and reckless securitization had turn out to be. The anchors actually laughed at us dwell on air.2 Folks have been very skeptical that any sort of a bubble was within the making, particularly as shares continued to rise. (Are you smarter than the markets?)

What would or wouldn’t make this a bubble?

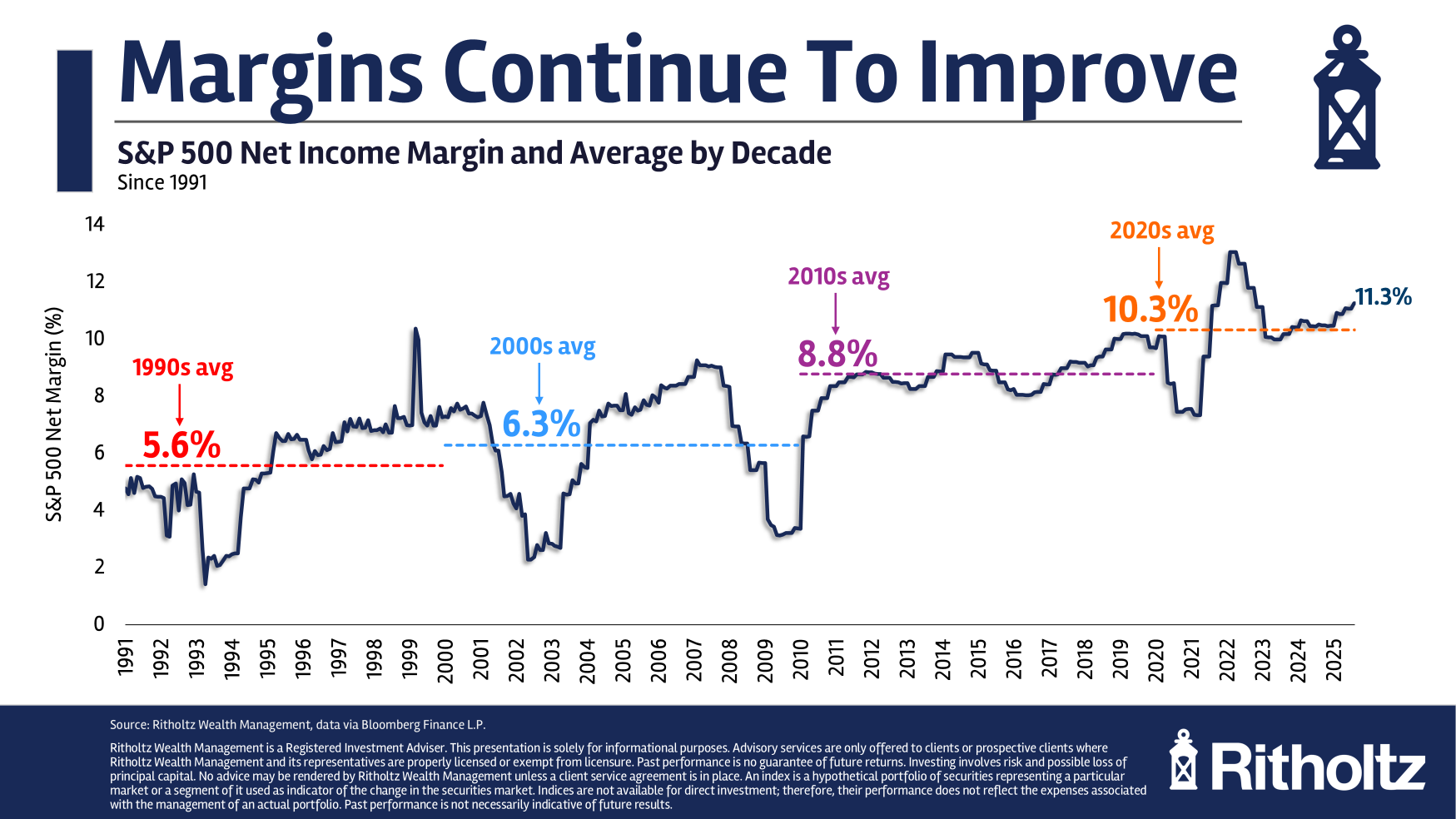

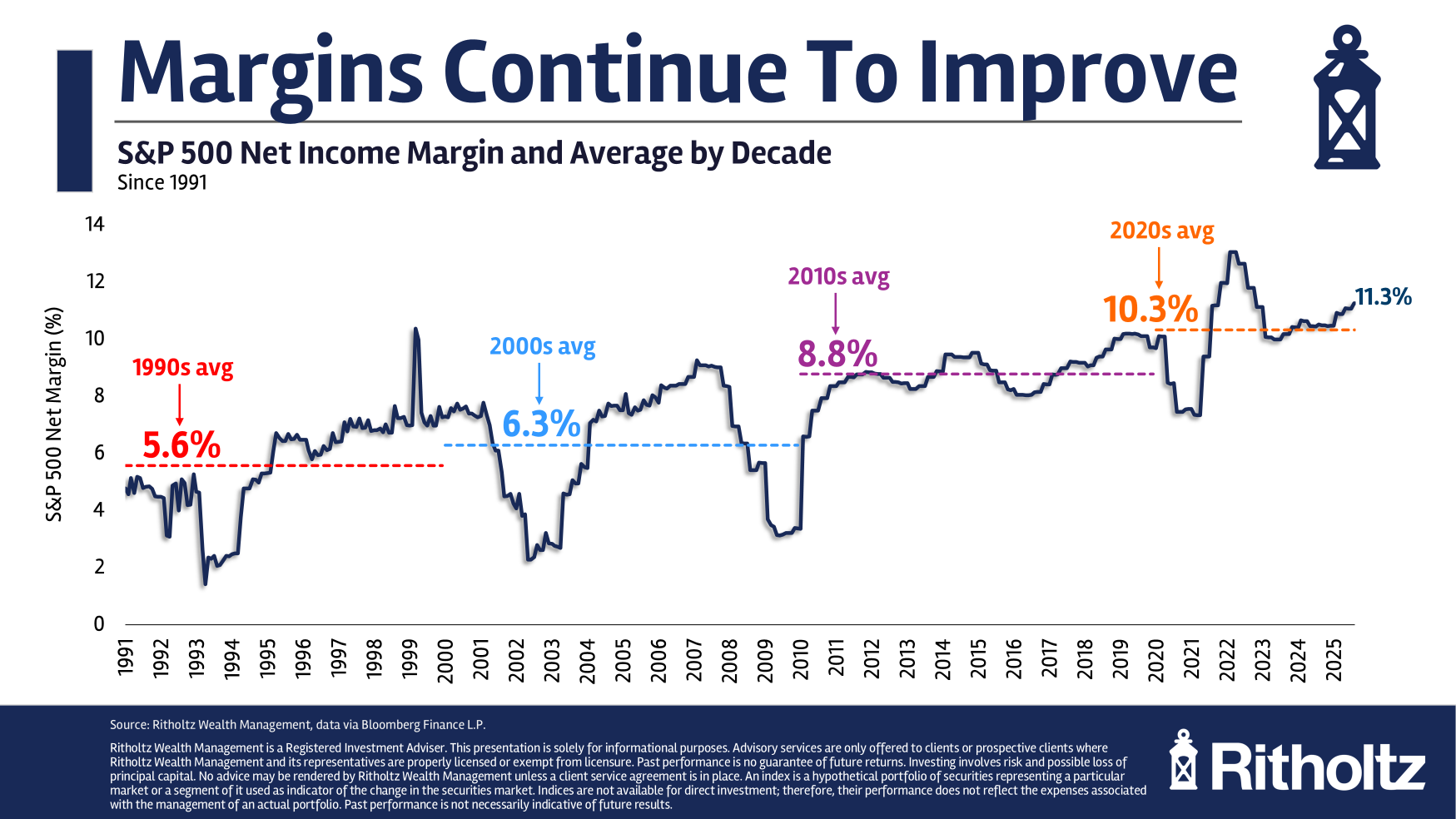

Value spikes in particular person firms with solely tangential relevance to AI are worrisome; so too would one other +25% for a 3rd 12 months in a row. But when we begin listening to different (non-AI) firms focus on on their earnings calls the fee financial savings of implementing AI, and the way they’ve elevated their effectivity, seen revenues and income rise, that would justify the inventory costs we see right now. That is in line with Vanguard’s Joe Davis’ tackle “concept multipliers” — the two-step implementation of recent applied sciences. The chart (on the prime) displays a number of components, together with low rates of interest, however don’t overlook expertise, automation, and improved effectivity, all of which make firms extra worthwhile.

Bubbles are by definition uncommon; elevated costs aren’t. It is rather difficult to discern the distinction—not that the issue has ever stopped individuals from attempting…

Beforehand:

RealTime Bubble Guidelines (October 16, 2025)

The Magnificent 493 (August 12, 2025)

All Time Highs Are Bullish (June 26, 2025)

A Spectacularly Underappreciated 15 Years (April 28, 2025)

__________

1. The Florida constructing increase was pushed largely by added railroad entry from the Northeast to Southern Florida. For extra on this, see Christopher Knowlton’s “Bubble within the Solar: The Florida Growth of the Twenties and How It Introduced on the Nice Melancholy.”

2. True story, ask Peter…