Let’s rewind to Y2K. Britney was topping the charts, individuals have been hoarding water in prep for the digital apocalypse, and U.S. shares had simply completed a blistering Nineteen Nineties bull market. The S&P 500 was invincible. Or so it appeared.

However then actuality hit. Tech bubble. 9/11. Two recessions. A housing collapse. Then out of the ruins a large 15 yr bull market in US shares the place the S&P 500 crushed every part in sight.

And what will we see now, 1 / 4 century later after all of the mud has settled?

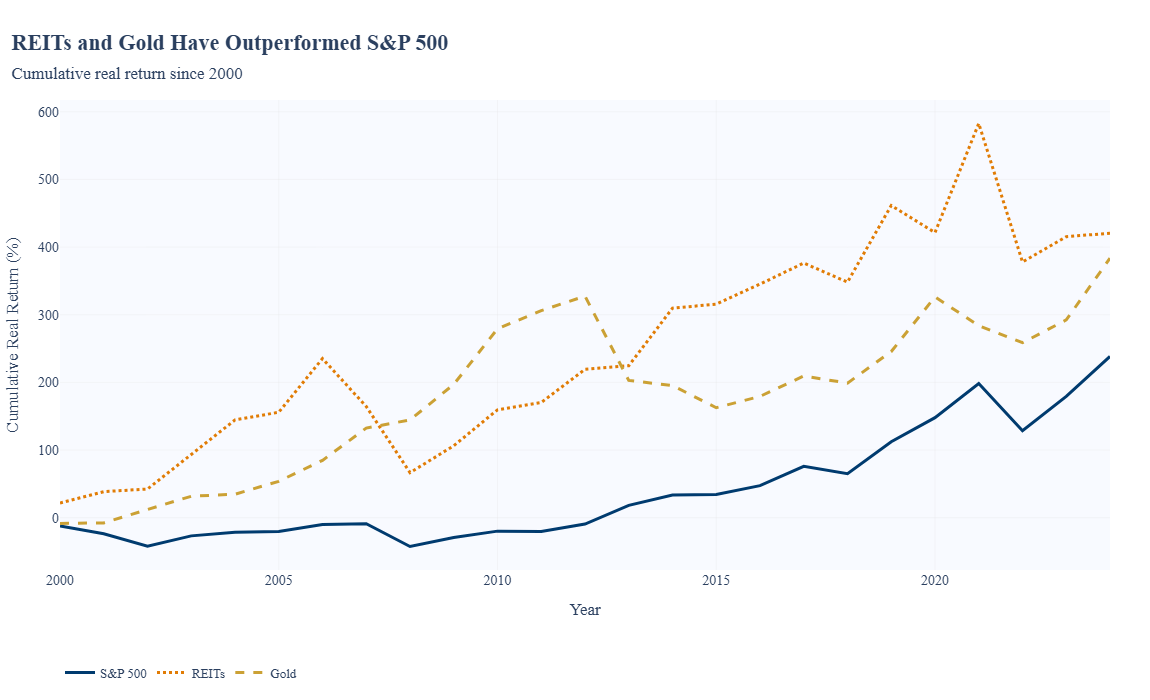

Regardless of the all time highs in shares, actual belongings like REITs and gold have each outperformed the S&P 500 because the flip of the century.

Let that sink in.

Whereas U.S. equities have gone on an absolute heater post-2009—significantly the Magnificent 7 in recent times—the longer lens tells a extra sobering story. Should you had gone all-in on SPY on the finish of 1999, your returns would path each shiny rocks and industrial property proxies.

That’s not a knock on U.S. shares. It’s a reminder of market cycles and the facility of diversification.

Recency bias can have you chasing U.S. shares into the stratosphere. However zoom out, and the outcomes get murkier. Gold isn’t speculated to outperform shares, proper? REITs are only for revenue, proper?

Earlier than somebody yells that we’re cherry choosing the beginning date —sure, after all we’re. The purpose nevertheless is that any asset class, even the premier asset class that’s US shares, can underperform different belongings for lengthy durations. Longer than most are prepared to simply accept.

The lesson right here isn’t to ditch U.S. shares. It’s to acknowledge that portfolio development is about greater than chasing the recent hand. Proudly owning a basket of worldwide belongings—shares, bonds, and actual belongings—means you’re not beholden to anyone regime.