Authorities shutdowns, the greenback falling 11% within the first half of 2025, its quickest decline in 50 years, report numbers of lawsuits towards the chief departmentand fears and fights over tariffs, stagflation, and the Federal Reserve’s independence.

All of it speaks to political instability, which creates financial instability.

It doesn’t matter whether or not you establish politically as crimson, blue, purple, inexperienced, or polka-dotted, the U.S.—and far of the remainder of the world—feels politically and economically unstable.

So how do you defend your cash from political threat and instability?

1. Inflation-Resilient Investments

In January 2025, the CPI inflation fee was 3%. It fell to 2.3% in April, earlier than steadily rising once more to 2.9% in August (the final month obtainable).

Anybody who thinks elevated inflation is overwhelmed is deluding themselves. It stays a really actual threat. The Federal Reserve acknowledged it at the same time as they lower rates of interest in September, opting to prioritize the job market over inflation.

Oh, and the devaluation of the greenback that I discussed earlier? Contemplate that one other large crimson flag for inflation.

So, which investments defend your portfolio towards inflation?

In a phrase, actual property (I suppose that’s two phrases, however you get the concept).

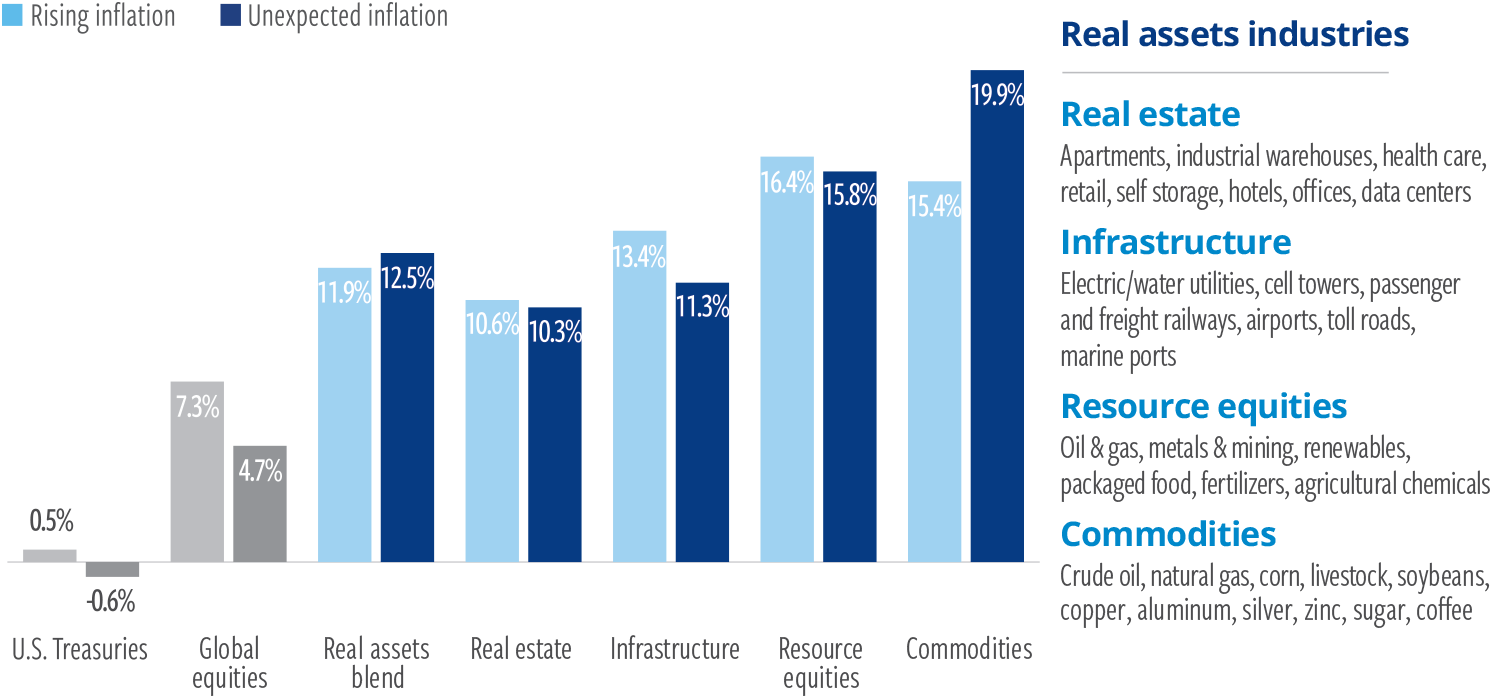

Actual property, commodities, treasured metals, and infrastructure do effectively in periods of excessive inflation:

Shares don’t do badly both, though they don’t carry out in addition to actual property. Actual property have intrinsic worth, so individuals simply pay the going fee, no matter that’s in immediately’s forex pricing.

