Some questions which might be rattling round in my head together with some quips, solutions and guesses.

1. What appears apparent now that can look silly with the good thing about hindsight sooner or later? In all probability one thing to do with crypto, AI, tech shares, authorities debt or local weather change.

2. Why do some beers style higher on draft whereas others style higher from a bottle or can? Guinness is at all times higher from the faucet. Mexican beers like Corona, Pacifico, Modelo, and so forth. are at all times higher in a bottle (with a lime after all). Mild beers are extra refreshing in a can.

Why?

I don’t understand it simply is.

3. What would be the reason for the following monetary disaster? It can in all probability be one thing nobody sees coming however my guess can be deregulation will go too far and we’ll get some form of monetary asset bubble that pops.

4. Why is it that I’m prepared to look at 10-12 episodes of a 30-minute size TV present, however a film that’s 2 hours and quarter-hour at all times appears ungodly lengthy? We have to convey again the 90-minute film.

5. What’s a standard apply immediately that future generations will giggle at? It could be driving your individual automotive though I’m positive there will likely be loads of holdouts even when it turns into apparent self-driving capabilities are significantly better than human drivers.

6. What side of synthetic intelligence are we going to remorse as a society? I’m wanting ahead to having an AI private assistant, AI tutors for my youngsters and an AI journey agent.

However I believe the film Her goes to return to life the place individuals have relationships with some type of AI and it’s going to get actually bizarre.

7. What’s one thing you strongly imagine that you simply hope you’re mistaken about? I believe it’s mainly not possible to repair the healthcare system in the USA. I hope I’m mistaken.

8. What’s your worst type of sunk prices not mattering? It’s The Bear, season 4 for me. That present was top-of-the-line issues on TV and it fell of a cliff. I nonetheless needed to end this season as a result of I made the prior funding.

They neutered top-of-the-line TV characters this decade (Cousin Richie).

Will I nonetheless watch season 5? Sure.

9. Will AI lead us all to work extra, not much less? Computer systems, phrase processors, Excel, the web, e mail, smartphones, Zoom calls and different types of know-how have made us all way more environment friendly. And but…individuals work greater than ever.

Everybody at all times complains about being soooo busy.

AI will make us extra environment friendly however in all probability simply work much more than most individuals do now.

10. How will the infant boomer switch of energy within the housing market play out? We’ve by no means seen something just like the dominance of child boomers within the housing market. That is from Enterprise Insider:

Child boomers dominate America’s housing market. They personal roughly $19.7 trillion price of US actual property, or 41% of the nation’s whole worth, regardless of accounting for under a fifth of the inhabitants. Millennials, by comparability, make up a barely bigger share of the inhabitants however personal simply $9.8 trillion of actual property, or 20%.

However Father Time will even issues out ultimately:

Between 2025 and 2035, boomers’ numbers are projected to say no by 23%, or about 15.6 million individuals, in line with an evaluation of Census knowledge by the Harvard Joint Middle for Housing Research. Between 2035 and 2045, their numbers are anticipated to drop by one other 47%, or 23.4 million individuals.

Will the following technology sit on these homes that get handed right down to them? Or will they promote them instantly?

Both approach, this pattern will take a while to play out.

11. What’s one thing you’d be prepared to alter your thoughts about if the info change? I’ve at all times thought school sports activities have been extra enjoyable to look at than professional sports activities. School soccer is the most effective. I like March Insanity.

I ponder if NIL cash, school free brokers and convention realignment will change my views right here.

