My morning practice WFH reads:

• It Is Trump’s On line casino Financial system Now. You’ll In all probability Lose. Step into the on line casino that now passes for the American financial system. The on line casino financial system was constructed on hypothesis and danger. Throughout markets and coverage, wagers on the long run are being made with different individuals’s cash at a value that would show catastrophic. (New York Instances)

• Ed Zitron Will get Paid to Love AI. He Additionally Will get Paid to Hate AI. He’s one of many loudest voices of the AI haters—at the same time as he does PR for AI corporations. Both manner, Ed Zitron has your consideration. (Wired)

• How Vanguard Stacks Up In opposition to Its Fund Business Friends: The place the low-cost powerhouse ranks versus different high asset managers by dimension, rankings, and supervisor possession. (Morningstar)

• LOL Me: Who you gonna belief: Barry Ritholtz or Jim Cramer? A trio of recent books from notable (and infamous) authors supply contemporary insights on retirement investing. (MoneySense) see additionally Make ‘cents’ of monetary literacy with these 4 podcasts: To get comfy with cash, I like to recommend listening to podcasts, which mix accessibility and persona. You’ll be able to study wherever — on a stroll, between lessons or whereas doing chores — and nonetheless take up complicated concepts. Many monetary podcasts use humor, storytelling and present occasions to make compound curiosity or credit score scores sound much less like lectures and extra like conversations with a nerdy good friend. (The Emory Wheel)

• Jesse Livermore & The Magnet of Dancing Inventory Costs: There’s a number of stuff in right here that sounds eerily just like at present’s setting. It was the tail finish of an excellent bull market. Retail traders had been beating the professionals. Buyers had been all in on the inventory market. It felt like nothing might cease the runaway bull market practice. (A Wealth of Widespread Sense)

• No, Ronald Reagan Didn’t Love Tariffs: Reagan did, in actual fact, repeatedly emphasize the virtues of free commerce. Like all trendy presidents, he nonetheless imposed some tariffs for political causes. However Reagan at all times stayed inside the boundaries of the legislation, utilizing his proper to impose discretionary tariffs as stress launch valves moderately than abusing his authority to make tariff coverage an instrument of his private. (Paul Krugman)

• The Math Trick Hidden in Your Credit score Card Quantity: Learn how this easy algorithm from the Sixties catches your typos. (Scientific American)

• Apple’s greatest iPhone overhaul in years ignites improve frenzy: Prolonged wait instances and beneficiant trade-in offers sign surging demand for newly redesigned system. (Monetary Instances) see additionally The proper shortcuts may give your iPhone superpowers. Right here’s how. Take the ache out of tedious duties with Apple’s Shortcuts app.(Washington Publish)

• U.S. Drops Out of Prime 10 in Passport Energy. Right here’s Why: Adecade in the past, america passport was seen as essentially the most highly effective on the earth by the Henley Passport Index, which ranks nations primarily based on the variety of locations a traveler can go to while not having a visa. In 2025, nevertheless, the U.S. passport has fallen from grace, dropping out of the highest 10 strongest passports globally for the primary time in 20 years. (Time)

• He’s Baseball’s $325 Million Pitcher—and He Would possibly Be Underpaid: Yoshinobu Yamamoto hadn’t pitched a single inning in American baseball when the Dodgers signed him to the richest contract ever given to a pitcher. After back-to-back playoff masterpieces, he’s starting to appear like a cut price. (Wall Avenue Journal)

You should definitely take a look at our Masters in Enterprise interview this weekend with Jon Hilsenrath of Serpa Pinto Advisory. Beforehand, he was chief economics correspondent for Wall Avenue Journal for 26 years. Dubbed the “Fed Whisperer” by Wall Avenue merchants for his scoops on the FOMC, he labored out of Hong Kong, NY, and D.C. He was a part of the Pulitzer Prize-winning group for on-scene protection of 9/11. He’s the creator of “Yellen: The Trailblazing Economist Who Navigated an Period of Upheaval.”