I hold round half of my web value in shares and half in passive actual property investmentsthough I’m more and more carving out some cash for treasured metals.

2. Recession-Resilient Investments

You assume Congress did the financial system any favors by letting the federal government shut down? Employees sitting round twiddling their thumbs hardly creates a booming financial system.

Oh, and we had a shrinking job market earlier than the shutdown. Job openings have steadily fallen for months nowand final month noticed destructive job development.

I’ve written about recession-resilient actual property investments. Within the co-investing membership that I make investments by, we’ve vetted and gone in on many recession-resilient investments over the past yr, together with:

- Industrial properties with years of backlogged orders

- Hire-protected multifamily properties

- Cellular dwelling parks with tenant-owned houses

- Self-storage services

Within the case of multifamily properties, we’ve gone in on some properties that designate a sure share of their models for inexpensive housing. These models have a ready checklist, and the properties typically get a property tax abatement in trade for the hire safety. When operators do that proper, they get an instantaneous bump in web working revenue—with out having to do a single unit renovation.

It’s also possible to spend money on recession-resilient shares, corresponding to utilities, shopper staples, and different defensive shares.

3. Money-Flowing Actual Property

The higher a property’s money movethe higher it might trip out political and financial instability.

In addition to, money move doesn’t require the market to enhance so that you can see returns. You may measure money move proper now, in immediately’s market.

If inflation and rents go up, money move solely will get higher. If an enormous recession hits and occupancy charges dip, at the least the property has loads of margin for error.

Many offers our co-investing membership have vetted and invested on this yr already money flowed effectively from Day 1. Certain, the operator plans to renovate a few of the models so as to add worth and lift rents. However the properties don’t require it to pay excessive distribution—they already throw off loads of money.

4. Make investments Internationally

Frightened about political instability right here within the U.S.? Diversify to incorporate extra abroad investments.

Admittedly, that’s a lot simpler to do with shares and REITs than it’s with different actual property investments. You should buy shares in a sweeping index fund like Vanguard’s All-World ex-US Shares ETF (VEU) to get broad publicity to the remainder of the world’s shares. I personal shares myself.

However lively or non-public fairness actual property investments? That’s a harder nut to crack. Within the co-investing membership, we’ve regarded for respected operators who personal worldwide actual property, and haven’t but pulled the set off with one.

5. Get Authorized Residency in One other Nation

I do some monetary writing for GoBankingRates, and my editor assigned me an article on the cash strikes that the wealthiest Individuals have made on this yr’s political atmosphere. I spoke with one CFP whose reply stunned me: His wealthiest purchasers are securing second residency visas, however aren’t really transferring overseas. Reasonablythey need a hedge towards political threat—a straightforward exit in the event that they ever want it.

I discovered that fascinating, partly as a result of I personally spent 10 years residing overseas. My daughter has twin citizenship in Brazil, and my spouse and I’ve long-term residency visas there by 2030.

The excellent news for on a regular basis individuals? You don’t want to purchase a golden visa or second passport. You may shortly and simply transfer overseas with a digital nomad visa, obtainable in 73 nations. Some require you to point out a certain quantity of revenue every month; others require you to point out a sure amount of cash within the financial institution. However they’re designed to be fairly painless.

The unhealthy information: They’re additionally designed for short-term stays, usually one to 4 years. After that, you’ll in all probability want to use for long-term residency.

Combat Instability With Flexibility

I don’t know which approach the winds will shift. However I wish to be able to throw up my sails to catch them, irrespective of which path they blow.

I’m not the one investor with an eye fixed on hedging geopolitical threat proper now, both. Look no additional than the worth of goldwhich exceeded $4,000 an oz in October for the primary time ever. Gold skyrocketed a dizzying 52.6% over the past yr, a positive signal that traders are fearful about geopolitical threat and forex devaluation.

Historian Neil Howe makes a troubling argument in The Fourth Turning Is Right here that each civilization in historical past has skilled a predictable four-generation cycle, culminating in a main disaster. The final of these crises was the Nice Despair and World Warfare II, which places us on schedule for the subsequent main disaster inside three to seven years.

I plan to maintain my wealth intact it doesn’t matter what comes down the pike, and more and more, which means hedging towards political threat.