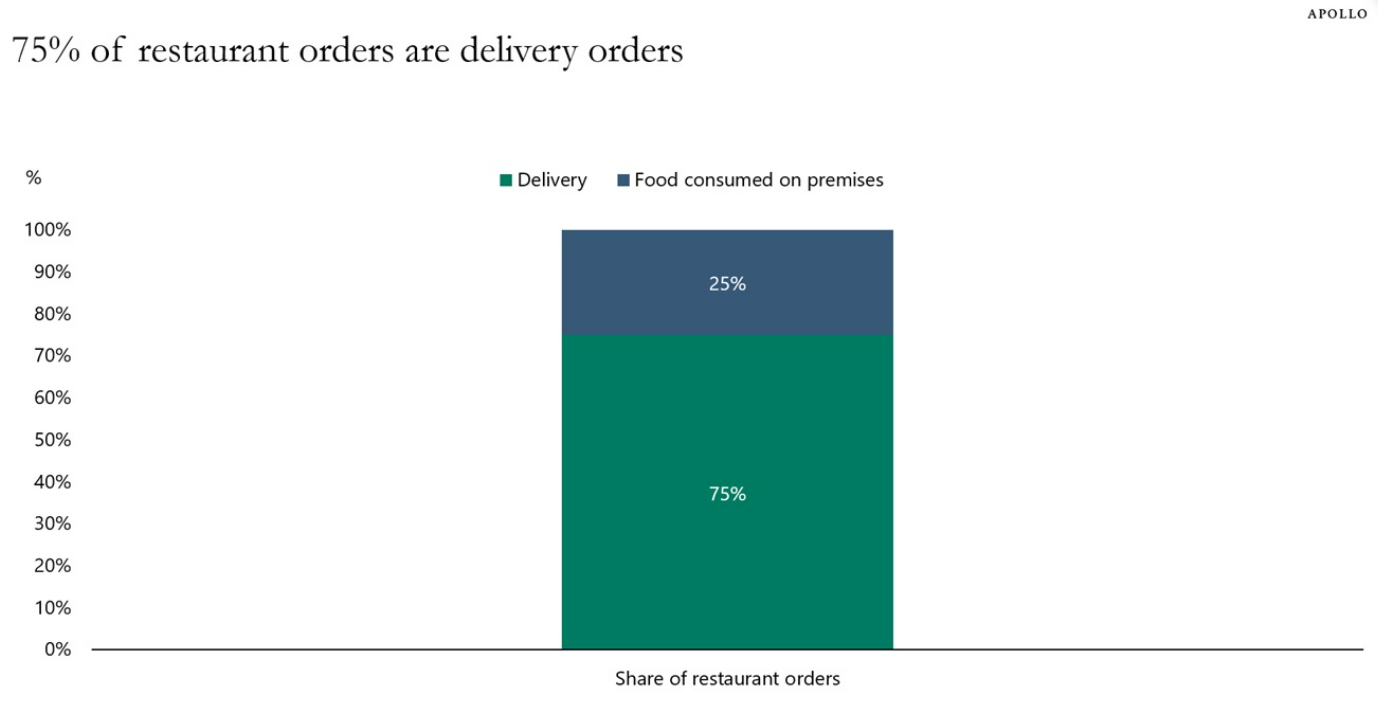

12. Is Doordash going to be the brand new latte issue for private finance gurus. Torsten has this chart displaying how most individuals favor supply orders to consuming in a restaurant:

Doordash looks like certainly one of life’s luxuries that’s turning into a necessity for lots of people. I ought to attempt to make it the brand new latte issue.

13. What’s an unbelievable innovation we take without any consideration as a result of we’re used to it? I do know some individuals get nostalgic for a Friday night time perusing Blockbuster Video however streaming is an unbelievable leap ahead.

I can consider an outdated film I wish to watch, pull it up on Prime Video or Apple, personal or lease it, and watch it instantly.

This would appear like magic to my Nineteen Nineties self who at all times forgot to rewind the VCR earlier than bringing again a rental to Household Video.

14. Why is it at all times so troublesome to foretell an asset bubble? Individuals have been calling tech a bubble since 2015. Everybody who known as the dot-com bubble and the GFC have been mistaken for years about this cycle.

Human nature is a difficult beast to pin down.

15. How has profession danger formed your actions? As somebody who works within the wealth administration business, I’ve been known as a shill for the inventory market previously. Clearly, it’s factor for our enterprise if the markets transfer increased.

I’m positive there’s a profession danger side to my love for the inventory market however I even have pores and skin within the recreation. The majority of my private belongings are invested in equities.

And if the inventory market fails to go up sooner or later all of us doubtless have larger issues to fret about.

16. Is an AI bubble inevitable? We’ve by no means actually seen an innovation that transforms society that didn’t result in a bubble. I’ll wager there was even a wheel bubble for the cavemen again within the day.

I’d be extra stunned if this doesn’t flip into one thing loopy.

17. Will we ever truly see a authorities debt disaster in America? My head says perhaps however my coronary heart says no, we’ll simply maintain kicking the can down the highway.

18. When will second-level pondering begin working once more? Howard Marks got here up with the concept of first and second-level pondering that goes like this:

First-level pondering: It’s an amazing firm, you should purchase it.

Second-level pondering: It’s an amazing firm however everybody already is aware of that and the inventory is overpriced. You must promote it.

First-level pondering has gained out over second-level pondering for the previous 15 years or so, and it’s not even shut.

Simply purchase the entire nice firms — Apple, Fb, Amazon, Microsoft, Netflix, Google, Tesla — and watch them go up.

Investing is often not that simple.

I do not know when that can change nevertheless it gained’t at all times be like this.

19. Why do private finance specialists concentrate on $5 coffees as a substitute of $50,000 cars? It’s the massive purchases like housing and transportation that matter. Take pleasure in your Starbucks.

20. What is going to lastly brings this financial cycle to an finish? It looks like there’s a lot cash sloshing round that the music will simply maintain enjoying however I do know cycles by no means final endlessly.

I’ll have some ideas on this subject later within the week.

Additional Studying:

Mega Cap World Domination