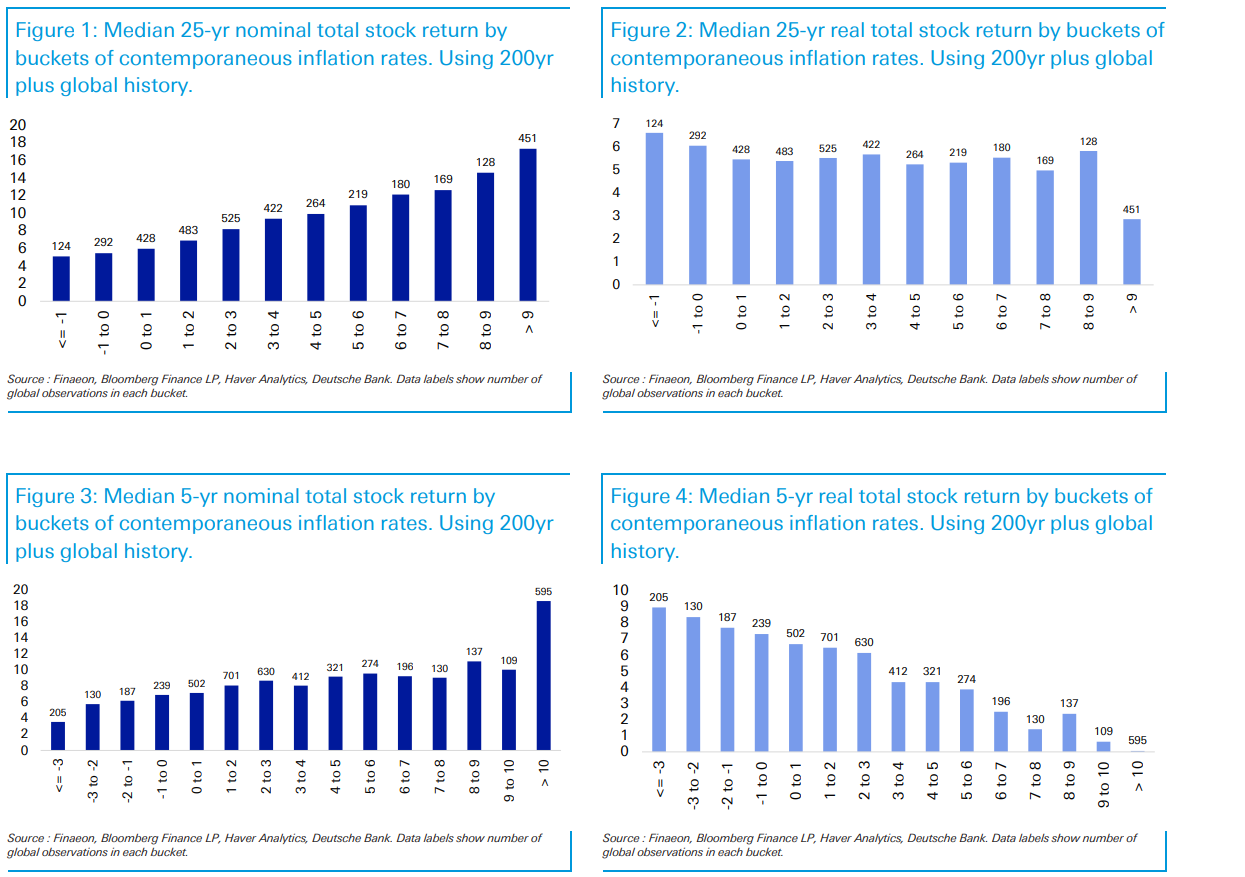

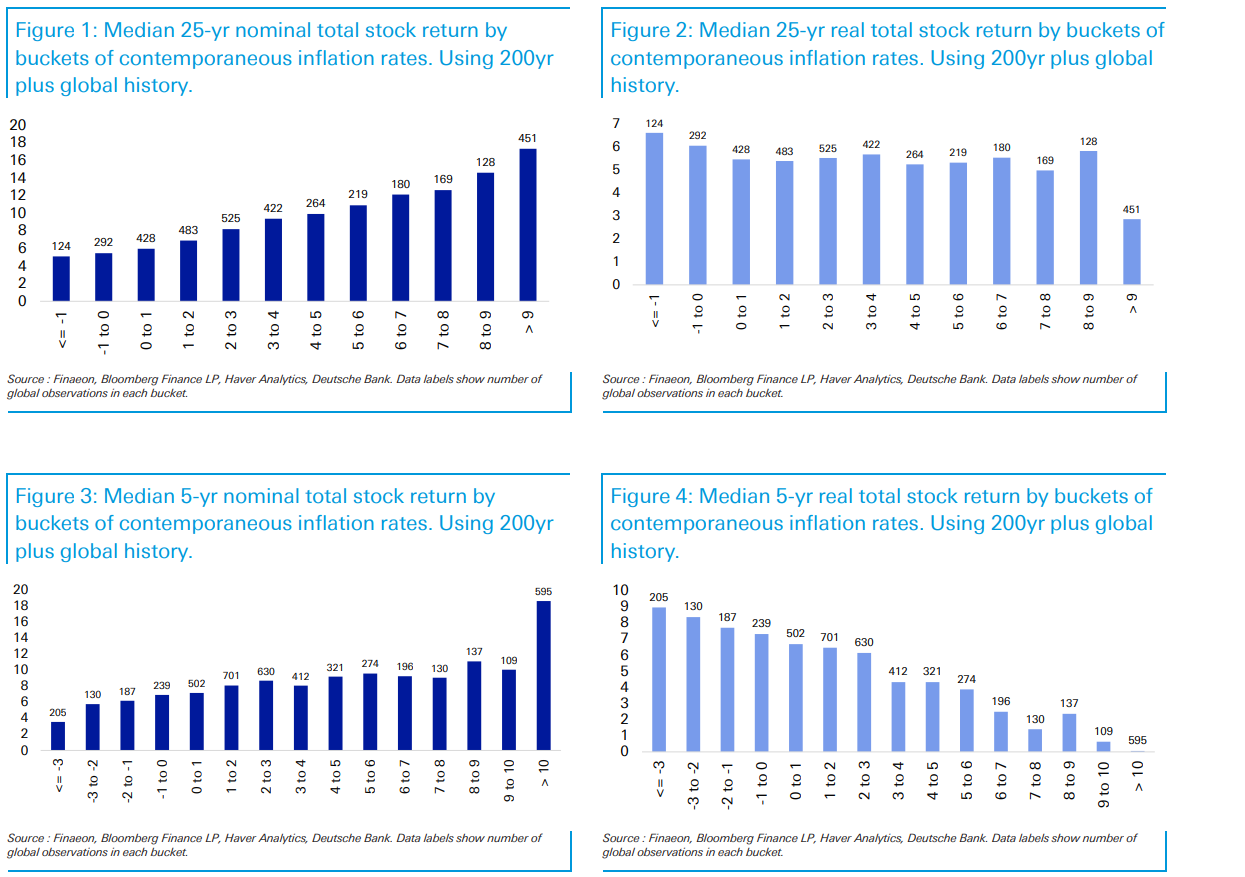

Nominal fairness returns rise ~linearly with inflation — equities act as an efficient inflation hedge. Actual returns decline modestly when inflation rises quite a bit; Equities carry out greatest in decrease to average inflation environments

Supply: Deutsche Financial institution Analysis Institute